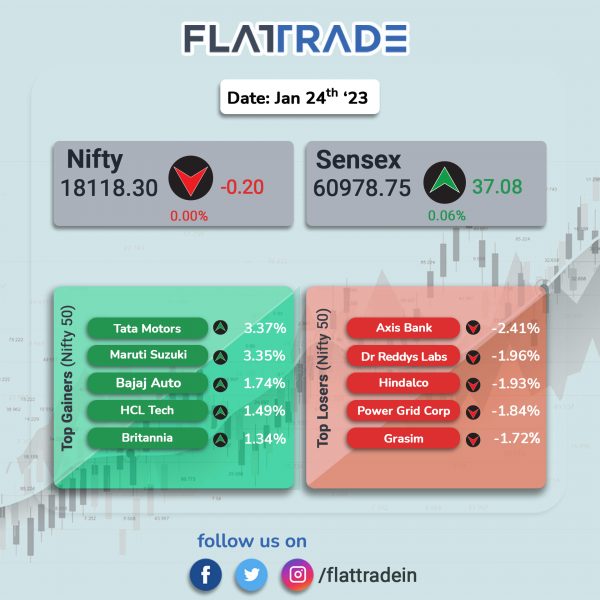

Benchmark indices pared gains and closed flat in a volatile session. Gains in IT and auto stocks were offset by losses in PSU Bank, pharma and realty stocks. The Sensex closed 0.06% higher and the Nifty 50 index ended flat.

In broader markets, Nifty Midcap 100 index fell 0.39% and the BSE Smallcap was down 0.43%.

Top gainers among Nifty sectoral indices were Auto [1.28%], IT [0.77%] and FMCG [0.14%]. Top losers were PSU Bank [-1.36%], Realty [-1.01%], Pharma [-0.98%], Metal [-0.89%] and Energy [-0.67%].

Indian rupee fell 33 paise to 81.72 against the US dollar on Tuesday.

Stock in News Today

Maruti Suzuki India (MSI): The auto major’s standalone net profit surged 132.5% YoY to Rs 2,351.3 crore, while its net sales rose 25.52% YoY to Rs 27,849.2 crore in Q3FY23. Its EBIT soared 131% to Rs 2,123 crore in Q3FY23 from Rs 919 crore in Q3FY22. Maruti Suzuki India sold a total of 465,911 vehicles during the quarter. Sales in the domestic market were 403,929 units and exports were 61,982 units. Pending customer orders stood at about 363,000 vehicles at the end of this quarter out of which about 119,000 orders were for newly launched models, the company said in an exchange filing.

SBI Cards and Payment Services: the company said its revenue from operations was up 6.37% QoQ at Rs 3,507.12 crore. Its profit after tax fell 3% QoQ to Rs 509.46 crore. EBITDA rose 8.9% QoQ to Rs 1,040.61 core, while EBITDA margin stood at 29.67% in the reported quarter as against 28.98% in the preceding quarter.

Tata Coffee: The company’s consolidated net profit declined 39.85% to Rs 26.63 crore in the quarter ended December 2022 as against Rs 44.27 crore during the quarter ended December 2021. Revenue climbed 19.26% to Rs 746.66 crore in the quarter ended December 2022 as against Rs 626.07 crore during the quarter ended December 2021.

JSW Steel: The company said that its wholly-owned subsidiary, JSW Steel Coated Products (JSWSCPL), has entered into a shareholders agreement and a share subscription agreement to acquire 31% stake in Ayena Innovation for total consideration of Rs 5.99 crore. This proposed investment is in line with endeavours of JSWSCPL to explore new avenues to increase consumption of coated steel products. It will enable JSWSCPL to further diversify its customer portfolio mix and enhancing its presence in the retail business.

Colgate-Palmolive (India): The company reported a 3.6% decrease in net profit at Rs 243.24 crore in Q3FY23 compared with Rs 252.33 crore in Q3FY22. The company recorded a marginal increase in revenue to Rs 1,281.21 crore in the quarter ended December 2022 as against Rs 1,271.29 crore reported in Q3FY22. Domestic sales growth reported for the quarter ended 31 December 2022 is 2.3%.

NBCC (India): The company said it secured total business of Rs 309.10 crore in December 2022. NBCC (India) provides civil engineering construction services. As on 30 September 2022, the Government of India held 61.75% stake in NBCC (India).

UCO Bank: The public sector bank said its net profit was up 110.37% YoY to Rs 652.97 crore in Q3FY23. Net interest income rose 10.74% YoY to Rs 1,951.85 crore in the quarter under review. The lender said its net NPA stood at 1.66% in q3FY23 as against 1.99% in Q2FY23.

EaseMyTrip: The company has acquired 55% in Glegoo Innovations, which runs cheQin, a real-time marketplace that connects hoteliers and travellers. The company said the acquisition strengthens its non-air, hotel booking channel.

CG Power & Industrial Solutions: The company said its consolidated net profit declined 58.20% to Rs 227.86 crore in the quarter ended December 2022 from Rs 545.06 crore during the quarter ended December 2021. Revenue rose 14.47% to Rs 1775.44 crore in the quarter ended December 2022 as against Rs 1551.01 crore during the quarter ended December 2021.

Chalet Hotels: The company reported a consolidated net profit of Rs 102.40 crore in Q3FY23 as against net loss of Rs 14.40 crore in Q3FY22. Revenue from operations jumped 76.48% year-on-year to Rs 289.74 crore in Q3FY23. Adjusted EBITDA jumped 152% YoY to Rs 119.30 crore in Q3FY23. Average daily room rate (ADR) stood at Rs 10,168, up by 100% over Q3FY22 and up 28% sequentially and occupancy rate was at 65% in Q3 December 2022 as against 60% in Q3 December 2021.

Vinati Organics: The company has subscribed to the additional 58,35,000 fully paid up equity shares of face value of Rs. 10/- each at par, amounting to Rs. 5.83 crore by way of subscription towards the rights issue of Veeral Organics, the company’s wholly-owned subsidiary, the shares rank pari passu to existing equity shares of the company.

Dilip Buildcon: The infrastructure company announced the completion of its road project in Karnataka. The provisional completion certificate has been issued by the authority and has declared the project fit for entry into commercial operations with effect from 12 December 2022. The project for six laning of Bangalore-Nidagatta section on NH-275 was executed on Hybrid Annuity Mode.

Indoco Remedies: The company’s net profit declined 15% YoY to Rs 27.9 crore, while its net revenue rose 18% YoY to Rs 410.60 crore in Q3FY23. EBIDTA fell by 16% YoY to Rs 61.7 crore while EBIDTA margin declined by 610 bps to 15% during the quarter.

Jammu & Kashmir Bank (J&K Bank): The lender reported 79.13% YoY jump in net profit to Rs 311.59 crore and its total income increased 22.5% YoY to Rs 2,682.67 crore in Q3FY23. The bank’s net interest income (NII) increased by 27% YoY to Rs 1,257.38 crore for the December quarter compared to Rs 993.30 crore recorded in the same period last year. The bank’s NIM has also improved by 54 basis points YoY to 4.10%, while its return on assets rose to 0.92% for the December quarter from 0.57% recorded in the corresponding quarter last fiscal. The ratio of net NPAs to net advances stood at 2.08% as of end of December 2022 as against 3% as of end of December 2021.

Info Edge (India): The company announced that its wholly owned subsidiary – Startup Investments (Holding) (SIHL) has agreed to invest about Rs.9.31 crore in Agstack Technologies (Gramophone). Gramophone is a full stack agritech platform for farmers and the company sells agri-inputs to farmers directly and via small retailers in an omnichannel model. It also provides advisory to farmers with respect to cropping and farming practices and also helps them in selling their output to buyers.

Granules India: The company’s revenue from operations marginally rose 0.4% QoQ to Rs 1,146 crore. Its profit after tax increased 14% QoQ to Rs 124 crore. EBITDA was up 4.8% QoQ to Rs 231 crore. EBITDA margin stood at 20% in the quarter under review as against 21% in the preceding quarter.

Separately, Granules India announced that the US Food & Drug Administration (USFDA) has approved the Abbreviated New Drug Application (ANDA) filed by Granules Pharmaceuticals, Inc (GPI)., a wholly-owned foreign subsidiary of the company, for Amphetamine Mixed Salts. It is bioequivalent to the reference listed drug product (RLD), Adderall XR Extended-Release capsules of Takeda Pharmaceuticals USA Inc. Mixed Salts of a Single-Entity Amphetamine ER Capsules are indicated for the treatment of Attention Deficit Hyperactivity Disorder (ADHD). This product will be manufactured at Granules manufacturing facility in Chantilly, Virginia.

Sunteck Realty: The company recorded 12% YoY increase in pre-sales to Rs 396 crore in Q3FY23. Pre-sales in the same period last year were Rs 352 crore. The company’s 9M FY23 pre-sales stood at Rs 1,066 crore, a growth of 33% YoY. Collections increased by 13% to Rs 304 crore in Q3FY23 from Rs 270 crore in Q3FY22. Collections for 9MFY23 stood at Rs 920 crore, a growth of 42% YoY. Additionally, collections efficiency for 9MFY23 stood at 86% against 81% in 9MFY22.

Rajesh Exports: The company announced the signing of a tripartite agreement with the Ministry of Heavy Industries (Government of India), Department of Industries and Commerce (Government of Karnataka) and ACC Energy Storage (100% subsidiary of the company) paving the way of the company’s foray into advanced technology energy solutions business. Rajesh Exports has been selected by the Indian Government as one among the three successful participants in the Rs 18,100 crore PLI Scheme for production of advanced chemistry cells.

Rattanindia Power: The company said its net loss stood at Rs 479.76 crore in the quarter ended December 2022 as against net loss of Rs 386.63 crore during the quarter ended December 2021. Sales rose 5.58% to Rs 849.72 crore in the quarter ended December 2022 as against Rs 804.79 crore during the quarter ended December 2021.

Jindal Drilling & Industries: The company’s net profit declined 27.77% to Rs 24.87 crore in the quarter ended December 2022 as against Rs 34.43 crore during the quarter ended December 2021. Sales rose 19.39% to Rs 138.24 crore in the quarter ended December 2022 as against Rs 115.79 crore during the quarter ended December 2021.

KEI Industries: The company said its net profit rose 27.04% to Rs 128.60 crore in the quarter ended December 2022 as against Rs 101.23 crore during the quarter ended December 2021. Sales rose 14.10% to Rs 1784.32 crore in the quarter ended December 2022 as against Rs 1563.85 crore during the quarter ended December 2021.

DCX Systems: The company’s net profit declined 5.05% to Rs 17.29 crore in the quarter ended December 2022 as against Rs 18.21 crore during the quarter ended December 2021. Sales declined 14.68% to Rs 355.95 crore in the quarter ended December 2022 as against Rs 417.18 crore during the quarter ended December 2021.

Torrent Pharma: The company said USFDA determined the inspection classification as Official Action Indicated. This inspection classification will not impact existing supplies or revenues from this facility. The USFDA had inspected the facility last year and issued Form 483 with three observations.

Westlife Foodworld: the company has appointed Saurabh Bhudolia as CFO of the company. Saurabh will report to Akshay Jatia, executive director, and will work closely with the leadership team to devise effective financial strategies for Westlife Foodworld. Prior to joining Westlife Foodworld, Saurabh held CFO positions at Lux Industries and Future Group India. He has also worked in organizations such as Tata Steel, Mondelez International, and Sula Vineyards.