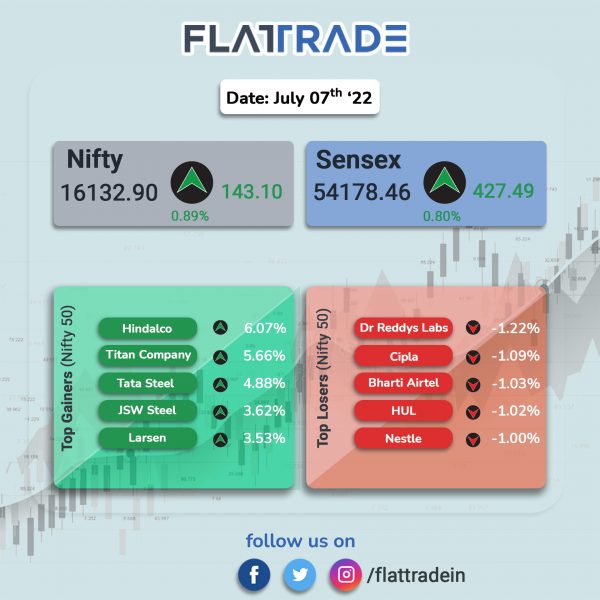

Major equity indices closed higher as falling commodity prices eased inflationary concerns. In addition, banks and metals stocks pushed Sensex and Nifty 50 index higher. The Sensex rose 0.80% and the Nifty 50 index climbed 0.89%.

In broader markets, NSE Midcap 100 index surged 1.35% and BSE Smallcap advanced 1.30%.

Top Nifty sectoral gainers were Metal [3.79%], PSU Bank [3.42%], Realty [2.62%], Pvt Bank [1.78%] and Bank [1.74%] and Auto [1.35%]. Nifty FMCG slipped 0.08%. All other sectoral indices closed in the green.

Indian rupee rose 13 paise to 79.18 against the US dollar on Thursday.

Stock in News Today

HDFC Bank, ICICI Bank and Axis Bank: The three banks have been allowed to provide letter of credit (LC) and direct bank transfer business for overseas procurement by India’s defence ministry. The selected banks may be allocated with LC business of Rs 2000 crore, each on the capital and revenue side, for a period of one year on concurrent basis. The performance of these banks will be monitored regularly.

FSN E-Commerce Ventures (Nykaa): Shares of the company closed 3.77% higher after the company announced its foray into men’s innerwear and athleisure category with its new brand, Gloot. The underwear range starts from Rs 499 and athleisure from Rs 899.

Star Health and Allied Insurance: Investment firm Credit Suisse initiated coverage of the health insurer with an ‘outperform’ rating citing its largest agency network, continued expansion and an attractive risk-to-reward ratio. The price target has been set at Rs 600 apiece. Shares of the company surged 11.74% to Rs 531.90 per equity share.

JSW Steel: The company posted a 16% jump in its consolidated crude steel output at 5.88 million tonne (MT) during April-June quarter of 2022. In the same period last year, its production was at 5.07 MT. On a quarter-on-quarter (q-o-q) basis, the steel production fell 2% from 5.98 MT in January-March 2022.

IndiGo: The company clarified that there was no smoke in the cabin of a flight from Raipur to Indore on Tuesday but “mist was created” by the heating, ventilation and air conditioning system due to humidity. The statement comes a day after officials of aviation regulator DGCA said the cabin crew of the IndiGo Raipur-Indore flight observed smoke in the plane after it landed at its destination on Tuesday.

In other news, the carrier has increased pilot salaries by a further 8% as it sees a recovery in traffic and also reinstated overtime allowance for pilots to the pre-Covid level.

Canara Bank: the public sector lender has raised the Marginal Cost of Funds Based Lending Rate (MCLR) with effect from Thursday. The lender also hiked Repo Linked Lending Rate (RLLR) from 7.30% to 7.80%, effective from today.

Bharat Heavy Electricals: The company has commissioned floating solar PV plant at 100 Mega Watt at NTPC Ramagundam in Telangana. The plant is installed across natural water reservoir and will ensure that aquatic ecosystem is maintained while producing clean power, the company said in an exchange filing.

Lupin: The pharma company received Establishment Inspection Report (EIR) from the U.S. FDA for its Somerset, NJ Manufacturing facility, according to its exchange filing. The U.S. FDA concluded its inspection of the facility in March 2022 and determined the inspection classification is Voluntary Action Indicated.

Escorts Kubota: The tractor maker will raise tractor prices starting July 10. The company said price hike was due to a steady rise in commodity prices and rise in input cost. The company said the price hike would vary across models and variants.

Ajmera Realty & Infra India: The company reported more than three-fold jump in its sales bookings to Rs 400 crore for the quarter ended June helped by improved demand. Its sales bookings stood at Rs 111 crore in the year-ago period. The carpet area sold by the company stood at 1.57 lakh square feet in April-June period of this fiscal as against 61,663 square feet in the year-ago period.

JTEKT India: Shares of the company rose 5%after the company approved a scheme to merge a subsidiary with itself. In an exchange filing, the company gave its nod for amalgamation of JTEKT Fuji Kiko Automotive with itself. The merger plan is subject to approval from NCLT and other applicable regulatory entities. For every 100 equity shares of JTEKT Fuji Kiko of face value of Rs 10, shareholders will get 200 equity shares of JTEKT India of face value of Re 1 each.