Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.46% lower at 17,151, signalling that Dalal Street was headed for a negative start on Tuesday.

Most Asian shares were trading lower following a fourth straight drop in US equities amid worries over rising interest rates and geopolitical threats. Japan’s Nikkei 225 index tanked 2.34% and Topix slumped 1.6%. Hang Seng fell 1.34%, while CSI 300 index rose 0.40%.

Indian rupee stood at 82.32 against the US dollar on Monday.

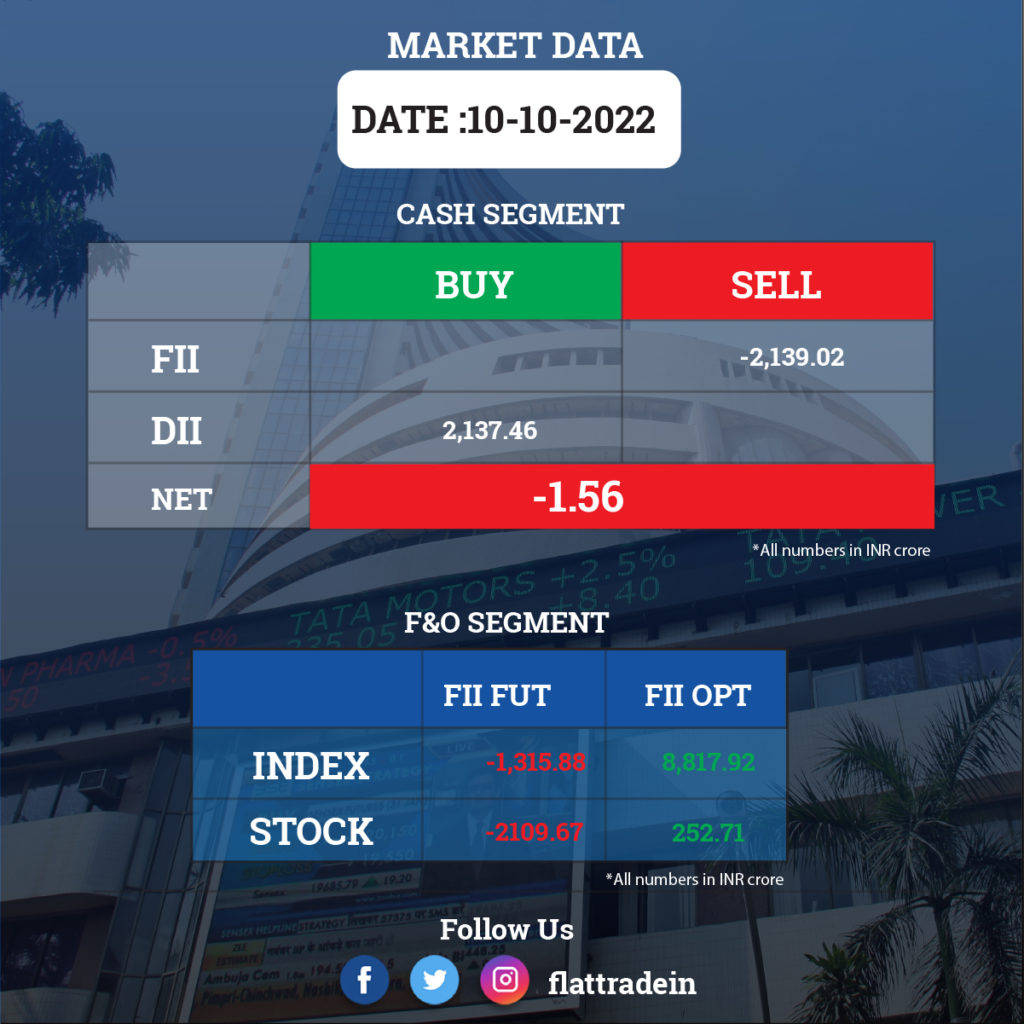

FII/DII Trading Data

Upcoming Results

Delta Corp, GM Breweries, Gujarat Hotels, Supreme Infrastructure India, and Trident Texofab will post their quarterly earnings.

Stocks in News Today

Tata Consultancy Services (TCS): The IT major reported a 10% sequential growth in consolidated profit at Rs Rs 10,431 crore in Q2FY23, with profitable growth across all industry verticals and in all major markets. Consolidated revenue grew by 4.8% sequentially and was up 18% YoY to Rs 55,309 crore, driven by strong execution, with dollar revenue rising 1.4% and constant currency revenue growth at 4% for the quarter. The order book remained strong at $8.1 billion for Q2FY23, though slightly down compared to $8.2 billion in previous quarter.

Adani Ports and SEZ (APSEZ): The company has received approvals from the National Company Law Tribunals at Ahmedabad and Hyderabad for acquiring 58% stake in Gangavaram Port Ltd (GPL) through the composite scheme of arrangement. With this stake purchase, GPL will become a fully-owned subsidiary of APSEZ. The acquisition of GPL is priced at around Rs 6,200 crore (517 million shares at Rs 120 each). The acquisition of the stake from D V S Raju and family will be a share swap, with 47.7 million APSEZ shares being issued to the erstwhile GPL promoters.

Bajaj Auto: The two-wheeler manufacturer said it has bought back over 64.09 lakh shares from public shareholders for Rs 2,499.97 crore under its share buyback exercise. The company, which had commenced the share buyback on July 4, 2022, said its Buyback Committee at its meeting held on Monday approved the completion and closure of the exercise from October 10, 2022.

Tata Motors: The automaker said its website faced temporary glitches as customers rushed in to book its recently introduced electric hatchback Tiago.ev. Bookings for the model commenced on Monday and deliveries are expected to commence from January next year. “All customer enquiries and booking-related concerns are being suitably addressed,” said Shailesh Chandra, Tata Motors Passenger Vehicles Managing Director.

Ashok Leyland: The bus maker and researchers at the National Centre for Combustion Research and Development (NCCRD) have joined hands for development and commercialisation of ‘swirl mesh lean direct injection (LDI) system’ for developing hybrid electrical vehicles using turbine technology. NCCRD is an arm of the Indian Institute of Technology, Madras. As part of the collaboration, Ashok Leyland handed over to NCCRD a nine-meter passenger electric bus on Monday.

Infosys: The IT services company said its board would decide on a proposal for share buyback in its meeting to be held on October 13 (Thursday). The board will finalise the company’s second quarter results on October 13.

JTL Infra: The company posted a 56.5% growth year-on-year in consolidated profit at Rs 20.27 crore for the September FY23 quarter, backed by strong operating performance. Consolidated revenue for the quarter grew by 14% YoY to Rs 299.9 crore.

Rategain Travel Technologies: Investor Wagner exited the company by selling entire 57.04 lakh equity shares or 5.28% shareholding in the company via open market transactions on October 6.

Panacea Biotec: The company has received long-term supply orders worth $127.30 million from UNICEF and Pan American Health Organization (PAHO). The company will supply WHO pre-qualified fully liquid Pentavalent vaccine, Easyfive-TT (DTwP-HepB-Hib). UNICEF order is worth $98.755 million for supply of 99.70 million doses during calendar years 2023-2027 and PAHO award is worth $28.55 million for supply 24.83 million doses during calendar years 2023-2025.

India Cements: The cement company has sold its entire shareholding in Springway Mining to JSW Cement. It has entered into a Share Purchase Agreement with JSW Cement and divested the entire shareholdings for Rs 476.87 crore. With this, Springway Mining is ceased to be the wholly-owned subsidiary of the company.

Triveni Turbine: Nippon Life India Trustee sold 2.92 lakh equity shares or 0.09% stake in the company via open market transactions. With this, its shareholding in the company reduced to 2.98%, from 3.07% earlier.

Inox Wind: The company said its subsidiary, Inox Green Energy Services, sold entire equity shareholding held in Wind One Renergy, Wind Three Renergy and Wind Five Renergy, to Adani Green Energy. All three special purpose vehicles successfully commissioned 50 MW each of SECI Tranche 1 in 2019. Inox Wind had won 250 MW under the Tranche 1 of Solar Energy Corporation of India’s (SECI -1) bids for wind power projects at Dayapar, Gujarat connected on the central grid, at a fixed tariff of Rs 3.46 per unit for 25 years for sale to PTC India.

Power Finance Corporation: Khandukhal Rampura Transmission, a wholly-owned subsidiary of PFC Consulting, that was established to develop 400 KV Khandukhal-Rampura D/C line has been transferred to the successful bidder, Megha Engineering & Infrastructures.

Bank of Baroda: The lender has hiked MCLR in the range of 10-15 basis points for across tenors. The revised MCLR will come into effect from October 12.

IRB Infrastructure Developers: The company reported toll revenue collection of Rs 328.24 crore, a decline of 2% from previous month’s collection. The revenue rose 36.6% Year-on-Year.