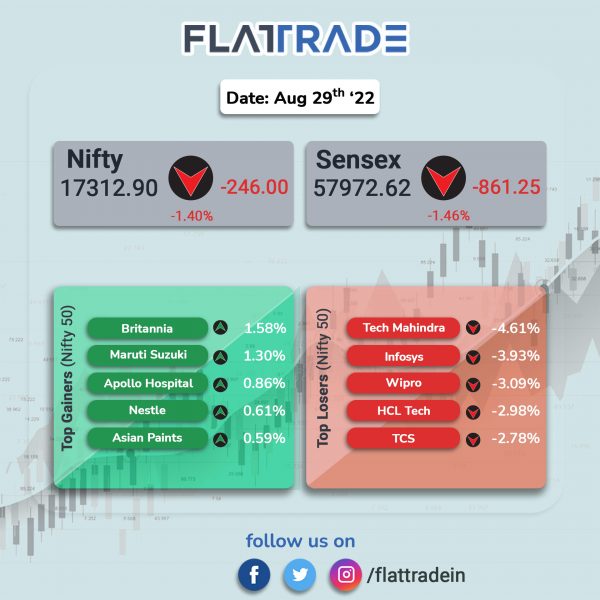

Dalal Street ended lower after opening gap-down due to weak global sentiments following the comments of the US Federal Reserve officials at Jackson Hole annual economic symposium on Friday. The Sensex tanked 1.46% and the Nifty 50 index fell 1.4%.

Broader markets also declined tracking headline indices. The Nifty Midcap 100 index lsot 0.83% and the BSE SmallCap was down 0.57%.

Top Nifty sectoral losers were IT [-3.53%], Media [-2.03%], Private Bank [-1.86%], Bank [-1.82%], Financial Services [-1.69%] and Metal [-1.53%]. Top gainer was FMCG [0.39%.]

The Indian rupee fell 10 paise to 79.96 against the US dollar on Monday.

Stock in News Today

Reliance Industries Ltd (RIL): The company’s chairman Mukesh Ambani made a slew of announcements in the 45th AGM. Ambani said that the company would launch Jio 5G services in India in the next two months. The company has set aside Rs 2 trillion for making it possible. “Within the next two months, by Diwali 2022, we will launch Jio 5G across multiple key cities including metro cities of Delhi, Mumbai, Chennai and Kolkata,” he said.

RIL will invest Rs 75,000 crore in the next five years to expand petrochemical capacity, its chairman Mukesh Ambani said on Monday. Speaking at the company’s annual general meeting, he said the investments will be in setting up a PTA plant, expanding polyester capacity, tripling capacity of vinyl chain and a chemical unit in UAE.

Reliance Retail will launch its FMCG business this year, Reliance Retail Ventures Director Isha Ambani said on Monday. The objective of this business will be to develop and deliver products and solve every Indian’s daily needs, with high quality products at affordable pricing, she said while addressing Reliance Industries’ annual general meeting.

The company’s subsidiary, Reliance Retail, has submitted a non-binding bid of about Rs 5,600 crore to acquire Metro Cash and Carry’s operations in India, reported The Economic Times citing industry executives aware of the development.

Grasim Industries: The company would invest Rs 3,117 crore in its existing businesses excluding the paints and B2B e-commerce business in FY23, its Chairman Kumar Mangalam Birla said on Monday. This investment would be towards capacity creation and modernisation of plants. He said that the company has already approved a total capex of Rs 10,000 crore for the paints business, out of which Rs 605 crore has been spent till FY22.

Vodafone Idea (VIL): A cyber security research firm claimed that call data records of around 20 million customers of the company were leaked and accessed by cyber-criminals, but the telecom operator has denied the breach. The company said that it learnt about a “potential vulnerability in its billing communication” and that “was immediately fixed” and a thorough forensic analysis was conducted to ascertain there was no data breach.

L&T Technology Services (LTTS): The company has won a five-year, multi-million dollar deal from BMW Group. The deal pertains to providing high end engineering services for the company’s suite of infotainment consoles for BMW’s hybrid vehicles. LTTS will provide services in areas of software build, integration, infotainment validation and defect management.

Ashok Leyland: The commercial vehicles manufacturer is set to launch its electric light commercial vehicle (eLCV) within six months. The company unveiled ithe Bada Dost i1 and Bada Dost i2. The company has also launched Bada Dost Edition with industry first features in a commercial vehicle. The Bada Dost i1 and i2 offer a payload of 1,250 kilo gram and 1,425 kg, respectively.

Bank of Baroda: The lender plans to raise at least 5 billion rupees ($62.52 million) through sale of Basel III compliant additional Tier I perpetual bonds, Reuters reported citing three merchant bankers. The state-run lender has invited coupon and commitment bids from bankers and investors on Tuesday, they said. The bonds are rated AA+ by ICRA and India Ratings and the issue will close for subscription later this week.

Data Patterns (India): Shares of the company jumped over 14% on heavy volumes and hit a record high of Rs 1094 in intraday trading. However, it pared some gains to close at Rs 1032.5 apiece. In the last two months, the shares have jumped about 70.80% from June’s closing price of Rs 640.5 per share.

BEML: The government is likely to invite financial bids for the privatisation of the company in the December quarter. Earlier this month, the corporate affairs ministry approved the demerger of land and non-core assets of BEML to BEML Land Assets. The official said that every shareholder of BEML will get shares in BEML Land Assets and the process of demerger would be completed by October 2022.

Punjab & Sind Bank (P&SB): The rating agency CRISIL has reaffirmed its rating on the long-term debt instruments of Punjab & Sind Bank (P&SB) at ‘CRISIL AA/Negative’. The ‘Negative’ outlook on the debt instruments reflects bank’s weak asset quality and profitability.

Lipin: The pharma major in partnership with Pharmascience announced that it has received tentative approval from the USFDA for its ANDA, Dasatinib tablets. These tablets are a generic equivalent of Sprycel tablets of Bristol-Myers Squibb company. The drug is used to treat a certain type of chronic myeloid leukemia, a type of cancer in white blood cells.

ICICI Bank: The lender will launch RuPay credit cards in partnership with NPCI. ICICI Bank Coral RuPay credit card will be launched, followed up with Rubyx and Sapphiro variants

Indian Railways Catering and Tourism Corp: The shares of the company lost over 7.3% in intraday trading after the company withdrew appointment of a consultant for data monetisation of lndian Railways, Bloomberg news reported. The decision was taken after the government withdrew Personal Data Protection Bill, 2018, according to the ticketing arm of Indian Railways, the report said.

Alembic Pharma: The company announced that it has successfully completed the USFDA Remote Regulatory Assessment (RRA) for its bioequivalence facility, bio-analytical division at Vadodara, without any observations. The company also received final approval from the US drug regulator for Chlorthalidone tablets USP, 25 mg and 50 mg. The approved ANDA is therapeutically equivalent to Hygroton Tablets of Sanofi Aventis. The drug is indicated for managing hypertension either as sole therapeutic agent or to enhance the effect of other anti-hypertensive drugs.

Aurobindo Pharma: The US health regulator has issued Form 483 with one observation after completion of inspection at Aurobindo Pharma’s subsidiary Aurolife Pharma’s Raleigh Plant in North Carolina. The company said that the observation by the USFDA is procedural in nature and there were no data integrity issues. The company also said it will work close with the US FDA to address the observation at the earliest.

Defence Equipment Companies: Shares of defence equipment manufacturers, service providers and ship building firms gained in intraday trading after the Defence Ministry approved the third positive indigenisation list (PIL) of 780 strategically important Line Replacement Units/Sub-Systems/Components with a timeline.

Sansera Engineering: The company has won a repeat order worth Rs 50.8 crore from a North American manufacturer of EV passenger cars, the company said in an exchange filing. The order pertains to manufacturing of precision forged and machine components for passenger vehicles. With this new order, the annual order book of Sansera Engineering with the customer rose above Rs 100 crore.