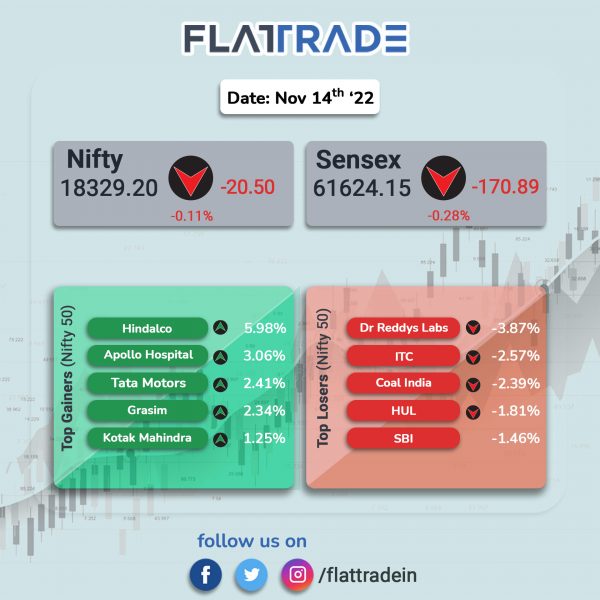

Benchmark equity indices fell, weighed by FMCG, PSU Bank and Energy stocks. The Sensex fell 0.28% and the Nifty slipped 0.11%.

In broader markets, Nifty Midcap 100 index edged up 0.06% and the BSE Smallcap index was up 0.25%.

Top losers among Nifty sectoral indices were Media [-2.4%], FMCG [-1.35%], PSU Bank [-0.60%] and Energy [-0.33%]. Top gainers were Metal [1.73%], Realty [1.13%] and IT [0.87%].

Indian rupee fell 47 paise to 81.26 against the US dollar on Monday.

India’s annual wholesale price-based inflation (WPI) eased in October to 8.39% year-on-year, the lowest since March 2021, helped by a fall in commodity prices, government data showed. The food inflation has decreased from 8.08% in September to 6.48% in October. Core Inflation stood at 4.6% during the reported month as against 7% in the preceding month.

Stock in News Today

Bharat Forge: The company posted a standalone net profit of Rs 268.1 crore in Q2FY23, down 14% YoY from Rs 311.7 crore. The company’s revenue rose 16% to Rs 1864 crore in Q2FY23 from Rs 1606 crore in the year-ago period. Its EBITDA fell 6.6% to Rs 453 crore in Q2FY23 from Rs 485 crore in Q2FY22.

Grasim Industries: The company’s profit rose 1.8% to Rs 964 crore in Q2FY23 from Rs 947 crore in the year-ago period. Its revenue jumped 36.7% YoY to Rs 6,745 from Rs 4,933 crore in the year-ago period. EBITDA rose 19.4% to Rs 956 crore in the quarter under review from Rs 801.5 crore in the corresponding quarter last year.

Sun TV Network: The company reported a consolidated net profit of Rs 407.4 crore, up 3% from Rs 395.6 crore. Revenue fell down 2.7% to Rs 825.7 crore in the reported quarter as against Rs 848.7 crore in the year-ago period. EBITDA edged up 1.7% to Rs 537.5 crore in the quarter under review from Rs 528.6 crore. EBITDA margin stood at 65.1% in the reported quarter compared with 62.3% in the year-ago period. The company’s board has declared an interim dividend of Rs 3.75 per share (75%) on a face value of Rs 5 per share.

India Tourism Development Corporation (ITDC): The company posted a net profit of Rs 10 crore in Q2FY23 as against Rs 1.5 crore in Q2FY22. Revenue was up 32.5% to Rs 92.2 crore in Q2FY23 as against Rs 69.6 crore in Q2FY22. EBITDA rose to Rs 11.4 crore in the reported quarter as against Rs 0.6 crore in the year-ago period.

Jyothy Laboratories: The FMCG company said its consolidated net profit was up 45.2% at Rs 64.6 crore in Q2FY23 from Rs 44.57 crore in Q2FY22. Its consolidated revenue up 12.6% at Rs 659.2 crore in Q2FY23 from Rs 585.3 crore in Q2FY22. The company’s EBITDA rose 21% YoY to Rs 80.5 crore in the quarter under review.

PNC Infratech: The company reported a net profit of Rs 132.1 crore in Q2FY23 compared with Rs 132.5 crore in Q2FY22. Revenue fell 0.1% to Rs 1,795 crore in the quarter under review from Rs 1,798 crore in the year-ago period. EBITDA dropped 10.9% YoY to Rs 326.4 crore.

Lux Industries: The company’s net profit more than halved to Rs 42.1 crore from Rs 100.4 crore in the year-ago period. Revenue rose marginally 1.4% to Rs 635.6 crore in Q2FY23 from Rs 627 crore in the year-ago period. EBITDA dropped 53.7% to Rs 63.4 crore from Rs 137 crore in the year-ago period.

Bharat Bijlee: The company reported a net profit of Rs 16.9 crore, up 17.4% from Rs 14.4 crore. Revenue rose 5.9% YoY to Rs 323.5 crore from Rs 305.4 crore in the year-ago period. EBITDA grew 8.6% to Rs 24 crore in Q2FY23 from Rs 22 crore in Q2FY22.

Hi-Tech Pipes: The company’s net profit fell 2.3% to Rs 4.3 crore in Q2FY23 from Rs 4.4 crore in Q2FY22. Revenue was up 16% YoY at Rs 598.5 crore in the quarter under review. EBITDA jumped 32.3% YoY to Rs 23.6 crore in the reported quarter.

Strides Pharma: The company reported a net profit of Rs 22.8 crore in Q2FY23 as against a loss of Rs 162.5 crore in the year-ago period. Revenue rose by 24.3% YoY to Rs 897 core from Rs 721.4 crore in the year-ago period.

Varrroc Engineering: The company reported a net loss of Rs 795 crore in Q2FY23 from Rs 298.3 crore in Q2FY22. Revenue was up 21.2% to Rs 1,828 crore in Q2FY23 from Rs 1,508.6 crore in Q2FY22. EBIDTA fell 59.1% to Rs 137.8 crore in Q2FY23 from Rs 337.1 crore in Q2FY22.

Alembic Pharmaceuticals: The company said it has received approval from the US health regulator to market Cyclophosphamide capsules, which is used in the treatment of different kinds of cancers, in the American market. According to IQVIA, cyclophosphamide capsules, 25 mg and 50 mg, have an estimated market size of $8 million in the US for twelve months ending Sep 2022.