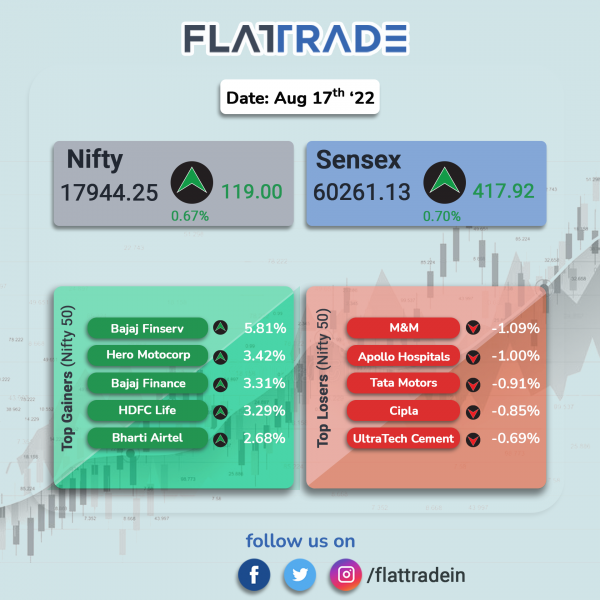

Benchmark indices ended higher on positive sentiments over easing oil prices and cooling inflation may likely nudge the Fed not to raise rates aggressively. The Sensex advanced 0.70% and the Nifty 50 index gained 0.67%.

Meanwhile, the Nifty Midcap 100 gained 0.47% and S&P BSE SmallCap advanced 0.53%.

Top Nifty sectoral gainers were PSU Bank [2.26%], Media [1.46%], IT [1.16%], Financial Services [0.86%] and FMCG [0.73%]. Top loser was Auto [-0.42%]

The Indian rupee strengthened by 21 paise to 79.45 against the US dollar on Wednesday.

Stock in News Today

UTI AMC: Shares of the company fell over 4.5%, after the company clarified to the exchanges that it was not aware of any negotiations with Tata AMC.

Bharti Airtel: The telco said that it has paid Rs 8312.4 crores to the Department of Telecom towards dues for spectrum acquired in the recently concluded 5G auctions. Airtel has paid 4 years of 2022 spectrum dues upfront. Airtel believes that this upfront payment coupled with the moratorium on spectrum dues and AGR related payments for four years will free up future cash flows and allow Airtel to dedicate resources to single-mindedly concentrate on the 5G roll out, according to its exchange filing.

RateGain Travel Technologies: Shares of the company rose after the SaaS company’s AirGain product was selected by Air India to adjust prices with real-time, accurate and high quality airfare data. AirGain would help Air India to stay ahead of competition through its analytical abilities, Rategain said in an exchange filing.

HDFC and Ansal Housing: HDFC has demanded Ansal Housing to repay its loans of Rs 13 crore with interest. HDFC said that it will invoke and sell 66.83 lakh shares of Ansal Housing pledged with it, if payment is not done within the prescribed time.

NXTDigital: Shares of the Hinduja Group company rose over 6.5%, after the company approved merger of Hinduja Leyland Finance into itself. The proposed merger will be completed purely through exchange of shares and there is no cash consideration involved. Shareholders of Hinduja Leyland will get 23 shares in NxtDigital for every 10 shares held by them in Hinduja Leyland.

Aarti Drugs: Shares of the company jumped over 11 per cent amid news reports that the government proposed to impose anti-dumping duty on Ofloxacin and intermediates imported from China for five years. The pharma company had alleged that dumping of the subject goods caused damage to domestic industry.

Sona BLW Precision Forgings (Sona Comstar): The company has partnered with DRIVE, an Israel-based innovation hub focused on smart mobility solutions. Kiran M Deshmukh, Group CTO of Sona Comstar, said, “Our partnership with DRIVE will help us speed up our innovation processes as we look to expand our collaboration with the Israeli hi-tech ecosystem in the mobility space.”

Indoco Remedies: The company has entered into an agreements to acquire up to 26% stake in Kanakal Wind Energy to set up solar power plant at Akkalkot, Solapur District in Maharashtra. Post the acquisition, it will become associate company of Indoco Remedies as the company will hold 26% of shares in Kanakal Wind Energy while remaining 74% will be held by First Energy.

Singer India: shares of the company rose 14.24% after Rakesh Jhunjhunwala’s Rare Investments bought a stake in the sewing machine maker. Several other firms also purchased Singer India shares via bulk deal.

Jindal Poly Films: Shares of the company gained 2.4% after the company made investment in equity shares of Universus Commercial Properties on its incorporation. The purpose of the proposed investment is to benefit from the profitable real estate opportunities by UCPL.