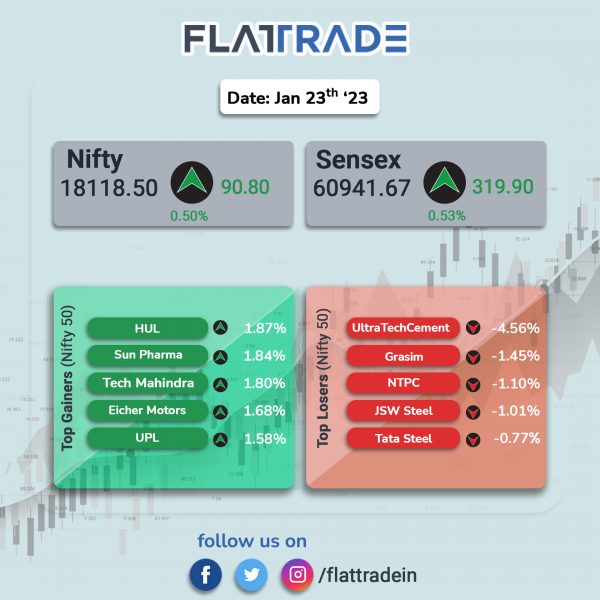

Indian benchmark equity indices closed in the green, supported by gains in IT and pharma stocks. The Sensex ended 0.53% higher and the Nifty 50 index rose 0.50%.

In broader markets, Nifty Midcap 100 index was up 0.56% and the BSE Smallcap index fell 0.3%.

Top gainers among Nifty sectoral indices were IT [1.88%], Pharma [0.89%], FMCG [0.83%], Auto [0.83%] and Bank [0.74%]. Top losers were realty [-0.63%] and Metal [-0.40%].

Indian rupee fell 27 paise to 81.39 against the US dollar on Monday.

Stock in News Today

Canara Bank: The lender reported a standalone net profit of Rs 2,882 crore in Q3FY23, up 91.88% from Rs 1,502 crore in the same period last year. Total income rose by 23.01% YoY to Rs 26,217 crore during the reported quarter. Net interest income increased by 23.81% to Rs 8,600 crore in Q3FY23 from Rs 6,946 crore in Q3FY22. Net interest margin in Q3FY23 was 3.05% as against 2.83% in Q3FY22. Net NPA ratio was 1.96% at the end of December 2022 as against 2.86% in the year-ago period.

Housing Development Finance Corp (HDFC): The company plans to raise at least 30 billion rupees ($370.5 million) through the sale of bonds maturing in 10 years, Reuters reported citing three merchant bankers. The issue will also have a greenshoe option to retain an additional 20 billion rupees and will close for subscription later this week. The bonds are rated AAA by CRISIL and will have a put option at the end of the third year.

IDBI Bank: The lender posted a 60% growth in net profit to Rs 927 crore in the third quarter ended on December 31, 2022, on lower provisioning and better interest income. The bank’s net interest income (NII) improved by 23 per cent during the third quarter of current fiscal to Rs 2,925 crore, as against Rs 2,383 crore in the same period last fiscal. Gross non-performing asset (NPA) ratio improved to 13.82% in Q3FY23 as against 21.68% in the year-ago period.

State Bank of India (SBI): The company has acquired 40% stake in Commercial lndo Bank LLC (CIBL), Moscow, for cash consideration of $14.67 million. CIBL is a joint venture between State Bank of lndia and Canara Bank in 60:40 ratio. Post-acquisition, SBI will be holding 100% stake in CIBL.

Tata Consultancy Services (TCS): The company has announced that it has helped Bitcoin Suisse AG (BTCS) create a next-generation crypto-financial technology platform, powered by TCS BaNCS. BTCS selected TCS BaNCS for its native support for digital assets and Swiss and global market readiness. The secure and scalable cloud-based solution covers all core functions like brokerage, custody, payments for crypto assets, including risk monitoring and supervision capabilities, and ensures continued regulatory compliance in Switzerland. The solution’s high level of straight-through processing enables faster turnaround times, resulting in further enhanced client experiences.

Adani Green Energy (AGEL): The company said that its sale of energy increased by 9% YoY at 2,507 million units in Q3FY23 as against 2,300 million units in Q3FY22. The increase in sale of solar energy was backed by 150 megawatt (MW) commissioned in Rajasthan in November 2022 and 140 basis points (bps) improvement in capacity utilisation factor (CUF). The solar portfolio CUF improved by 140 bps to 23.3% primarily backed by integration of SB Energy portfolio and improved plant/ grid availability. The firm’s wind portfolio CUF was at 14% in Q3 FY23 as against 18.6% in Q3 FY22. Sale of energy in this segment jumped 47% YoY to 300 million units, on the back of capacity increase from 497 MW to 971 MW YoY.

Larsen and Toubro (L&T): The conglomerate announced that its construction arm has secured significant orders for its power transmission & distribution and buildings & factories businesses. According to L&T’s classification, the value of the orders lies between Rs 1,000 crore and Rs 2,500 crore. The renewables arm of the power transmission & distribution (PT&D) business has received a turnkey EPC order to establish a 112.5MW Solar Power Plant in south-western part of West Bengal. Further, in the overseas market, the business has won an order to implement the electrical system along with the associated civil and instrumentation works for an energy company in the Middle East.

Coal India Limited: The company’s subsidiary, Mahanadi Coalfields Limited (MCL), is looking to diversify into power generation, and plans to set up a Rs 12,000 crore power plant in Odisha, IANS reported. It also aims to enter into aluminium business and may soon set up a greenfield aluminium project. Sources said that the 1,600 megawatt capacity coal-fired power project would come up in Odisha’s Sundargarh district as a wholly owned subsidiary of MCL, according to IANS.

EaseMyTrip: The travel company has announced its foray into EaseMyTrip Franchise, a flagship brand of EaseMyTrip. The company aims to provide a retail store experience to its customers with EaseMyTrip Franchise and target a new set of offline customers who will enable the company to expand its reach.

Meghmani Organics: The company’s consolidated net profit declined 87.79% YoY to Rs 8.35 crore in Q3FY23, while net sales fell 14.19% YoY to Rs 549.43 crore in Q3FY23. EBITDA fell 20.7% to Rs 61 crore during the period under review and EBITDA margin stood at 11.1% in Q3FY23 compared to 12.1% in Q3FY22.

Glenmark Pharma: The drug maker has launched I.V. injection formulation, AKYNZEO I.V., under an exclusive licensing agreement with Helsinn, a Swiss biopharma group company. AKYNZEO I.V is used for the prevention of chemotherapy-induced nausea and vomiting (CINV). The drug is already being marketed in the EU, the US, and Australia.

India Grid Trust (IndiGrid): The company will acquire 100% stake in Khargone Transmission at an enterprise value of about Rs 1,497.5 crore. IndiGrid had signed a share purchase agreement on January 21, 2023, for the acquisition and the completion of the acquisition would depend on receipt of Unitholders” consent, regulatory and other relevant approvals.

Lemon Tree Hotels: The hospitality company has signed a franchise agreement for a 59 room property in Kumbhalgarh under the company’s brand ‘Lemon Tree Resorts’. The hotel will feature 59 well-appointed rooms, a restaurant bar, meeting rooms and a swimming pool. The property is expected to be operational by December 2023.

Karur Vysya Bank (KVB): The lender said its net profit rose 55.97% to Rs 289.29 crore in the quarter ended December 2022 as against Rs 185.48 crore during the quarter ended December 2021. Total Operating Income rose 20.70% to Rs 1695.22 crore in the quarter ended December 2022 as against Rs 1404.51 crore during the quarter ended December 2021. NII was up 29.4% to Rs 889 crore in Q3FY23 from Rs 687.2 crore in the same period last fiscal. Net NPA improved to 0.89% in the reproted quarter as against 1.36% in the preceding quarter.

Route Mobile: The company’s net profit rose 85.18% to Rs 82.44 crore in the quarter ended December 2022 as against Rs 44.52 crore during the quarter ended December 2021. Revenue rose 75.16% to Rs 985.72 crore in the quarter ended December 2022 as against Rs 562.77 crore during the quarter ended December 2021. EBITDA jumped to Rs 124.5 crore in Q3FY23 from Rs 60.7 crore in the corresponding quarter last fiscal.

Oriental Hotels: The company reported a net profit of of Rs 15 crore in Q3FY23 comapred to Rs 7.4 crore in the year-ago period. Its revenue rose 38.5% to Rs 105.7 crore in the reported quarter from Rs 76.3 crore in the corresponding quarter last fiscal. Its EBITDA jumped 63.5% to Rs 32.3 crore in the reported quarter from Rs 19.8 crore in the same period last year.

Arvind SmartSpaces: The company’s profit fell 28.3% to Rs 4.2 crore in Q3FY23 from Rs 5.9 crore in Q3FY22. However, revenue rose 22.6% to Rs 52.6 crore in the reported quarter from Rs 42.9 crore in the year-ago period. The company’s EBIDTA was down 27.3% YoY to Rs 8.72 crore in Q3FY23.

Thangamayil Jewellery: The company registered a net profit of Rs 13.8 crore in Q3FY23, up 21.8% from Rs 11.3 crore in Q3FY22. Its revenue increased 18% to Rs 744.5 crore in the reported quarter from Rs 630.8 crore in Q3FY22. EBITDA rose 14.3% YoY to Rs 29.6 crore in the quarter under review.

Tamilnad Mercantile Bank: The lender posted a net profit of Rs 279.7 crore in Q3FY23, up 37.9% from Rs 202.9 crore in the year-ago period. Its NII was up 18% to Rs 534.2 crore in the quarter under review from Rs 452.8 crore in the corresponding quarter last year. Net NPA ratio declied to 0.75% in the Q3FY23 from 0.86% in the same period last fiscal. Provisions stood at Rs 32.9 crore in Q3FY23 as against Rs 112.8 crore in Q3FY22.

Indoco Remedies: The company said that the United States Food and Drug Administration (USFDA) has conducted GMP inspection of the Solid Oral Formulation Facility (Plant 1) at Goa. The inspection was conducted from 16 January 2023 to 20 January 2023. The USFDA has issued Form 483 with 9 observations, and the company said in an exchange filing that it will address their concerns within the stipulated time.

Marksans Pharma: The company said that the UK MHRA has granted Market Authorisation to the company’s wholly-owned subsidiary Relonchem Limited for Fluoxetine 20mg/5ml Oral Solution. The product is used for treatment of depressive illness and other mental as well as mood disorders. The product will be manufactured at the plant of Bell, Sons & Co. (Druggists) located at Gifford House, Slaidburn Crescent, Southport, UK.

Compuage Infocom: The company posted a net profit of Rs 8.49 crore in the quarter ended December 2022, up 9.41% from Rs 7.76 crore during the quarter ended December 2021. It revenue rose 2.57% to Rs 1166.67 crore in the quarter ended December 2022 as against Rs 1137.49 crore during the quarter ended December 2021.

Madhya Bharat Agro Products: The company’s net profit rose 69.11% to Rs 38.71 crore in the quarter ended December 2022 as against Rs 22.89 crore during the quarter ended December 2021. Revenue jumped 49.19% to Rs 286.29 crore in the quarter ended December 2022 as against Rs 191.90 crore during the quarter ended December 2021.