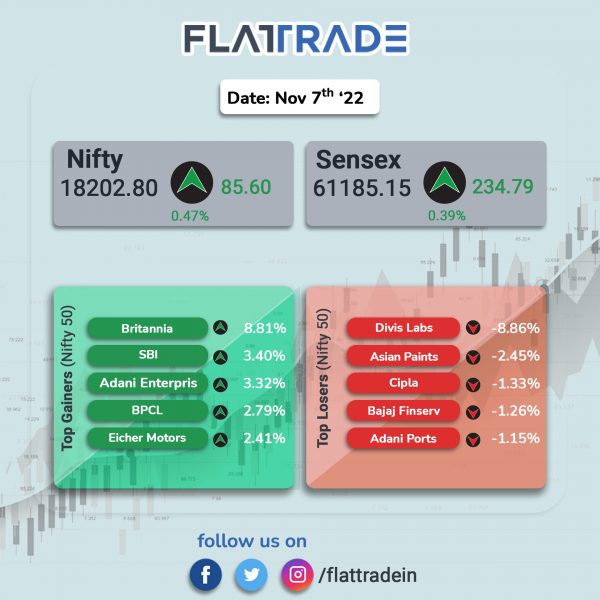

Benchmark stock indices closed higher, aided by gains in metal and public sector bank stocks. The Sensex rose 0.39% and the Nifty increased 0.47%.

In broader markets. Nifty Midcap 100 index rose 0.81% and the BSE Smallcap index was up 0.64%.

Top gainers among Nifty sectoral indices were PSU Bank [4.46%], Metal [1.58%], Auto [1.30%], Oil & Gas [1.09%] and Realty [1.05%]. Top loser was Pharma which fell 1.43%.

Indian rupee strengthened by 52 paise to 81.92 aginst the US dollar on Monday.

Stock in News Today

Divi’s Laboratories: The company’s consolidated revenue fell 7% to Rs 1,855 crore in Q2FY23 from Rs 1,988 crore in the year-ago period. Its consolidated net profit fell 19% YoY to Rs 494 crore as against Rs 606 crore in the year-ago period. EBITDA fell 24% to Rs 621 crore in Q2FY23 from Rs 818 crore in the year-ago period. Shares of the company plummeted 9%.

Aditya Birla Capital: The company said its consolidated net profit rose 29% to Rs 488.25 crore as against Rs 376.90 crore in the year-ago period. Its consolidated revenue from operations was up 22% YoY to Rs 6,825.01 crore as against Rs 5,596.49 crore in the same period last year. EBITDA rose about 26% YoY to Rs 1,679.68 crore in Q2FY23.

Rail Vikas Nigam: Shares of the company zoomed 17.6% after it won a contract from Central Organisation for Railway Electrification. The contract involves increasing the speed potential to 160 kmph in Pradhankhanta – Bandhua Section of Dhanbad Division under East Central Railway, according to its stock exchange filing. The cost of the contract is Rs 137.55 crore.

India Cements: The company reported a consolidated net loss of Rs 113.26 crore for the second quarter ended September 2022. The bank had posted a net profit of Rs 29.75 crore during the year-ago period. Its revenue from operations was up 7.46% to Rs 1,327.06 crore in Q2FY23 from Rs 1,234.85 crore in the same period last year. The company’s total expenses stood at Rs 1,528.01 crore, up 27.16% in the September quarter of FY23.

Marico: The company posted a consolidated net profit of Rs 301 crore in Q2FY23, down 3% from Rs 309 crore in the year-ago period. Consolidated revenue rose 3% YoY to Rs 2,496 crore in the reported quarter as against Rs 2,419 crore in the year-ago period. Ebitda rose 2% YoY to Rs 433 crore in Q2FY23. Shares of the company fell 6.4% due to poor quarterly results.

Ujjivan Small Finance Bank: The lender reported a net income of Rs 294.3 crore in Q2FY23 as against Rs 273.8 crore in the year-ago period. The lender’s interest income rose to Rs 993.18 crore in the quarter under review as against Rs 645 crore in the year-ago period. Net interest margin stood at 9.8% in Q2FY23 compared to 8.1% in the year-ago period.

Puravankara: The realty company reported a loss of Rs 21 crore in the quarter that ended September FY23, compared to a profit of Rs 12 crore in the corresponding quarter last year. The company reported a sales of Rs 793 crore in the quarter under review, up by 33% in the same period last fiscal. The sale realisations improved to Rs. 7,454 per sq. ft. from Rs. 6,845 per sq. ft. last year, an improvement of 9%.

Go Fashion: The clothing retailer has recorded a 3.76% rise on its profit after tax for the second quarter ending September 30, 2022 at Rs 19.3 crore, according to its exchange filing. The company had registered profit after tax at Rs 18.6 crore during corresponding quarter previous year. Total revenue during the quarter under review stood at Rs 165.8 crore as against Rs 112.1 crore in the corresponding quarter last fiscal. CEO Gautam Saraogi said that the company was moving ahead with its expansion plans by opening 120-130 new stores ever year. The company during the quarter ending September 30, 2022 opened 36 new stores and in the first six months of the financial year it added 66 stores.

City Union Bank: The company’s net profit rose 52% to Rs 276.4 crore in the Q2FY23 from Rs 182.1 crore in the year-ago period. The lender’s net interest income increased 19% YoY to Rs 567.9 crore. The companys net NPA stood at 2.69% int he quarter under review as against 2.89% in the preceding quarter.

Punjab & Sind Bank: The lender said its net profit rose 27% to Rs 278 crore in the second quarter of FY23 on the back of reduction in bad loans. The bank had reported a profit of Rs 218 crore in the year-ago period. Total income of the bank during the reported quarter of FY23 rose to Rs 2,120.17 crore against Rs 1,974.78 crore in the corresponding period of FY22. Net NPAs also came down to 2.24% from 3.81% in the second quarter of previous year.

Rajesh Exports: The company has formed a wholly-owned subsidiary named ACC Energy Storage Pvt. The company was selected under the government’s ACC PLI scheme, along with Reliance Industries and Ola Electric in July this year.