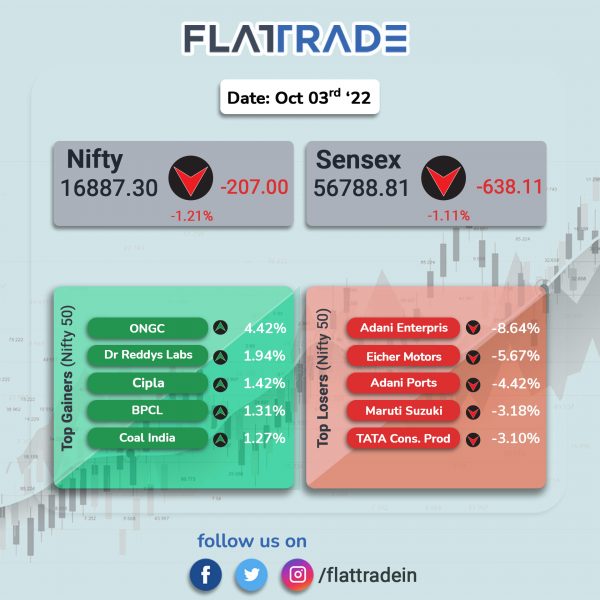

Dalal Street ended lower due to negative global sentiments and broad-based selling across sectors. The Sensex dropped 1.11% and the Nifty 50 index lost 1.21%.

The Nifty Midcap 100 index tumbled 1.6% and the BSE Smallcap fell 0.54%.

Top losers in Nifty sectoral index were Metal [-3.02%], PSU Bank [-2.67%], FMCG [-2.09%], Auto [-2.03%] and Bank [-1.56%]. Nifty Pharma was the sole index which gained 1.13%.

Indian rupee closed 53 paise lower to 81.87 against the US dollar on Monday.

In the economic front, the seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) stood at 55.1 in September 2022, expanding for the fifteenth month in a row. The headline figure, however, slipped from 56.2 in August 2022.

The gross GST revenue collected stood at Rs 1.47 lakh crore in September 2022 and it is the seventh month in a row in which gross receipts have been more than Rs 1.4 lakh crore, according to government data. The September 2022 revenue was 26% higher than the GST receipts in the same month last year.

In other news, India’s eight core infrastructure sectors’ output grew 3.3% in August 2022, lowest in past nine months, as against 12.2% in the year-ago period, official data showed.

Stock in News Today

Nykaa (FSN E-Commerce Ventures): The company’s board approved bonus share issue of five new shares each for one equity share held. The company will issue 2,37,27,61,850 equity shares of face value of Re 1 each to its shareholders. The company has fixed November 3, 2022, as the record date for the purpose of determining members eligible for bonus shares. Shares of the company jumped 11.15% in intraday but lost most of the gains made during the session to close 2.52% higher.

Adani Ports and Special Economic Zone (APSEZ): The company said that it has recorded a cargo volume of 26.1 million metric tonnes (MMT) in September 2022, registering a growth of 13% YoY. The company said that the average monthly cargo run rate is well aligned within its annual guided range of 350 -360 MMT.

Meanwhile, shares of Adani Group companies fell between 4.5% -12% due to selling pressure. Shares of Adani Green witnessed the biggest fall of 11.27% in intraday day among Adani Group companies.

Lupin: The company gained 6.9% in intraday trade after the pharma major announced that it has received the Establishment Inspection Report (EIR) from United States Food and Drug Administration (USFDA) for its Ankleshwar manufacturing facility in Gujarat.

HDFC: The NBFC has increased its Retail Prime Lending Rate (RPLR) on housing loans, on which its Adjustable Rate Home Loans (ARHL) are benchmarked, by 50 basis points, with effect from October 1.

Hero MotoCorp: The two-wheeler major’s total sales declined 1.95% to 519,980 units in September 2022 as against 530,346 units sold in September 2021. The company’s total domestic sales stood at 507,690 units, up 0.44% YoY, while total exports were at 12,290 units, down 50.61% YoY.

Ashok Leyland: The bus manufacturer’s total commercial vehicle (CV) sales climbed 84% to 17,549 units in September 2022 from 9,533 units sold in September 2021. The total sales of medium & heavy commercial vehicles (M&HCV) soared 124% to 11,314 units, sales of light commercial vehicles (LCVs) surged 39% to 6,235 units in September 2022 over the year-ago period.

Mahindra & Mahindra: The company’s domestic sales of tractors rose to 47,100 units, from 39,053 units during September 2021. Exports for the month stood at 1613 units, registering a growth of 26%.

Meanwhile, Mahindra’s Utility Vehicles segment recorded its highest monthly sales of 34,262 SUVs, growing 166% over last year. Overall, the automotive business recorded a monthly sales of 64,486 vehicles with a growth of 129% and highest ever quarterly sales of 179,673 vehicles with a growth of 77% over last year.

Sterlite Technologies: The company announced Gram Galaxy at IMC 2022 to accelerate last-mile rural connectivity and village digitalisation. The stock erased all the days in a weak market.

Chalet Hotels: Shares of the company rose 6.7% in intraday trade after the company said that rating agency ICRA had reaffirmed the company’s credit rating and the outlook on the long-term rating was revised from Negative to Stable. In a separate exchange filing, the company also said that another rating agency India Ratings had affirmed the company’s credit rating and outlook on the long-term issuer rating was revised from Negative to Positive.

Kajaria Ceramics: The company has entered into a joint venture with Ramesh for a manufacturing facility in Nepal. The company plans to invest up to Rs 125 crore by way of equity and/or loan for setting up the manufacturing facility. The total investment in the plant would be Rs 250 crore. The company would manufacture ceramic and glazed vitrified tiles in the proposed facility.

Triveni Turbine: Brokerage firm Anand Rathi initiated coverage of the company stock with a ‘buy’ recommendation and a target of Rs 285 per equity share. The brokerage firm noted that the company’s strong order book increase in addressable market, industry leading market share and capacity increase would aid the company in entering the next leg of growth.

Gokaldas Exports: The company’s promoter group — Clear Wealth Consultancy Services LLP — sold 1.5 million shares of Gokaldas Exports to Abu Dhabi Investment Authority, a sovereign state-owned wealth fund, at Rs 349.75 per share.

Steel Strips Wheels: The company announced that it approved subdivision of shares from one equity share of face value of Rs 5 to five equity shares of face value of Re 1 each. The record date will be announced soon, the company said.

Wardwizard Innovations & Mobility: The company sold 4,261 units of electric two-wheelers in September 2022, up 70% from 2500 units sold in the same period last year. Shares of the company rose 2.18% in intraday trade on Monday.

V-Mart Retail: The company has opened 16 new stores across nine states and closed two stores in two states in the July – September quarter of FY23. With this the total number of stores now stands at 405 stores.

J.Kumar Infraprojects: The company said that it has received a letter of acceptance (LoA) from Municipal Corporation of Greater Mumbai (MCGM) for a contract worth Rs 352.30 crore. The contract is for the proposed re-construction of Siddharth Municipal General Hospital on land at Siddharth Nagar, Goregaon.

Aster DM Healthcare: The company announced its association with Narayanadri Hospital & Research Institution to strengthen its presence in the southern part of India. This is part of the company’s O&M asset light model strategy undertaken by Aster DM Healthcare to add up to 500 – 700 beds in India. The company plans to expand the existing 150 bed hospital to 250 beds making it a comprehensive tertiary care facility, with the option of expanding to a quaternary care facility in future.

Veranda Learning Solutions: The company has inked a pact with the Electronics and Information, Communication Technology (E&ICT) Academy of IIT Guwahati to offer a range of technical and management courses and programmes. Under the agreement, they will co-develop specialized courses on Product Management, Supply Chain & Project Management, and Digital Business Management, to create a pool of skilled human resources in emerging areas.

Welspun: The company has signed an agreement with Laxmi Organic Industries for sale of land, civil structures, excluding plant & machinery, situated at Dahej unit of the company in Gujarat for a consideration of Rs 130 crore. Welspun management said that the transaction would not have any material and adverse effect on operations of the company.