Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.5% higher at 18,237.50, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian shares were trading higher tracking Wall Street which ended in the green on Monday, boosted by gains in technology stocks. The Nikkei 225 index rose 1.61% and the Topix gained 1.35%.

Indian rupee fell 27 paise to 81.39 against the US dollar on Monday.

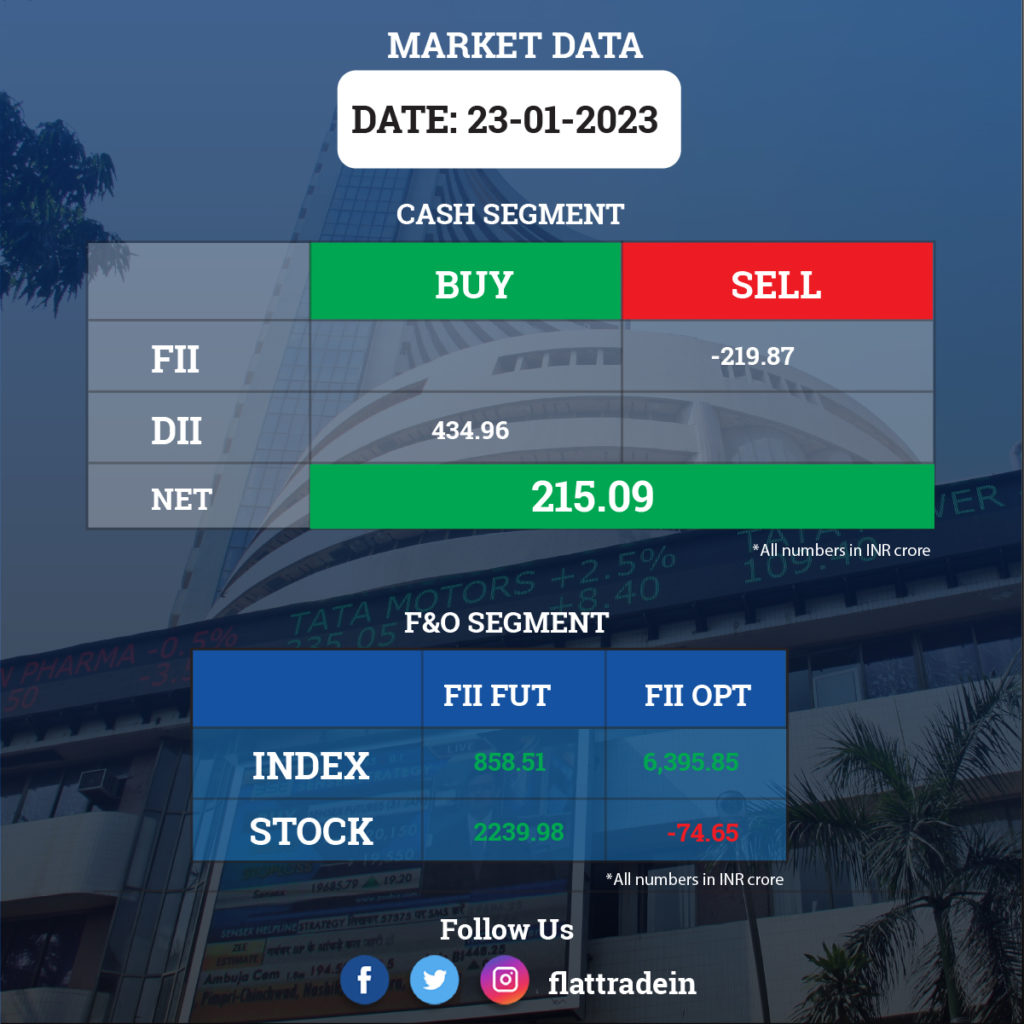

FII/DII Trading Data

Upcoming Results

Maruti Suzuki India, HDFC AMC, Colgate-Palmolive, CG Power and Industrial Solutions, Chalet Hotels, Gateway Distriparks, Granules India, Indoco Remedies, Indus Towers, Latent View Analytics, Macrotech Developers, Motilal Oswal Financial Services, Nazara Technologies, Pidilite Industries, PNB Housing Finance, SBI Cards and Payment Services, Sona BLW Precision Forgings, Tata Coffee, TVS Motor Company, and United Spirits will report their quarterly results today.

Stocks in News Today

Axis Bank: The private sector lender has reported a massive 62% year-on-year increase in Q3FY23 profit at Rs 5,853 crore, led by healthy other income and net interest income. Net interest income rose 32% to Rs 11,459 crore for the quarter under review versus Rs 10,360 crore in the year ago period. Net interest margins expanded to 4.34% at the end of the December quarter against 3.77% a year ago. The total loan book expanded 15% to Rs 7.62 lakh crore, while total deposits for the bank climbed 10% on-year to reach Rs 8.48 lakh crore. Gross non-performing loan ratio improved to 2.38% against 3.17% a year ago. Net non-performing ratio stood at 0.47% versus 0.91% last year.

HFCL: Domestic telecom gear company’s consolidated net profit grew 25.3% on-year and over 20% sequentially, to Rs 102 crore in Q3FY23 on the back of a healthy order book. Revenue during the quarter ended December 2022 declined 10.65% on-year to Rs 1086 crore. The company’s EBITDA grew 10.75% on-year to Rs 193 crore, while EBITDA margin climbed to 17.8%, from 14.88% in the previous quarter. HFCL’s order book stood at more than Rs 7000 crore as on December 31, 2022, as compared to Rs 5820 crore in the previous quarter.

Jindal Stainless: The company reported a 28% drop in quarterly consolidated net profit to Rs 314 crore for the third quarter ended December 2022 from Rs 435 crore a year earlier as steel exports continued to reel under the impact of a government levy until recently. The company’s revenue from operations climbed 12% to Rs 6,350 crore during the reported quarter from Rs 5,670 crore in the year-ago period. Jindal Stainless, which had an annual melt capacity of 1.9 million tonnes (MT) till March 2022, aims to increase its capacity to 2.9 MT by the end of FY2023.

Shoppers Stop: The retail chain reported a 18.86% decline in consolidated net profit at Rs 62.74 crore in the third quarter ended on December 2022. The company had posted a consolidated net profit of Rs 77.32 crore in the same period last fiscal, it said in a regulatory filing. Its consolidated revenue from operations during the quarter under review stood at Rs 1,137.07 crore as against Rs 958.11 crore in the same period a year ago, it added. The company opened six department and five beauty stores in the December quarter, taking the total store count to 271, spread across 50 cities across India.

Tata Motors: The automaker’s American Depositary Shares (ADS) were delisted from the New York Stock Exchange effective Monday.

Tata Communications: The company’s net profit slipped 7.3% to Rs 208.95 crore in Q3FY23 from Rs 225.51 crore in Q3FY22. Total income, however, was up 12.5% YoY to Rs 1,918.86 crore.

Poonawalla Fincorp: The non-banking finance company has registered a strong 89% year-on-year growth in consolidated profit at Rs 182.1 crore for the quarter ended December FY23, with writeback of impairment of financial instruments for the quarter. Net interest income grew by 42% YoY to Rs 463.7 crore during the quarter.

Dilip Buildcon: The company and Skyway Infraprojects joint venture has declared as L-1 bidder for the tender floated by Madhya Pradesh Jal Nigam Maryadit, Bhopal. The order is worth Rs 1,947.06 crore. Also, its subsidiary Raipur-Visakhapatnam-CG-2 Highways Limited has received the appointed date letter from the National Highways Authority of India and had declared the appointed date as January 9, 2023.

Amber Enterprises: The contract manufacturer of room air-conditioners reported a 56% year-on-year decline in consolidated profit at Rs 14.2 crore for December FY23 quarter dented by margin, with a significant increase in raw material cost, employee expenses and finance cost. Revenue from operations for the quarter grew by 38.4% to Rs 1,348.3 crore compared to the year-ago period.

Container Corporation of India: The state-owned logistics company has reported a 3.5% year-on-year growth in standalone profit at Rs 296.5 crore for quarter ended December FY23, with healthy operating profit and margin. Revenue for the quarter grew by 3.6% to Rs 1,988.4 crore compared to the year-ago period.

Gland Pharma: The pharma company has reported a 15% year-on-year decline in profit at Rs 232 crore for December FY23 quarter with lower topline as well as weak operating performance. Revenue from operations for the quarter at Rs 938 crore declined 12% compared to the year-ago period.

FSN E-Commerce Ventures (Nykaa): The company said that the board members have appointed P Ganesh as Chief Financial Officer and key managerial personnel of the company effective February 3, 2023.

Welspun Corp: Associate company, East Pipes Integrated Company for Industry (EPIC) in the Kingdom of Saudi Arabia has signed contracts for the supply of steel pipes for water transmission with a total value of SAR 569 million. The pipes have to be supplied within 12 months and the financial impact of this will be starting in Q1FY24.

Amber Enterprises: The company reported a net loss of Rs 5.50 crore for the quarter ended December 2022 as against a profit of Rs 14.48 crore in the year ago period. Total income, however, was up 37.5 per cent YoY at Rs 921.55 crore.

Supreme Petrochem: The company’s net profit plunged 45.5 per cent to Rs 89.59 crore in the quarter ended December 2022 as against Rs 164.54 crore in the year ago period. Total income was down 8.4 per cent YoY at Rs 1,194.57 crore.

Syngene Internatinal: The company’s net rose nearly 6% to Rs 109.50 crore in Q3FY23 from Rs 103.40 crore in Q3FY22. Total income was up 23.2% YoY at Rs 803.80 crore.

Zensar Technologies: The company said its consolidated net profit for the quarter ended December fell 16% YoY to Rs 76.5 crore, but rose 35% sequentially. Its revenue rose 8.6% YoY to Rs 1,198 crore, but fell 3% sequentially.