Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.79% higher at 16,109, indicating that Dalal Street was headed for a positive start on Thursday.

Most Asian stocks traded higher on Thursday, tracking the US markets’ rise overnight. Japan’s Nikkie 225 index was up 0.73% and Topix index rose 0.65%. China’s Hang Seng fell 0.44%, while CSI 300 index advanced 0.47%.

Indian rupee rose 7 paise to 79.30 against the US dollar on Wednesday.

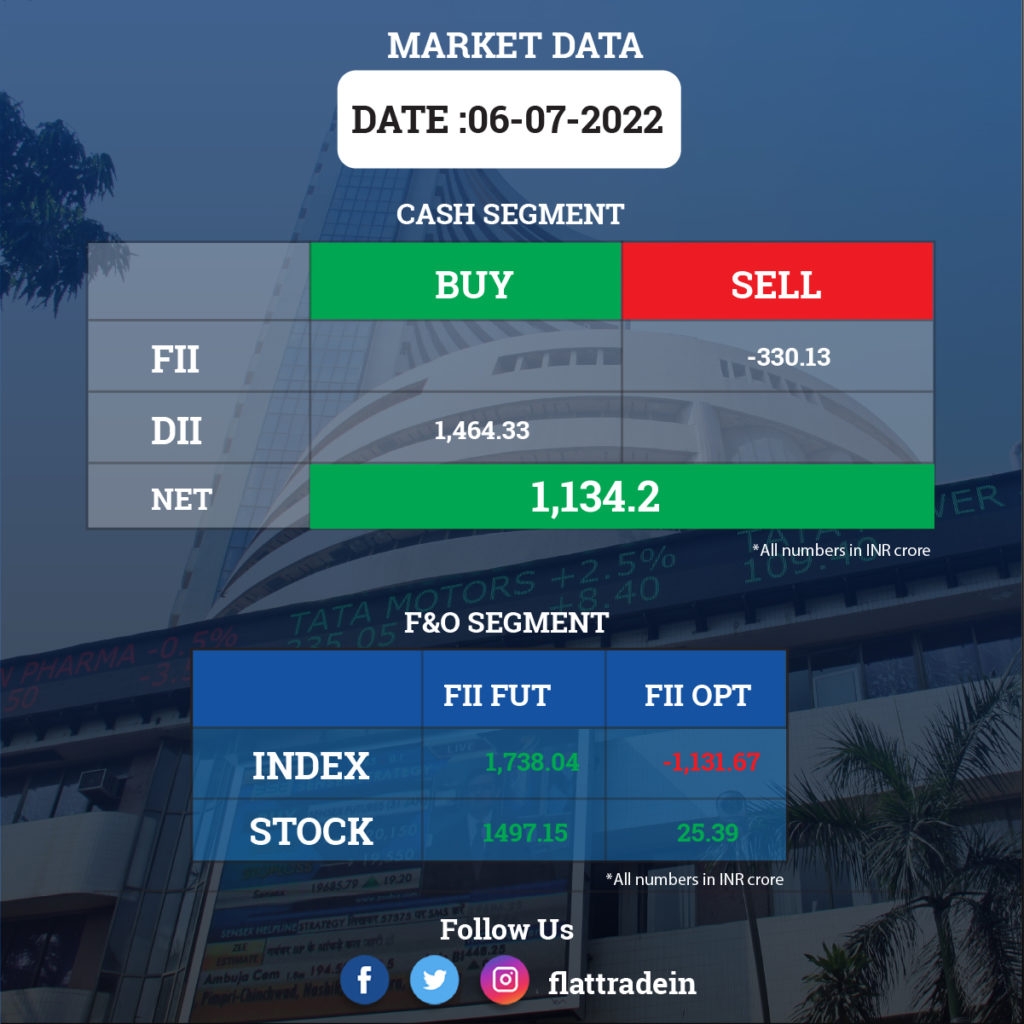

FII/DII Trading Data

Stocks in News Today

Titan: The company said its sales in the April-June quarter were up nearly three-fold on a year-on-year basis due to a low base in the year-ago period which was affected by Covid-19. Its network expansion and campaigns continued to progress well throughout Q1FY23, which was the non-disrupted first quarter in the last three years.

Reliance industries Ltd (RIL): The conglomerate’s retail arm has entered into a franchise agreement with Gap Inc to bring the American fashion brand to India. Reliance Retail will be the official retailer for the fashion house in India, mixing exclusive stores and digital commerce platforms.

Tata Chemicals: The company is focused on sustainability and committed to reduce its carbon emission by 30 per cent by 2030, Tata Chemicals chairman N Chandrasekaran said on Wednesday. “The company is also focused on sustainability and we are leveraging the whole sustainability movement to focus increasingly on green chemistry, embracing circularity, carbon reduction and biodiversity,” Chandrasekaran said during the company’s 83rd Annual General Meeting. He added that the company would invest Rs 5,000 crore in capital expenditure (capex) in the next few years.

NTPC and Gujarat Alkalies: NTPC Renewable Energy (NTPC REL), a fully-owned subsidiary of NTPC, has signed a Memorandum of Understanding (MoU) with Gujarat Alkalies and Chemicals to collaborate in setting up India’s first commercial-scale Green Ammonia and Green Methanol projects.

Piramal Enterprises: The company has received shareholders’ approval to demerge its pharmaceuticals business and simplify the corporate structure. The company has received 99% of votes at the shareholders meeting.

Power Grid: The company’s board has approved a fund raise of upto Rs 11,000 crores.

IndusInd Bank: The bank announced a strategic partnership with MoEngage, the insights-led customer engagement platform to deliver a differentiated digital experience across multiple customer journeys.

TVS Motor Company: The company has forayed into the premium lifestyle segment by launching the industry-first ‘modern-retro’ motorcycle, the TVS RONIN.

City Union Bank: The old private sector lender said that the board of directors has approved raising further capital through QIP route to the tune of Rs 500 crore subject to shareholder approval.

Sobha: The realty company’s sales volume rose 51.7% yoy to 13.6 lakh sq. ft. Its total sales value rose 67.7% yoy to Rs 1,145 crore. Average price realization increased to Rs 8,431 in quarter ended June compared to Rs 7,626 a year ago.

Equitas Small Finance Bank: The small finance bank reported 22% YoY growth in Q1FY23 gross advances at Rs 21,699 crore and the sequential increase was 5%, while deposits growth was 19% YoY and 8 percent QoQ at Rs 20,386 crore.

PBA Infrastructure: The company said its board has approved voluntary delisting of equity shares of the company from NSE, but equity shares would remain to be listed on the BSE.

Ethos: The luxury watch retailer has signed an exclusive distribution agreement with the globally-renowned watch and jewellery brand Jacob & Co. The partnership will unlock access to the brand’s unique collections for Ethos customers pan-India.

Deep Industries: The company has received Letter of Awards from ONGC, for charter hiring of 1000 HP mobile drilling rigs for Ahmedabad asset for a period of 3 years. The total estimated value of the said awards is $19.02 million or Rs 150.24 crore.