Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.8% lower at 16,070.5, signalling that Dalal Street was headed for a negative start on Tuesday.

Asian shares fell on Tuesday as investors were worried over gloomy economic outlook amid high inflation, China’s fresh COVID outbreak and Europe’s energy shortage. Japan’s Nikkei 225 index fell 1.68% and Topix was down 1.46%. China’s Hang Seng fell 1.03% and CSI 300 index dropped 0.42%.

Indian rupee fell 19 paise to 79.43 against the US dollar on Monday.

HCL Technologies, Sterling and Wilson Renewable Energy, National Standard (India), Delta Corp and Anand Rathi Wealth are expected to report quarterly earnings.

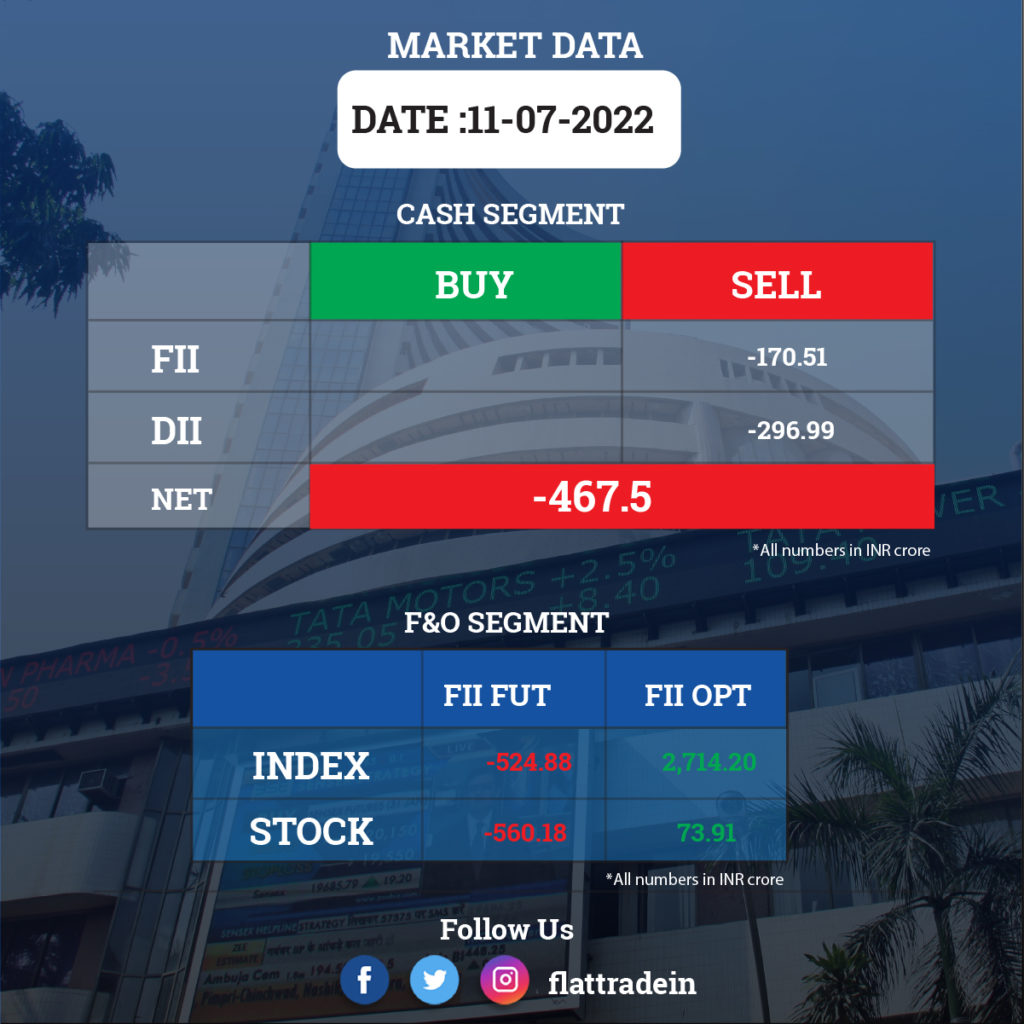

FII/DII Trading Data

Stocks in News Today

IndiGo: The airline said it will “rationalise” the salaries of its aircraft maintenance techniciansand remove “anomalies cause by the pandemic”, according to an internal communication. A sizeable number of the airline’s aircraft maintenance technicians went on sick leave on Saturday and Sunday in Hyderabad and Delhi to protest against their salaries, sources said.

Meanwhile, the airline’s 75 new Airbus aircraft will be fitted with seats of German company Recaro from January 2023 onwards to upgrade passenger experience, a statement said on Monday. IndiGo’s current fleet of over 280 Airbus aircraft are equipped with ‘Dragonfly’ seats of French company Safran.

Murugappa Group: The group will launch an electric three-wheeler brand called Montra by September and invest Rs 200 crore in the segment. TI Clean Mobility (TICM), a fully-owned subsidiary of Tube Investments of India (TII), will own the electric vehicles business. TICM will also manufacture electric tractors through Cellestial E-Mobility, where the group bought a controlling stake of 70% for Rs 161 crore.

HDFC Life: The insurance company has invested in Z3Partners’ new fund, ‘Z3Partners Tech Fund’, which is a tech and digital investment-focused Venture Capital (VC) fund.

IndiGo:

Star Health and Allied Insurance: The company has partnered with Common Services Centers, under Ministry of Electronics & Information Technology, to expand their business to rural customers, across tier-II, tier-III cities and rural markets pan India.

Spandana Sphoorty Financial: the company’s consolidated net profit declined by 42% to Rs 28.6 crore in the March quarter (Q4FY22) on one-time settlement fees and transition expenses. It had posted a consolidated net profit of Rs 49.3 crore in the year-ago period. Its consolidated total income also declined sharply from Rs 480.3 crore in Q4FY21 to Rs 299.1 crore in Q4FY22. Its business operations were impacted in the second half of FY22 after Padmaja Reddy resigned from her position as the Managing Director of the company on November 2, 2021.

SpiceJet: A case of fraud has been registered against the company’s Chairman and Managing Director Ajay Singh and others for allegedly cheating a Gurugram resident by delivering fake share certificates to him. Complainant Amit Arora, a resident of the Magnolias, Golf Links, Golf Course Road, Gurugram, stated in his police complaint that Singh had delivered a fake depository instruction slip (DIS) of 10 lakh shares for services provided to him.

Eureka Forbes: The company appointed Pratik Pota as Managing Director and Chief Executive Officer for a term of five years effective from August 16. The appointment was made following current MD and CEO Marzin R Shroff’s resignation.

Borosil Renewables: The company will consider fund raising through further public offer, issuance of American Depository Receipts or Global Depository Receipts, issuance of Foreign Currency Convertible Bonds, qualified institutions placement or through a combination on July 14.

HFCL: The company received an order from a domestic telecom company for their Fiber to the Home Network and Long Distance Fiber Network in various Telecom Circles. The order is worth Rs 59.22 crore.

Trident: The company production volumes for the month of June stood at 3,333 MT of Bath Linen, 1.95 million Meters for Bed Linen and 8,186 MT for Yarn. It also produced 12,500 MT Paper and 7,673 MT of Chemicals.