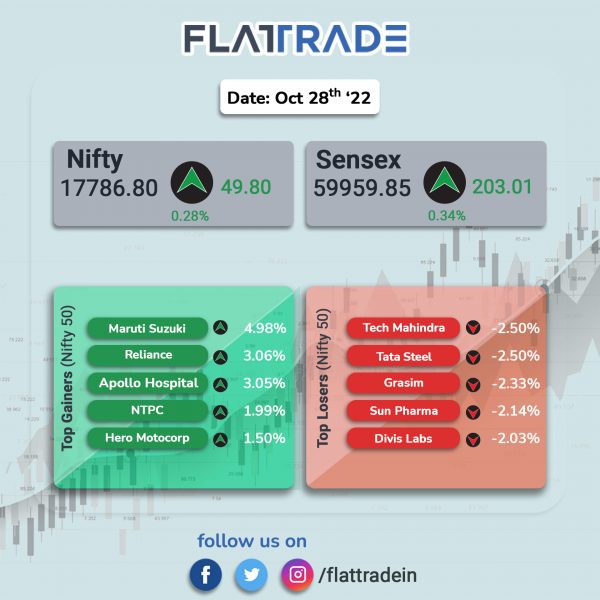

Benchmark equity indices ended higher, helped by gains in auto and energy stocks. The Sensex rose 0.34% and the Nifty gained 0.28%.

Broader markets declined, weighed by selling pressure. The Nifty Midcap 100 index fell 0.54% and the BSE Smallcap dropped 0.62%.

Top gainers among Nifty sectoral indices were Auto [1.63%], Energy [1.39%] and Oil &Gas [1.03%]. Top losers were Metal [-1.46%], Pharma [-1.36%], IT [-0.89%], Bank [-0.75%] and Private Bank [-0.66%].

The Indian rupee edged up 2 paise to end at 82.47 against the US dollar on Friday.

Stock in News Today

Maruti Suzuki: The automaker’s net profit zoomed 333.87% to Rs 2112.50 crore in the quarter ended September 2022 as against Rs 486.90 crore during the quarter ended September 2021. Revenue rose 47.90% to Rs 28,545.90 crore in the quarter ended September 2022 as against Rs 19,300.50 crore during the quarter ended September 2021. The company said pending customer orders stood at about 412,000 vehicles at the end of September 2022, and about 130,000 pre-bookings are for recently launched models.

Vedanta: The mining company reported a 53% year-on-year decline in consolidated profit after tax (PAT) at Rs 2690 crore in the September 2022 quarter. Its consolidated revenue from operations rose 20% to Rs 36,237 crore from Rs 30,048 crore registered during the same period last fiscal. The performance was affected by weaker commodity prices, mainly, in its aluminium business.

Tata Chemicals: The company said its revenue was up 40% YoY to Rs 4239 crore. Its EBITDA rose 84% to Rs 920 crore. The EBITDA margin improved to 22% in the reported quarter as against 17% in the year-ago period.

NIIT: The company said its consolidated net profit declined 24.55% to Rs 39.56 crore in the quarter ended September 2022 as against Rs 52.43 crore during the quarter ended September 2021. Consolidated revenue rose 24.28% to Rs 392.22 crore in the quarter ended September 2022 as against Rs 315.59 crore during the quarter ended September 2021.

TTK Healthcare: The company said its net profit declined 22.64% to Rs 9.91 crore in the quarter ended September 2022 as against Rs 12.81 crore during the quarter ended September 2021. Sales declined 17.72% to Rs 169.79 crore in the quarter ended September 2022 as against Rs 206.36 crore during the same period ended September 2021.

FSN E-Commerce Ventures (Nykaa): The retailer’s shares tanked more than 6%, extending steep losses. Investors are concerned as the lock-in period for pre-IPO shareholders including promoters, employees & other institutions ends on November 10.

Rane Holdings: The auto ancillary company said its consolidated net profit rose 33.55% to Rs 20.10 crore in the quarter ended September 2022 as against Rs 15.05 crore during the quarter ended September 2021. Sales rose 27.10% to Rs 879.29 crore in the quarter ended September 2022 as against Rs 691.81 crore during the quarter ended September 2021.

Ramco Industries: The company said that its net profit slumped 98.20% to Rs 2.58 crore in the quarter ended September 2022 as against Rs 143.55 crore during the quarter ended September 2021. Revenue slipped 2.41% to Rs 302.63 crore in the quarter ended September 2022 as against Rs 310.10 crore during the same period ended September 2021.

Narayana Hrudayalaya: Shares of the company soared 9% to hit a record high in Friday’s intraday trade, on healthy outlook. “The momentum is likely to be driven by sequential in-patient volume and, thus, higher In-patient conversion. One important lever could be incremental elective surgeries, due to continuum of pentup demand, post Covid led complications and higher international patients mix,” analysts at ICICI Securities said.

South Indian Bank: The RBI has approved Salim Gangadharan as Part Time Non-Executive Chairman of The South Indian Bank for one year with effect from November 2, 2022.

RBL Bank: Shares of the company rose over 4% in intraday trade after businessline reported, citing sources, that the RBI will likely withdraw its official Yogesh Dayal from the board of the lender ahead of the expiry of his term.

Gokaldas Exports: The company said its consolidated net profit was almost flat at Rs 39.8 crore in QFY23 compared with Rs 39.39 crore in the preceding quarter. Revenue slipped to Rs 569.67 crore in the reported quarter from Rs 610.64 crore in the preceding quarter.

Dwarikesh Sugar: Shares of the company fell 5% in intraday trade after the company reported 80.22% YoY fall in net income to Rs 7.84 crore for the quarter-ended September 2022. Revenue rose 6.8% to Rs 540.11 crore in the quarter under review as against Rs 505.78 crore in the year-ago period. EBITDA margin stood at 5.24% in the reported quarter.

Vaibhav Global: The company’s consolidated net profit tumbled 45.64% to Rs 22.93 crore in Q2FY23 from Rs 42.18 crore reported in Q2FY22. Revenue from operations rose 1.81% to Rs 646.26 crore in quarter ended September 2022 as against Rs 634.79 crore recorded in the same period a year ago. EBITDA margin declined to 8.1% in Q2 FY23 as compared to 11.5% reported in Q1FY23.

Meanwhile, the board of directors of the company has declared second interim dividend of Rs 1.50 per equity share. The record date is November 5 and the dividend shall be paid to the shareholders within 30 days from the date of declaration.