Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.24% higher at 15,803.5, indicating that Dalal Street was headed for a positive start on Wednesday.

Asian stocks slipped as investors’ fears over global recession deepened. Japan’s Nikkei 225 index dropped 1.26% and Topix plunged 1.37%. Hang Seng index lost 1.57% adn CSI 300 index fell 1.04%.

Indian rupee plunged to a record low of 79.37 against the US dollar on Tuesday.

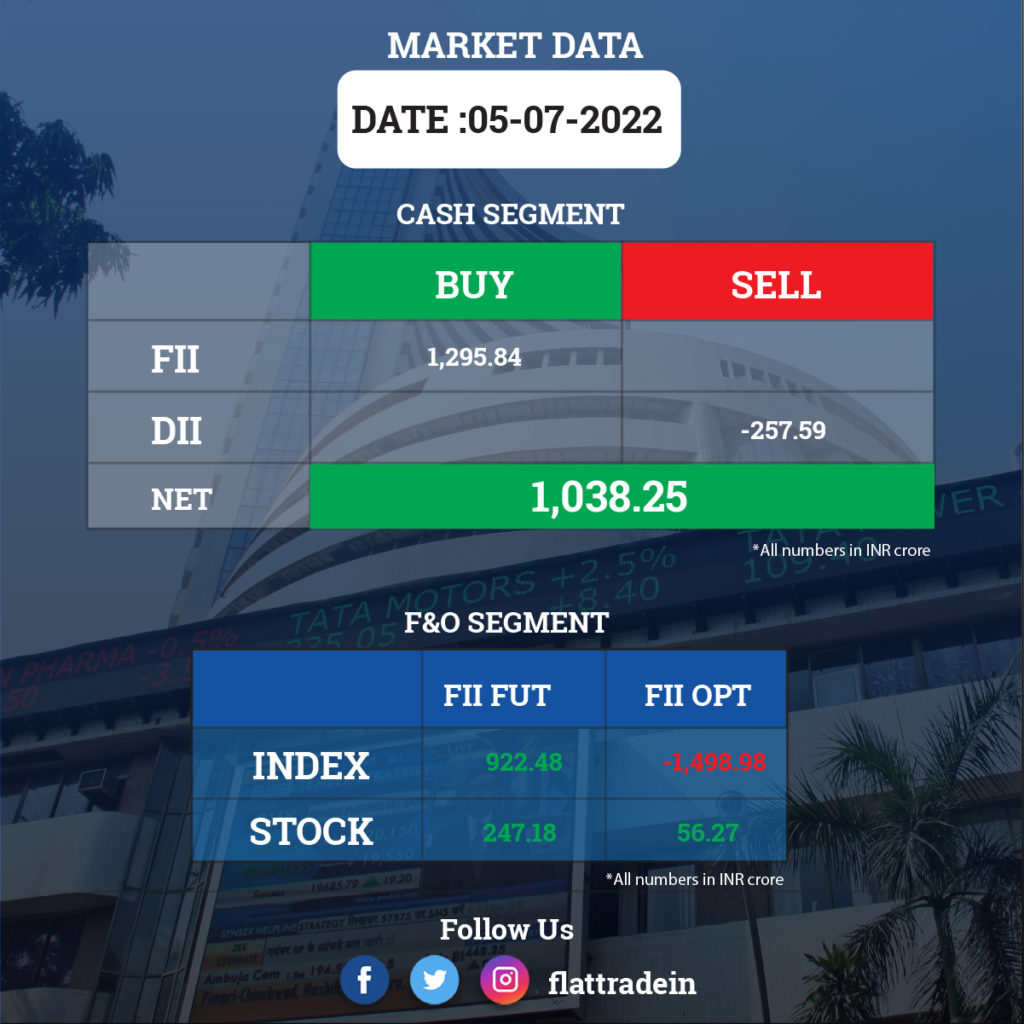

FII/DII Trading Data

Stocks in News Today

Adani Transmission: The company said that it will seek shareholders’ approval for the proposed related-party transactions worth up to Rs 10,600 crore in 2022-23. Three resolutions for the purpose of related party transactions during 2022-23 are listed on the agenda as per the notice of the company’s AGM (Annual General Meeting) scheduled on July 27.

Marico: The company’s domestic business volumes in Q1FY23 declined in mid-single digits, due to drop in Saffola Oils, while Parachute coconut oil recorded a minor volume decline. Value added hair oils grew in low single digits in value terms despite weak consumption sentiment, especially in rural. The International business maintained its strong momentum, delivering high-teen constant currency growth. Consolidated revenue in the quarter ended June 2022 was marginally higher on a year-on-year basis.

Biocon: The company’s subsidiary Biocon Biologics has received EU GMP certificate from the Health Products Regulatory Authority (HPRA), Ireland, for its new monoclonal antibodies (mAbs) drug substance manufacturing facility (B3) at Biocon Park, Bengaluru. This is after the good manufacturing practice (GMP) inspection conducted in April 2022 by the said authority.

Tejas Networks: The company has acquired 62.65% stake in Saankhya at a price of Rs 454.19 per equity share. The transaction cost is Rs 276.24 crore. After this transaction, Saankhya has become a subsidiary of the company.

Bajaj Finance: The company’s assets under management rose 3.55% month-on-month to Rs 2.04 lakh crore in the quarter ended June, even as net liquidity surplus was Rs 11,550 crore.

KPI Green Energy: The company has received an order for executing solar power project of 23.60 MWdc capacity from Nouveau Jewellery LLP and 3 MWdc capacity from Nouveau Diamonds Manufacturing India LLP. The order is under ‘captive power producer (CPP)’ segment of the company.

Satia Industries: The company has received an order worth over Rs 105 crore from National Council of Educational Research and Training (NCERT). The company will supply 11,000 tons of Maplitho paper of 80 GSM in sheets and reels for printing of text books.

Transcorp International: Tide, the UK’s leading SME-focused business financial platform, has partnered with Transcorp International, an Authorised Dealer Category II and perpetual Prepaid Payment Instrument (PPI) license holder. They will launch co-branded prepaid cards (Tide Expense Card) as an entry product. Tide will offer payment services to small businesses across India, starting with a Tide business account, accompanied by a Tide Expense Card.

Equitas Holdings: The company has completed the sale of its entire shareholding in its subsidiary, Equitas Technologies (ETPL). With this, the company complied with the condition stated by RBI as part of its no objection letter for amalgamation of Equitas Holdings with Equitas Small Finance Bank.. Consequently, ETPL has ceased to be the subsidiary of the company.

South Indian Bank: The lender’s advances grew 11% year-on-year and 4.8% sequentially to Rs. 62,095 crore. Deposits rose 4% over a year ago but fell 1% on a quarterly basis. The lender’s CASA ratio stood at 34% in Q1 FY23 compared to 33% in Q4 FY22 and 30% in Q1 FY22.

J Kumar Infraprojects: The company has received letter of acceptance from BMC for building Sewer Tunnel-Phase I from Don Bosco to New Malad IP. The project is worth Rs 571.01 crore, and the company has 60% stake in the JV which comes to Rs 342.60 crore.