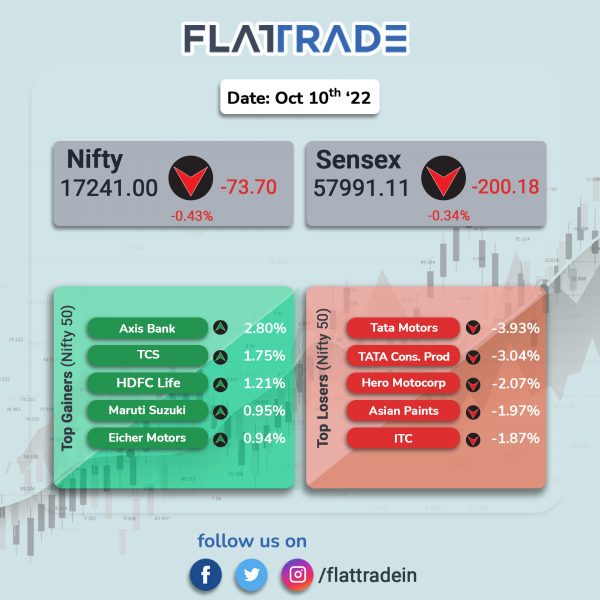

Benchmark indices ended lower but trimmed some losses in the second half of the session, helped by renewed buying in IT and select banking stocks. The Sensex fell 0.34% and the Nifty 50 index dropped 0.43%.

The Nifty Midcap 100 index tanked 0.95% and the BSE Smallcap was down 0.58%.

Top losers among Nifty sectoral indices were FMCG [-1.10%], Media [-1.07%], PSU Bank [-1.01%], Energy [-1.01%] and Realty [-0.8%]. Nifty IT [1.06%] was the only sectoral index that closed in the green.

Indian rupee stood at 82.32 against the US dollar on Monday.

India’s forex reserves dropped by $4.9 billion and the country’s reserves declined for a ninth consecutive week for the week ended September 30. As on Septemebr 30, the fores reserves stood at $532.66 billion, according to RBI data.

Stock in News Today

Reliance Industries Ltd (RIL): The conglomerate and Reliance Jio are in discussions with lenders to raise up to $1.5 billion and $2.5 billion, respectively, through foreign loans, reported The Economic Times. According to sources, the companies are in discussions with a number of lenders, including Barclays, HSBC, and Mitsubishi UFJ Financial Group. The loans are likely to have a five-year term and expected to be priced 130-150 basis points higher than the Secured Overnight Financing Rate (SOFR).

Adani Group: Billionaire Gautam Adani will raise about $10 billion from global investors like Temasek, GIC, and other private equity fund managers, according to a report by Livemint. The report said that the capital will be raised through a sale of stakes and the funds will be used for clean energy, ports and cement businesses.

Meanwhile, the group is in advanced talks with debt-laden Jaiprakash Power Ventures to buy its cement unit, ET NOW reported citing people familiar with the matter. The conglomerate could pay about Rs 5,000 crore for a cement grinding unit and other smaller assets, one of the sources said.

Easy Trip Planners (EaseMyTrip): Shares of online travel and ticket booking company rallied 6% in intraday trade after the company announced that its board has approved a bonus issue of three shares for every one share held i.e. 3:1 ratio and a stock split in the ratio of 1:2. The company also said that authorised share capital will be increased to Rs 200 crore from Rs 75 crore subject to shareholders’ and regulatory approval.

One 97 Communications (Paytm): The company said the value of loans disbursed by Paytm grew 482% year-on-year (YoY) to Rs 7,313 crore in Q2FY23. The value was Rs 1,257 crore in Q2 FY22. The number of loans disbursed grew 224% YoY to 9.2 million in Q2. Paytm disbursed 2.84 million loans in the same quarter last fiscal. Shares of the company jumped over 5% in intraday trade.

Computer Age Management Services (CAMS): The company announced that its board will meet on October 17 for considering of enhancing its equity investment in CAMS Financial Information Services, a wholly-owned subsidiary of the company. CAMSFINSERV is an account aggregator and has been registered with Reserve Bank of India as an NBFC- Account Aggregator.

Bank of Maharashtra: The bank increased its lending rate (MCLR) by 20 basis points across different tenors, effective from October 10, 2022. The overnight MCLR increased from 7.10% to 7.30 and MCLR for one month rose from 7.25% to 7.45%. The interest rate on the three month MCLR was raised from 7.40% to 7.60%, and the six month MCLR rate increased from 7.50% to 7.70%. The one year MCLR rate was raised from 7.60% to 7.80%.

EKI Energy: In an exchange filing, the company restated that Indian will not witness any ban for export of its surplus carbon credits. The company’s announcement came in the backdrop of a clarification by the country’s Minister for Power and New & Renewable Energy, RK Singh. CMD and CEO of EKI Energy Services Manish Dabkara said that this clarification will enable the entire industry ecosystem to strengthen the country’s domestic market with a steady supply of credits that will further accelerate India’s journey to a carbon neutral future.

JSW Steel: The company said that consolidated crude steel production rose 12% YoY to 5.62 million tonnes, in the second quarter of FY23. Thee company’ Indian operations saw 36% YoY rise in crude steel production. However, the output fell 3% sequentially due to extended maintenance shutdowns in JSW Ispat Special Products, subdued market conditions in the U.S. and lower capacity utilisation in other locations in India on account of supply and logistics constraints in sourcing of iron ore.

Ramkrishna Forgings: The company secured exports order worth Rs 131.5 crore from one of the largest TIER-1 manufacturers for use in the North American HCV segment. The order will be executed over a period of four years. The company said that it is in line with their strategy of increasing the revenue share and strengthening its exports.

Bandhan Bank: The lender reported a 22% jump in loans and advances at Rs 99,374 crore at end of September 2022 quarter. The bank’s loans and advances were Rs 81,661 crore in the year-ago period. Total deposits of the private sector lender rose by 21% to Rs 99,365 crore during the quarter, as against Rs 81,898 crore a year ago. Retail deposits stood at Rs 73,660 crore, 7% higher from Rs 68,787 crore in the year-ago period.

Sterlite Technologies: The company announced that it is its collaborating with Vocus Group for Project Horizon in Western Australia. Under the partnership, Sterlite Technologies (STL) will provide high strength optical fibre cables for Vocus’s inter capital network extension program. As part of the Project Horizon, Vocus deploy the first competitive fibre backbone between Perth and Port Hedland, and is the first major infrastructure project under Vocus’ $1 billion investment program.

Deep Industries: The company said that it has received letter of award (LoA) from Oil India for a contract worth Rs 71.64 crore. The contract pertains to charter hiring of two 550-750 horsepower (HP) capacity workover rigs for a period of three years. The company is engaged in the business of prospecting, exploring, developing, opening and working mines, drilling and sinking shafts or wells and to pump, refine raise, dig and quarry coal bed methane, minerals, ores, gases such as methane gas.

Artson Engineering: Shares of the company jumped more than 5% after the company announced that it had received a purchase order worth Rs 42.76 crore from Kutch Copper, a 100% subsidiary of Adani Enterprises. The order pertains to the manufacture and supply of 10 numbers of Gas to Gas Heat Exchanges and the order will be executed in 11 months.

Meanwhile, Artson Engineering also informed the exchange that its Chief Operating Officer and Key Managerial Personnel — BV Ramesh Krishna — tendered resignation from the services of the company citing personal reasons. BV Ramesh Krishna will continue in his current position till January 2023.

Gravita India: Shares of the company nearly 6% after the company announced that its step-down subsidiary in Senegal started commercial production of Aluminium from a new recycling plant with an annual capacity of around 4,000 MTPA. The company expects an additional revenue of approximately Rs 60 crore per year with gross margins of 20% from the new capacity.

Atul Auto: The company’s board approved a preferential issue of Rs 115 crore worth of warrants to promoters and non-promoters of the company, including ace investor Vijay Kishanlal Kedia. The board approved to issue up to 5.81 million warrants at Rs 198 apiece, each convertible into one equity share of the company within a maximum period of 18 months from date of allotment

Mold-Tek Packaging: The company informed that it has received a “Letter of Award” (LOA) from Grasim Industries – Birla Paints Division for the supply of Packing Material. The company plans to set up a co-located plant in Panipat to cater to their demands. The company stated that the new facility will be built at an estimated cost of Rs 30 crore and operational by the end of the calendar year 2023. In addition, the company also has plans to establish Food and FMCG IML container production facilities in Panipat.

Veranda Learning Solutions: Shares of the company rose 4.5% in intraday trade fter the company announced that its board will meet October 12, to consider potential acquisition. The company offers diversified and integrated learning solutions in online, offline hybrid and offline blended formats to students, aspirants, and graduates, professionals and corporate employees.