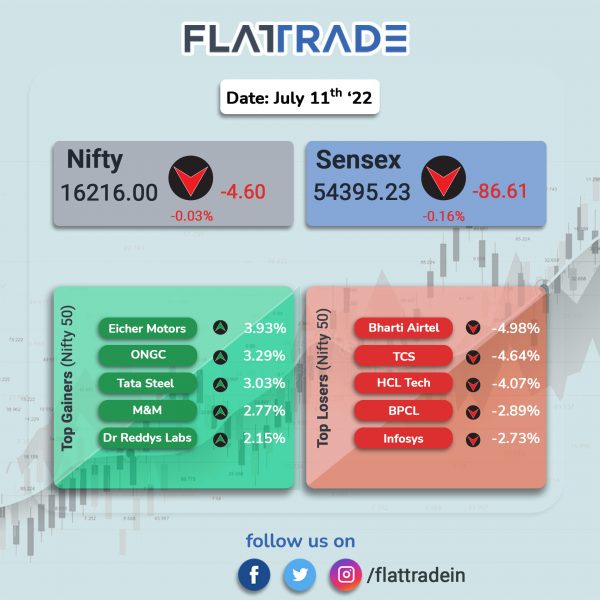

Benchmark indices closed lower, weighed by losses in technology stocks and Airtel. The Sensex fell 0.16% and the Nifty 50 index dipped 0.03%.

Broader markets outperformed benchmark indices. The NSE Midcap 100 index gained 0.94% and BSE Smallcap was jumped 1.07%.

Top Nifty sectoral gainers were Energy [2.7%], Metal [1.97%], PSU Bank [1.88%], Realty [1.47%], Pvt Bank [1.21%] and Auto [1.05%]. Top losers was Nifty IT [-3.08%].

Indian rupee fell 19 paise to 79.43 against the US dollar on Monday.

Stock in News Today

One 97 Communications (Paytm): The fintech company, in an exchange filing, said that the number of loans disbursed through the company’s platform grew 492% y-o-y to 8.5 million loans in the quarter ending June 2022, while the value of loans disbursed grew 779% y-o-y to Rs 5,554 crore. The company had disbursed 14.33 lakh loans worth Rs 632 crore in the year-ago period. The company said that it is seeing increases in average ticket size due to the scale-up of the personal loans business in particular.

Airtel: Shares of the company tanked about 5%, after Adani Group sought to bid for 5G airwaves to provide private network and cybersecurity solutions in its other businesses such as airport, port and logistics.

Larsen & Toubro (L&T): The company’s Buildings & Factories (B&F) business has secured significant contracts from various clients. According to L&T’s classification, the value of the significant project range between Rs 1,000 crore and Rs 2,500 crore. It has secured orders from renowned data center service providers to construct data centers of a total capacity of 10.8 megawatt (MW) at Mumbai and Navi Mumbai.

Coal India: The company said its capex jumped to Rs 3,034 crore in Q1FY2024 compared to Rs 1,193 crore in Q1FY2022. The capex increase came on the back of strong spending in acquiring land and strengthening transport infrastructure in its coalfields under first mile connectivity projects, Coal India said.

Public Sector Banks: Shares of state-owned banks rose after Bloomberg reported that finance ministry sought the approval of law ministry for its rules to privatise state-run banks. Government may present the proposed rules during the parliament’s Monsoon Session, Bloomberg said citing source.

Steel companies: The Indian government is likely to cut or abolish the recently-imposed export taxes on key steel products soon, Financial Express reported citing unidentified government sources. Recently, the central government had levied a 15% export duty on several finished steel products and pig iron to tackle inflation and increase output.

Wipro Ltd: The IT services company plans to offer employee promotions every quarter and boost salaries of most of its workforce by 10% in September, with the top performers receiving more than 15% hikes, according to a news report by Livemint. Wipro recorded an attrition of 23.8% in the March quarter.

Power Grid Corporation of India : The company said that it has been declared as the successful bidder for establishing an inter-state transmission system for evacuation of power from Neemuch SEZ. The company’s bid has been declared successful under tariff-based competitive bidding (TBCB). The project has been awarded on a build, own, operate and transfer basis.

Dr. Reddy’s Laboratories: The pharma company announced the launch of Fesoterodine Fumarate Extended-Release tablets, a therapeutic generic equivalent to Toviaz (fesoterodine fumarate) extended-release tablets in the US market approved by the USFDA.

Thomas Cook India: Shares of the company rose 5.6% in intraday trading after the company launched Vistara Getaways- International, in exclusive partnership with Vistara. Vistara Getaways provides users with dynamic inventory and ready-to-book holidays.

Bank of Maharashtra: The lender cut its marginal cost of funds-based lending rate (MCLR) by 20-35 basis points (bps) across tenors effective July 11. The state-owned lender cut overnight and one-month MCLR by 25 bps to 6.90% and 7%, respectively. The three-month MCLR was cut by 35 bps to 7.2%. One-year MCLR were cut by 20 bps to 7.5%, according to the bank’s exchange filing.

Himadri Speciality Chemical: The company said that the promoter, BLC family, have also submitted request/application under Regulation 31A of SEBI listing regulations to reclassify themselves from promoter and promoter group to public category. The FSA has been entered to amicably settle all past issues between SSC family and BLC family. With this, BLC family will cease to hold any right in the management and/or control in the company.

Glenmark Pharmaceuticals: The company has launched India’s first topical Minocycline 4% Gel for the treatment of moderate to severe acne, under the brand name MINYM. Minocycline is a potent antibacterial gel which exerts a strong anti-inflammatory action.

Dilip Buildcon: The company said it was declared as the lowest bidder for ‘Gandhisagar-2 Multi-Village Water Supply Scheme’ in Madhya Pradesh. The awarded bid project cost for the project is Rs 1400 crore and estimated completion time is 28 months. The project entails engineering, procurement, construction, testing, commissioning, trial run and operation & maintenance of various components of the scheme.