Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.35% lower at 16,857.50, signalling that Dalal Street was headed for a gap-down start on Monday.

Japanese markets rebounded from day’s lows with the Nikkei 225 index gaining 0.65% and the Topix index rising 0.27%. Chinese stocks fell due to negative sentiments in markets amid fear of recession risks. The CSI 300 index fell 0.58% and the Hang Seng index down 0.92%.

Indian rupee closed 52 paise higher at 81.34 against the US dollar on Friday.

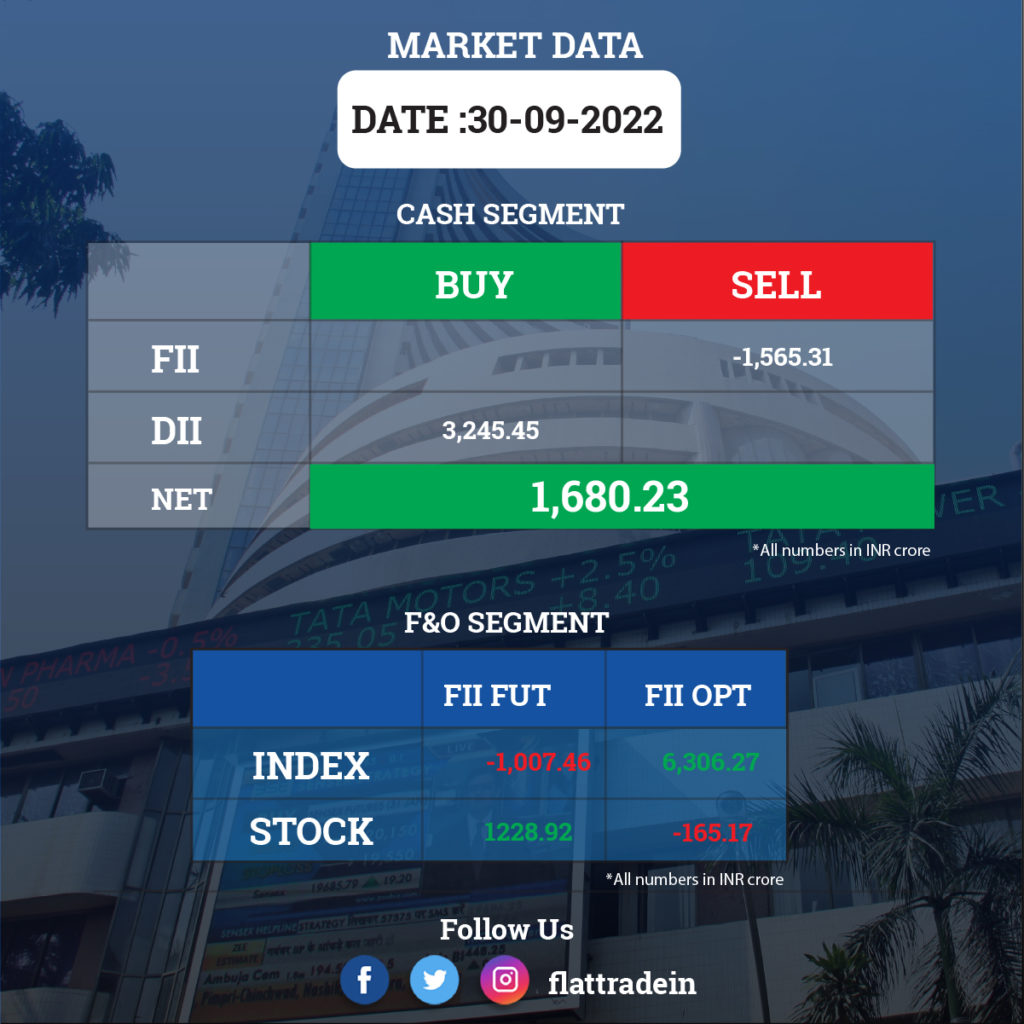

FII/DII Trading Data

Stocks in News Today

Reliance Jio, Airtel and Vodafone Idea: Mukesh Ambani announced that his telcom firm will launch 5G services across the country by December 2023 during the the sixth India Mobile Congress where Prime Minister Narendra Modi launched 5G sevices in the country. Jio is rapidly progressing to roll out 5G services within this month, he added.

Meanwhile, Airtel will roll out 5G services nationwide by March 2024, while Vodafone Idea will do the same in the coming months, leaders of both companies during the event.

Adani Group: The group will raise money from the market to buy road projects from Macquarie Asia Infrastructure Fund (MAIF), Business Standard reported. Two entities of Adani Enterprises — Adani Road GRICL (ARGL) and Adani Road STPL — will raise up to Rs 800 crore through non-convertible debentures, according to the report. Each of the entities will raise up to Rs 400 crore by issuing debentures. ARGL will acquire 56.8% stake in Gujarat Road Infrastructure Company (GRICL). ARGL is also evaluating to subsequently acquire IL&FS’s 26.8% stake in GRICL and ultimately have 83.6% shareholding in the entity. ARSL will acquire 100 per cent holding in Swarna Tollway Pvt. Ltd (STPL) from Macquarie.

NTPC: The state-run power giant said it has logged 15.1% growth in power generation at 203.5 billion units (BU) during April-September 2022 due to improved performance and an increase in demand for power in the current year. Overall plant load factor of NTPC coal stations stood at 76.3% in the period under review. The total installed capacity of NTPC is 70,234 MW.

HFCL: The telecom equipment manufacturer and technology provider, has launched its 5H 8T8R Macro Radio Unit (RU), its first product from the 5G family. The announcement came after Prime Minister Narendra Modi on Saturday launched the 5G service in India at India Mobile Congress 2022. The company said the radio unit has a compact form factor, improved energy efficiency, supports digital beamforming and zero-touch provisioning.

Maruti Suzuki: The carmaker reported a two-fold increase in total wholesales to 1,76,306 units in September. The company was hit by a massive shortage of electronic components last year and it dispatched 86,380 units in September 2021. The company’s domestic sales rose over two-fold to 1,54,903 units against 68,815 units in September 2021, the company said in a statement. Exports jumped to 21,403 units from 17,565 units in the corresponding month last year, the company said.

Tata Motors: The company reported a 44% yearly jump in domestic sales to 80,633 units in September 2022, compared with 55,988 units sold to dealers in September last year. The Tata group company also witnessed an increase of 85% in the domestic passenger vehicle (PV) sales to 47,654 units in September 2022, compared with 25,730 vehicles in September last year. The growth was mainly driven by Nexon and Punch models, said Shailesh Chandra, said Managing Director, Tata Motors Passenger Vehicles. Total sales of commercial vehicles (CVs) increased 9% to 34,890 in September 2022 from 33,258 in September last year.

Bata India: Kanchan Chehal is proposed to take up a Global role with Bata Group, hence he ceased to the whole-time director but would continue to serve the board at Bata India as a non-executive director. In addition, Vidhya Srinivasan has resigned as Director – Finance and Chief Financial Officer of the company to pursue opportunities outside, effective November 12, 2022. For the interim period, Shaibal Sinha, the non-executive non-independent director, has been assigned the responsibility to oversee the finance & accounts functions of the company.

Coal India: The company said its coal production in September 2022 increased by 12.3% to 45.7 million tonnes, and offtake rose by 1.1% to 48.9 million tonnes compared to same period last month. These are provisional numbers.

TVS Motor: The company registered a growth of 9% in September 2022 with sales of 379,011 units as against 347,156 units in September 2021. Two-wheelers registered a growth of 9%, with sales increasing from 332,511 units in September 2021 to 361,729 units in September 2022. Domestic two-wheeler rose 16% from 244,084 units a year ago to 283,878 units in September 2022.

Royal Enfield: Motorcycle maker reported an over two-fold rise in total sales at 82,097 units in September 2022. The company had sold 33,529 units in the same month last year. Domestic sales were higher at 73,646 units last month against 27,233 units in September 2021. Exports were also up at 8,451 units compared to 6,296 units in the year-ago month, it added.

APL Apollo Tubes: The steel tube maker registered a quarterly sales volume of 6.02 lakh tonnes in Q2FY23, up 41% YoY. The sales volume for the first half of FY23 was 10.25 lakh tonnes compared to 8 lakh tonnes in the same period last year. In the second half of FY23, the sales volume is expected to rise from the commissioning and ramp-up of the new Raipur plant, the company said.

Escorts Kubota: The company said its agri machinery segment sold 12,232 tractors in September 2022, registering a growth of 38.7% as against 8,816 tractors sold in the same month last year. Domestic tractor sales increased 42.7% to 11,384 units and export sales stood at 848 tractors compared in the said period.

Zydus Lifesciences: The pharma company has received approval from the United States Food and Drug Administration to market Sildenafil, a high blood pressure drug. It works by relaxing and widening the blood vessels in lungs, which allows the blood to flow more easily. The drug had an annual sales of $65 million in the United States, according to IQVIA data of August 2022.

Dilip Buildcon: The company received a provisional completion certificate for rehabilitation and up-gradation from two to four lane for Varanasi – Dagamagpur section of the National Highway-7 on EPC mode in Uttar Pradesh. With this, the authority declared the project fit for entry into commercial operation on September 29.

Suzlon Energy: The founder and chairman Tulsi Tanti passed away on the night of October 1 following a cardiac arrest, the company said in a regulatory filing.

Federal Bank: The kerala-based bank’s CASA deposits aggregated to Rs 68,873 crore, up 10.7% YoY. CASA ratio reached 36.41% in Q2 compareed to 36.16% in Q2. Gross advances grew 19.4% YoY while customer deposits jumped 8.5% to Rs 1,83,106 crore.

Karur Vysya Bank: The private lender’s total deposits jumped to Rs 73,614 crore in Q2 compared to Rs 65,410 crore YoY, while CASA deposits rose to Rs 25,913 crore versus Rs 23,159 crore YoY. Advances jumped to Rs 62,416 crore vs Rs 53,850 crore.

Punjab National Bank: The lender hiked repo-linked lending rate by 50 basis points to 8.40% from 7.90%, after a similar increase by RBI. Base rate and MCLR across tenors have been hiked by 5 basis points

Muthoot Capital Services: The company has completed a securitization transaction of Rs 121.56 crore on September 30, according to its exchange filing. This is the fourth securitization transaction carried out by the company during the FY23, the company said. The entire pool is from the non – priority sector and has been taken after considering the RBI guidelines, Muthoot Capital added.

63 Moons Technologies: The company will provide software support services to Multi Commodity Exchange of India (MCX) for three months effective from October 1. Its ongoing software support and maintenance agreement ended on September 30.

Likhitha Infrastructure: The company has received orders worth Rs 177 crore from various oil & gas distribution companies during the quarter ended September 2022. The total outstanding order book of the company as on September 2022 is Rs 1,125 crore.

Future Supply Chain Solutions: Mayur Toshniwal has resigned as a director of the company with effect from September 30, 2022.