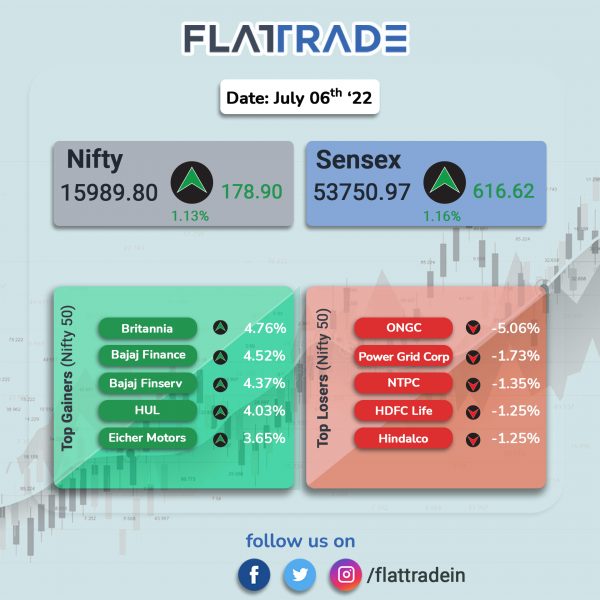

Benchmark equity indices closed in the green helped by gains in FMCG, auto and realty stocks as well as broad-based buying. The Sensex rose 1.16% and the Nifty 50 index climbed 1.13%.

In broader markets, NSE Midcap 100 index surged 1.9% and BSE Smallcap rose 0.94%.

Top Nifty sectoral gainers were FMCG [2.64%], Auto [2.6%], Realty [2.27%], Media [1.84%], Financial Services [1.6%]. Top loser was Energy [-0.62%] as oil prices declined.

Indian rupee rose 7 paise to 79.30 against the US dollar on Wednesday.

Stock in News Today

Dabur India: The FMCG company expects to report high single-digit revenue growth on very high base in Q1, according to its quarterly business update. Its Food & Beverages segment has seen strong double-digit growth, while Home & Personal Care segment is likely to log high single to low double-digit growth. The company said it is taking cost saving initiatives to support margins amid unprecedented input cost pressure.

Maruti Suzuki India (MSI): The company expects to have only hybrid (mild and strong), flexible fuel, compressed natural gas (CNG), electric, bio-fuel powered vehicles in its product portfolio, Shashank Srivastava, Senior Executive Director, Marketing & Sales told IANS.

Coal India (CIL): The state-owned company said it strives to avoid discordance or strikes in view of the importance of the coal sector in the country. The Ministry of Coal said negotiations are in process and it expects to conclude wage pact of its non-executive workforce at the earliest.

Apollo Hospitals: The hospital chain announced a tie-up with Singapore-based ConnectedLife to integrate Apollo’s artificial intelligence-based web tool AICVD with ConnectedLife’s digital solutions for wellness, condition management and other health-focused applications. The AICVD tool can predict the risk of cardiovascular disease. This will empower healthcare providers with the tools to predict the risk of cardiac disease in their patients and initiate intervention early enough to make a real difference.

Godrej Consumer: The company expects to deliver early double-digit sales growth on a high base, according to Q1 business update. It said short-term challenges like global commodity inflation and performance of Indonesia business continue to play out in the first quarter. Personal care segment sustained double-digit growth while home care witnessed low single-digit decline in sales. Rural markets witnessed slower growth compared to urban.

Aurobindo Pharma: Shares of the company rose 2% after its subsidiary Eugia Pharma received final approval from U.S. FDA to manufacture and market Triamcinolone Acetonide Injectable Suspension multiple-dose vials.

Delhivery: Shares of the company rose 3.3% after brokerage firm Edelweiss initiated coverage of the stock with a ‘buy’ recommendation and set the target price at Rs 650 per equity shrare. The brokerage firm cited the company’s its superior mid-mile aggregation, technological capability and a unique mesh network that will drive optimal utilisation.

Macrotech Developers: The company informed exchanges that Q1 pre-sales rose 194% YoY to Rs 1,857 crore. The company logged 75% of sales growth required to meet full-year guidance in first quarter.

Amara Raja Batteries: The company is looking at acquisitions overseas to expand its lead acid battery business, said a top company official. “We are looking at Africa, the Middle East and South East Asia. We have studied the markets and are on the lookout for acquisitions,” said Jayadev Galla, Co-Founder and Chairman.

SpiceJet: The Directorate General of Civil Aviation has issued a show cause notice to the carrier for poor internal safety oversight and inadequate maintenance actions. The civil aviation regulator issued the show cause notice on Wednesday following multiple aircraft troubles in the past two weeks.

Bajaj Hindusthan Sugar: Shares of the company fell 9.5% after Business Standard reported that lenders have declared Bajaj Hindusthan Sugar a non-performing asset (NPA) as the company failed to make payments related to debt, worth Rs 4,814 crore as of March 31, 2022.