Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.25% higher at 18,394, signalling that Dalal Street was headed for a positive start on Wednesday.

Asian shares were trading lower as investors awaited the results of the US midterm elections. The Nikkei 225 index fell 0.16% and the Topix was down 0.18%. The Hang Seng index slippped 0.04% and the CSI 300 index was down 0.12%.

Indian rupee rose 52 paise to settle at 81.92 against the US dollar.

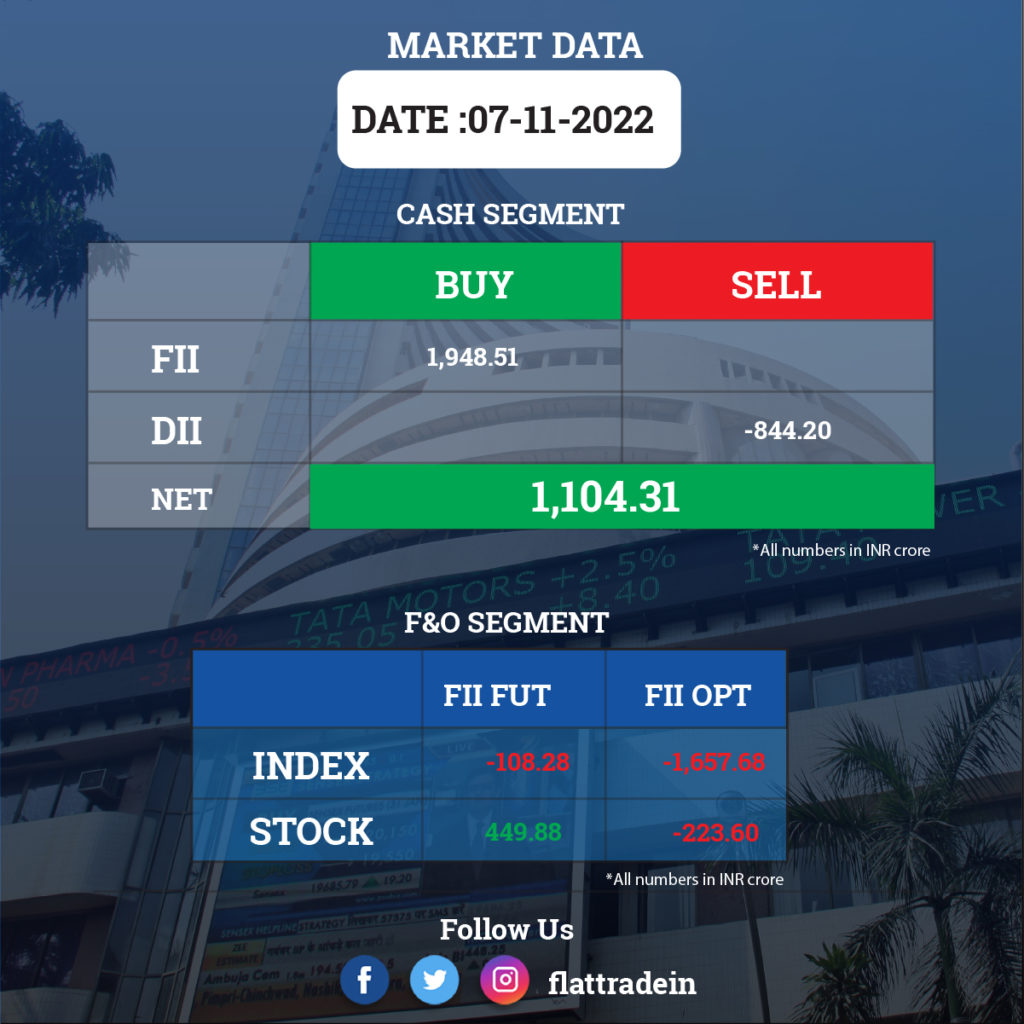

FII/DII Trading Data

Upcoming Results

Tata Motors, Lupin, Pidilite Industries, Godrej Properties, NALCO, Bajaj Consumer Care, Balrampur Chini Mills, Barbeque-Nation Hospitality, Deepak Nitrite, Edelweiss Financial Services, Engineers India, Nuvoco Vistas Corporation, Petronet LNG, Prestige Estates Projects, Quess Corp, Star Health, and Tracxn Technologies will report their quarterly earnings on November 9.

Stocks in News Today

Coal India: The coal mining company posted a 106% year-on-year increase in consolidated profit at Rs 6,044 crore for the quarter ended September FY23, supported by healthy top line, higher other income, and strong operating performance. Revenue from operations jumped 28% YoY to Rs 29,838 crore for the quarter with raw coal production rising 10.6% YoY to 139.2 million tonnes, and raw coal off take increasing 4.8% to 154.53 million tonnes.

One 97 Communications (Paytm): The company reported a net loss of Rs 571.5 crore for the July-September 2022 period, widening from Rs 473.5 crore in the same period last year. Its revenue from operations jumped 76% in the September-quarter to Rs 1,914 crore, mainly on account of a surge in growth of loan disbursals. Revenue from the financial services business grew 293% year-on-year to Rs 349 crore. Loan disbursement surged to Rs 7313 crore in the reported quarter.

Bharat Petroleum Corp: The company reported a net loss of Rs 338.49 crore in the quarter ended September 2022. It had posted a net profit of Rs 3149.28 crore in the year-ago period. The second quarter net loss narrowed sharply from a loss of Rs 6,147.94 crore in the preceding quarter. Consolidated revenue from operations stood at Rs 1,28,355.72 crore in Q2FY23 up from Rs 1,01,938. 72 crore in the same quarter last year. The company’s average Gross Refining Margin (GRM) for H1FY23 stood at $22.30 per barrel compared to $ 5.23 per barrel in H1FY22.

Jubilant FoodWorks: The company reported 9.8% YoY jump in its consolidated Q2 profit at Rs 131.5 crore, while revenue from operations jumped 16.6% YoY to Rs 1,3014.8 crore. Its standalone EBITDA margin declined 170 bps YoY to 24.3% in Q2. Jubilant opened 76 new Domino’s stores taking the network strength for Domino’s in India to 1,701 stores. It entered 22 new cities during the quarter to expand its reach to 371 cities across India.

PB Fintech: The financial services company has reported a consolidated loss of Rs 186.6 crore in the July-September quarter, a decline from a loss of Rs 204.3 crore in the previous quarter. Total revenue for the group grew to Rs 633.8 crore in the period, from Rs 552.6 crore in the quarter ended June 30. Insurance premium during the reported quarter stood at Rs 2,545 crore, up 79% year-on-year.

Oil and Natural Gas Corp (ONGC): The company has applied to the new Russian operator of the Sakhalin-1 to retain its stake in the oil and gas project in the Far East, Reuters reported citing a source familiar with the matter. Russia has established a new entity, managed by a Rosneft subsidiary, that owns investor’s rights in Sakhalin 1 after the exit of previous operator ExxonMobil.

IndiGo Airlines: The carrier said that around 30 aircraft were grounded due to “supply chain disruptions” and it is evaluating wet leasing of planes and other options to boost operations. An IndiGo spokesperson on Monday confirmed to PTI news agency that about 30 aircraft are on the ground.

BSE: The company reported a 48% fall in net profit at Rs 33.8 crore for the quarter ended September 2022 from Rs 65.1 crore in the year-ago period. Its operating income fell by 75% to Rs 13.4 crore from Rs 53.2 crore in the year-ago period. Its operating margin dropped to 7% in the reported quarter from 28% a year ago.

Life Insurance Corporation of India (LIC) and Voltas: LIC has increased its shareholding in Voltas by buying an additional 2% stake. The insurer said it had acquired Voltas’ shares worth Rs 634.50 crore through open market transactions during the period from August 10 to November 4, 2022.

IOL Chemicals and Pharmaceuticals: The company said it has received certificate of suitability from EDQM to supply Pantoprazole Sodium Sesquihydrate API in European markets. The European Directorate for the Quality of Medicines & HealthCare (EDQM) is a mandatory certification for distribution of any API/ pharma products in Europe.

KEC International: The company posted a consolidated net profit of Rs 55.24 crore in Q2FY23, 31.2% decline from Rs 80.3 crore in the year-ago period. Consolidated revenue from operations was up 13.3% at Rs 4064 crore in Q2FY23 as against Rs 3587.5 crore. EBITDA fell 29.7% to Rs 177.95 crore in Q2FY23 from Rs 253.1 crore in the year-ago period.

Bosch: The auto component major reported a flat consolidated net profit of Rs 372.4 crore for the second quarter ended September 30. The company had posted a net profit of Rs 372 crore in the July-September quarter of the previous fiscal. Its revenue from operations rose to Rs 3,662 crore for the period under review compared to Rs 2,918 crore in the same period last fiscal.

Welspun India: The home textiles major reported a 95.86% decline in its consolidated net profit to Rs 8.33 crore for the second quarter ended September 30, mainly due to high input costs. It had posted a consolidated net profit of Rs 201.50 crore in the July-September quarter a year ago. Its revenue from operations slipped 15.04% to Rs 2,113.46 crore during the quarter under review. It was Rs 2,487.63 crore in the year-ago period.

The company’s total expenses in the reported quarter fell 4.29% to Rs 2,122.85 crore. Its revenue from home textiles was Rs 2,011.41 crore and Rs 159.59 crore from the flooring segment.

Aditya Birla Capital: The NBFC said its net profit increased 30% year-on-year to Rs 488 crore in the quarter ending September 2022. Overall loan book expanded 36% year-on-year to Rs 64,975 crore. Net interest margin (NIM) grew 35 basis points year-on-year to 6.58%.

CEAT: The tyre maker reported a 17% decline in standalone net profit at Rs 29.9 crore in Q2FY23, as against a net profit of Rs 35.96 crore in the corresponding period of the last financial year. Revenues from operations rose 18.7% to Rs 2,886.37 crore in the quarter under review, from Rs 2,432.32 crore in the year-ago period. “we expect the second half of this year to be better in terms of revenue and margins because of improving domestic demand and stabilising commodity prices,” said Anant Goenka, Managing Director of the company.

Minda Corp: The auto component maker reported an increase of 48% in net profit at Rs 57.8 crore in the second quarter of FY23. The company registered a net profit of Rs 39.1 crore in the corresponding period of the last financial year. Operating revenue during the quarter under review grew 57% to Rs 1147.1 crore, compared to Rs 731.3 crore in the year-ago period. Ebitda margin stood at 10.8% in Q2FY23 as against 10.6% in Q2FY22.

HT Media: The company reported a consolidated net loss of Rs 167.75 crore for the second quarter FY23. The company had posted a net profit of Rs 29.91 crore during the year-ago period. Its revenue from operations rose 10.66% to Rs 409.25 crore during the quarter under review against Rs 369.82 crore in the corresponding period of the previous fiscal. HT Media Chairperson and Editorial Director Shobhana Bhartia said that the festive season provides further growth opportunities across business verticals as retail and commercial activity picks up in the ongoing quarter.

Coal India: The state-owned company reported a net profit of Rs Rs 6,044 crore, up 106% YoY Q2FY23. Its consolidated revenue jumped 28.1% YoY to Rs 29,838 crore during the quarter. Cola India’s production of raw coal improved to 139.228 million tonnes during the second quarter from 125.839 million tonnes in the year-ago period. The company declared an interim dividend of Rs 15 per share and fixed November 16 as the record date.

Affle India: The company said its net profit was up 22.9% at Rs 59 crore in the second quarter of FY23 as against Rs 48 crore in the year-ago period. Revenue rose 29% to Rs 354.59 crore in the reported quarter as against Rs 274.7 crore in the same period last fiscal. EBITDA increased 36.2% YoY to Rs 70.77 crore.

Sequent Scientific: The company said its net loss stood at Rs 3.75 crore in Q2FY23, compared with a net profit of Rs 14.3 crore in the year-ago period. Revenue fell 3.7% to Rs 337.6 crore in the reported quarter compared with Rs 350.6 crore in the same period last fiscal. The company will acquire 100% stake of Tineta Pharma for Rs 2108 crore through preferential allotment route.

Sintex Industries: The textiles maker reported a consolidated net loss of Rs 277.93 crore during Q2FY23 as against a net loss of Rs 181.92 crore in the year-ago period. Revenue from operations was up at Rs 692.16 crore in Q2FY23 from Rs 614.87 crore in the year-ago period.

Brookfield India Real Estate Trust: The company reported a 48% rise in its net operating income to Rs 241.3 crore for the quarter ended September 2022. Its net operating income (NOI) stood at Rs 162.8 crore in the year-ago period. The company has declared a distribution of Rs 170.89 crore or Rs 5.10 per unit for the quarter ended September 2022, according to its exchange filing.

RateGain Travel: The company registered a net profit at Rs 12.9 crore in Q2FY23 as against a loss of Rs 1.9 crore in Q2FY22. Revenue rose 47% to Rs 124.6 crore in Q2FY23 compared with Rs 85 crore in the year-ago period. EBITDA improved to Rs 17.6 crore in the reported quarter from Rs 4 crore in the year-ago period.

Sundaram Finance: The NBFC posted a consolidated revenue from operations of Rs 1336.82 crore in Q2FY23 from Rs 1293.19 crore in the year-ago period. The company’s consolidated profit after tax stood at Rs 331.57 crore in Q2FY23 compared with Rs 273.80 crore in Q2FY22. The asset under management in the NBFC’s lending and general insurance business stood at Rs 49,601 crore at the end of September 2002 quarter as against s 46,190 crore in the same period last year.

Ramco Systems: The mid-sized IT company reported a loss of Rs 60.32 crore in Q2FY23 compared with a loss of Rs 12.9 crore in Q2FY22. Revenue dropped 15.8% to Rs 118.59 crore in Q2FY23 as against Rs 140.7 crore in Q2FY22. EBITDA loss stood at Rs 40.41 crore in the reported quarter compared with EBITDA of Rs 5.2 crore in th eyear-ago period.

Vinati Organics: The company’s net profit rose 14.6% to Rs 116 crore in Q2F23 from Rs 101.2 crore in Q2FY22. Revenue from operations increased by 11.9% to Rs 566.3 crore in Q2FY23 from Rs 506.3 crore in the corresponding quarter last fiscal. EBITDA was at Rs 148.5 crore in Q2FY23, up 13.4% from Rs 130.9 crore in Q2FY22. Margin fell to at 26.2% in the reported quarter from 35.9% in the same period last fiscal.

Mold-Tek Packaging: The company said its net profit was up 10.2% at Rs 19.4 crore in Q2FY23 as against Rs 17.6 crore in Q2FY22. Revenue increased 14.5% to Rs 182.6 crore in Q2FY23 from Rs 159.5 crore in the year-ago period. EBITDA was up 6.7% YoY to Rs 34.1 crore. Margin declined 18.7% in the reported quarter of FY23 as against 20% in the corresponding quarter last year.

Greenply Industries: The company said that its net profit fell 26% to Rs 23.6 crore in Q2FY23 from Rs 31.9 crore in Q2FY22. Revenue rose 14.4% to Rs 494.7 crore in Q2FY23 from Rs 432.4 crore in the corresponding quarter last fiscal. EBITDA was down 1.8% YoY to Rs 48.8 crore from Rs 49.7 crore in the year-ago period.

Avadh Sugar: The company reported a net loss of Rs 16.3 crore in Q2FY23 as against a net profit of Rs 25.2 crore in the year-ago period. Revenue fell 4.9% to Rs 589.2 crore in Q2FY23 from Rs 619.6 crore in the corresponding quarter last fiscal. EBITDA plunged 99.4% to Rs 0.5 crore from Rs 74.8 crore in the same period last fiscal.