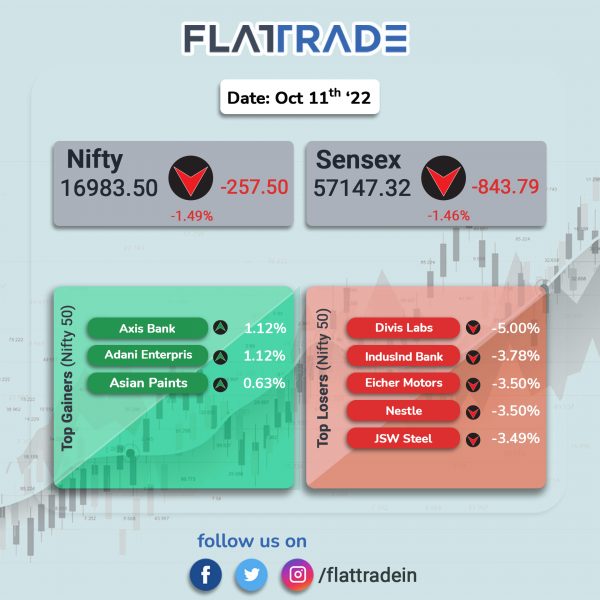

Dalal Street tumbled after oscillating in a narrow range due to weakening rupee and subdued global market sentiments. The Sensex tanked 1.46% and the Nifty 50 index lost 1.49%.

The Nifty Midcap 100 index tanked 1.74% and the BSE Smallcap fell 1.47%.

Top losers among Nifty sectoral indices were Realty [-3.07%], Metal [-2.2%], Media [-2.02%], IT [-1.99%] and FMCG [-1.76%]. All indices ended in the red on broad-based selling.

Indian rupee stood at 82.33 against the US dollar on Tuesday.

Stock in News Today

Larsen & Toubro (L&T): The company’s construction arm has secured ‘Significant’ orders from the Water Resources Department, Government of Odisha. L&T termed the order ‘Significant’ as the value of the order ranges between Rs 1,000- Rs 2,500 crore. The aggregate scope of the order includes execution of 23 Lift Irrigation Schemes with the objective to irrigate a culturable command area of 29,914 hectares in the districts of Keonjhar, Jajpur & Kendrapada on a turnkey basis.

Brigade Enterprises: The company’s board has appointed Executive Director Pavitra Shankar as Managing Director for a period of five years with effect from 12th October. The board has also approved Executive director Nirupa Shankar has been redesignated as Joint Managing Director. Chairman and MD MR Jaishankar has stepped down from the position of Managing Director, but will continue as Executive Chairman.

RateGain Travel Technologies: The company announced that it has been selected by Royal Orchid Hotels to drive profitability, better connectivity and real time pricing insights with bundled solution offering. RateGain’s Real-time Rate Intelligence Solution — OPTIMA — will help the Group to optimize their pricing strategy in accordance with the current market trends and competitor rates.

Automotive Axles: The company announced that Cummins Inc is making an open offer to shareholders of Automotive Axles to buy up to 39,29,114 shares with face value of Rs 10 each (26% of share capital), as on the 10th working day from closure of tendering period. Morgan Stanley has been appointed as manager to the open offer and the offer is made at a price of Rs 1,504.43 apiece.

Maharashtra Seamless and HDFC Bank: Maharashtra Seamless said that it has made a voluntary prepayment of long term loan outstanding of approximately Rs 315 crore to HDFC Bank on October 10 from internal accruals of the company. The company further informed that this long-term loan was availed from HDFC Bank in 2019 for part fund the acquisition of United Seamless Tubulaar.

ITD Cementation: The company has informed exchanges that it has bagged orders worth Rs 1,755 crore. The orders pertain to construction of west container terminal in the port of Colombo, Sri Lanka, construction of berth and yard facilities at Dhamra Port (two packages) in Odisha as well as piling and civil work for coke oven project at Hazira plant in Gujarat.

Sobha: The realty firm’s total sales declined 0.89% to 1.34 million square feet in Q2FY23 as compared with 1.35 million square feet recorded in the same period last year. As compared with Q1FY23, the company’s sales volume fell by 1.61%. Total sales value increased to Rs 1,164.2 crore in Q2FY23, up 13.01% YoY and up 1.63% QoQ. Sobha said that it has also recorded highest ever share of sales value, rising 12.5% to Rs 961 crore in Q2 FY23 from Rs 854.2 crore in Q2 FY22.

G M Breweries: The company’s net profit of rose 3.84% to Rs 22.69 crore in the quarter ended September 2022 as against Rs 21.85 crore during the same quarter last fiscal. Revenue rose 22.35% to Rs 141.86 crore in the reported quarter as against Rs 115.95 crore during the year-ago period. EBITDA stood at Rs 30.82 crore for the quarter ended September 2022 as against Rs 21.67 crore in the corresponding quarter last financial year.

ABB India: The company in an exchange filing said that Varanasi’s water supply body has collaborated with ABB India for its smart technology to facilitate smooth and efficient water supply to the city. The city’s pumping station and sewage treatment plants (STPs) have been installed with ABB softstarters for better water management operations. With this technology, ABB enables uninterrupted water supply to 60% of Varanasi city.

Ashiana Housing: The company announced that the entire 224 units in Phase 1 of Ashiana Amarah project which is located in Sector 93, Gurugram, have been booked by customers. The sale value of the project is Rs 242.6 crore. The Phase 1 of Ashiana Amarah project has a total saleable area of 3.95 lakh square feet. Shares of the company jumpd nearly 10% in intraday trade on Tuesday.

Suzlon Energy: The company’s Chief Financial Officer (CFO) Himanshu Mody said that the company would be able to pare its debt by Rs 583.5 crore, if its rights issue worth Rs 1,200 crore, gets fully subscribed. Mody also said that the company was looking to repay its remaining debt in eight years. The company will issue up to 240 crore partly paid-up equity shares at an issue price of Rs 5 per share aggregating to Rs 1,200 crore.

Dr Reddys Laboratories: The pharma major announced that its largest manufacturing facility in Bachupally, Hyderabad, has been recognised as part of the Global Lighthouse Network (GLN) by the World Economic Forum (WEF). With this recognition, the facility joins the GLN, a community of over 100 manufacturers that are showing leadership in applying Fourth Industrial Revolution (Industry 4.0 or 4IR) technologies to drive impact in productivity, workforce engagement, sustainability, and supply chain resilience.

KG Petrochem: In an exchange filing, the company said its Non-Executive Independent Director, Kamlesh Sharma, resigned on October 10. It added that Sharma does not hold directorships in any other listed entities.