Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.25% lower at 18,090 signalling that Dalal Street was headed for a negative start on Wednesday.

Asian shares were trading higher with the Nikkei 225 index rising 0.11% and the Topix gaining 0.19%.

Indian rupee fell 33 paise to 81.72 against the US dollar on Tuesday.

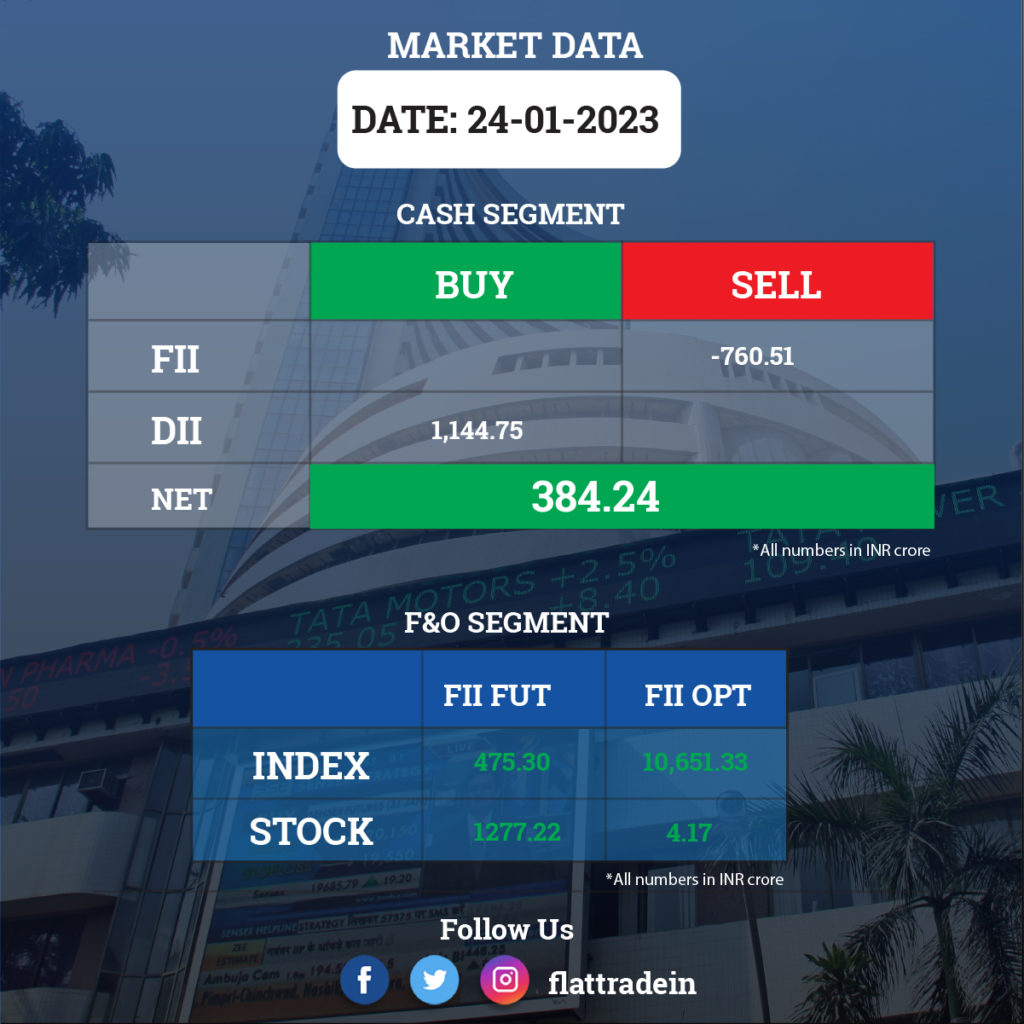

FII/DII Trading Data

Upcoming Results

Tata Motors, Bajaj Auto, Dr Reddy’s Laboratories, Cipla, Tata Elxsi, Indian Bank, Amara Raja Batteries, Arvind, Ceat, Chennai Petroleum Corporation, Dixon Technologies, DLF, Embassy Office Parks REIT, Equitas Holdings, Go Fashion, Indraprastha Gas, Jyothy Labs, Olectra Greentech, Patanjali Foods, TeamLease Services, Torrent Pharmaceuticals, and VIP Industries will report their quarterly earnings today.

Stocks in News Today

Pidilite Industries: The adhesives manufacturer has reported a 14.3% year-on-year decline in consolidated profit at Rs 307.7 crore for quarter ended December FY23, impacted by a lower operating margin. Revenue grew by 5.2% to Rs 2,998 crore compared to the year-ago period with C&B business growing at 7%. In Q3FY22, it registered robust growth as a result of trade increasing inventory stocking because of substantial price increases in the quarter. Overall numbers missed analysts’ expectations.

TVS Motor Company: The two-and-three-wheeler manufacturer has registered a 22% year-on-year growth in standalone profit at Rs 352.8 crore for December FY23 quarter despite higher input costs. Revenue from operations grew by 14.7% to Rs 6,545 crore compared to the year-ago period, with volume rising 0.09%to 8.79 lakh YoY. Operating profit at Rs 659 crore increased by 16% with a margin expansion of 10 bps at 10.1%compared to the same period last year. The board members have declared an interim dividend of Rs 5 per share.

United Spirits: The company said that its consolidated net profit declined by 27% to Rs 214 crore in the third quarter ended December 2022. The company had reported a net profit of Rs 295 crore in the October-December quarter of last fiscal. Total income declined to Rs 6,631 crore for the period under review as against Rs 8,917 crore in the year-ago period, United Spirits said in a regulatory filing.

HDFC Asset Management Company (AMC): The company reported 2.68% YoY rise in net profit to Rs 369.40 crore and 4.25% YoY rise in total income to Rs 662.93 crore in Q3FY23. Operating profit for the quarter ended December 2022 was Rs 397.4 crore as compared to Rs 398.9 crore for the quarter ended December 2021. The AMC had a quarterly average assets under management of Rs 4,44,800 crore as of December 2022 compared to Rs 4,47,100 crore as of December 2021 and its market share was 11% in QAAUM of the mutual fund industry. The ratio of equity oriented AUM and non-equity oriented closing AUM was 55:45, compared to the industry ratio of 50:50 as on 31 December 2022.

Bharti Airtel: The telecom operator said that it has raised the minimum tariff plan to Rs 155 from Rs 99-111 earlier in seven circles. The company said that it has discontinued metered tariff and introduced the Rs 155 plan as entry-level plan in seven circles. The company has scrapped its minimum recharge plan of Rs 99.

Barbeque-Nation Hospitality: Anurag Mittal has resigned as Chief Financial Officer of the company. He will cease to be Chief Financial Officer from February 7, 2023. The company will release its quarterly earnings scorecard on February 7.

Triveni Engineering Industries: The company said the board members have approved further capex of Rs 90 crore for the sugar business group and Rs 100 crore capex for power transmission operations. In addition, the company has reported a 13%year-on-year growth in consolidated profit at Rs 147.3 crore for the quarter ended December FY23, led by lower tax cost and higher other income. Revenue grew by 34% to Rs 1,659 crore compared to the year-ago period, but operating profit fell 4.6% YoY to Rs 193.4 crore for the quarter.

Nazara Technologies: The gaming software company has clocked a 76% year-on-year growth in consolidated profit at Rs 18.1 crore for the quarter ended December FY23. Revenue from operations grew by 69.4% to Rs 315 crore compared to the year-ago period. Operating profit increased by 3.4%YoY to Rs 30.1 crore and margin fell 600 bps YoY to 9.6% for the quarter.

Macrotech Developers (Lodha): The real estate developer has posted a 41.7% year-on-year growth in consolidated profit at Rs 404.5 crore despite lower revenue and weak operating performance, supported by other income and lower tax costs. Revenue for the quarter declined 14% to Rs 1,774 crore, but pre-sales grew by 16% YoY to Rs 3,035 crore compared to the year-ago period. The company reduced net debt by Rs 753 crore to Rs 8,042 crore.

Indus Towers: The mobile tower installation company has posted a consolidated loss of Rs 708.2 crore for the quarter ended December FY23 against a profit of Rs 1,570.8 crore in the same period last fiscal. The loss was attributed to doubtful debt provision made of Rs 2,298 crore against receivables from one of the telecom companies. Revenue fell 2.3% YoY to Rs 6,765 crore for the quarter, and EBITDA tanked 68% to Rs 1,185.8 crore compared to the year-ago period.

Coffee Day Enterprises (CDEL): The Sebi imposed a penalty of Rs 26 crore on CDEL for alleged violation of securities laws. The regulator also directed the company to initiate steps to recover dues of Rs 3,535 crore – the amount diverted from seven subsidiaries of the company to Mysore Amalgamated Coffee Estates (MACEL).

Rail Vikas Nigam: The company has secured Rs 38.4 crore worth order from Southern Railway. The company has received letter of award for provision of automatic block signalling with dual MSDAC, EI/OC interface and block optimization in Arakkonam Junction-Nagari section of Chennai division in Southern Railway. The cost of the project is Rs 38.4 crore.

Motilal Oswal Financial Services: The company has posted a 5.5% year-on-year decline in consolidated profit at Rs 226.5 crore for quarter ended December FY23. Consolidated revenue from operations grew by 4.6% to Rs 1,072.1 crore compared to same period last fiscal. The company received board approval for an interim dividend of Rs 7 per share.

Quick Heal Technologies: The cybersecurity software company has posted consolidated loss of Rs 9.3 crore for quarter ended December FY23, against profit of Rs 14.3 crore in corresponding period last fiscal. Revenue fell 16.1% to Rs 66.8 crore compared to year-ago period, while EBITDA loss at Rs 11.4 crore for the quarter against profit of Rs 20.5 crore in same period last fiscal.

Strides Pharma: The company narrowed its consolidated net loss to Rs 82 crore in Q3FY23 as against a net loss of Rs 127 crore in Q3FY22. Total income grew 9 per cent YoY to Rs 865 crore.

Lupin: The company’s wholly-owned subsidiary – Lupin Digital Health has launched its digital therapeutics solution ‘Lyfe’ for cardiac patients in India as it aims to go beyond the pill and provide a support ecosystem for patients.

CarTrade Technologies: The company reported a net profit of Rs 14.05 crore in Q3FY23 as against a net loss of Rs 18.49 crore in Q3FY22. Total income was up 13.2 per cent YoY at Rs 115.86 crore.

PNB Housing Finance: The company’s net profit rose 43% YoY to Rs 269 crore in Q3FY23 on the back of improved margins and net interest income (NII). Total income jumped over 20% YoY to Rs 1,797 crore.

Sasken Technologies: The company has registered a 3.9% year-on-year growth in consolidated profit at Rs 31.3 crore for quarter ended December FY23 despite weak operating performance, driven by higher topline and other income. Revenue grew by 15.5% YoY to Rs 122.8 crore in Q3FY23.

Sonata Software: The company has appointed Samir Dhir as MD & CEO, and Srikar Reddy as executive vice chairman with effective from February 14, 2023. Currently Samir Dhir is the Whole-time Director & CEO and Srikar Reddy is the current Managing Director and a member of the board of directors.

Tatva Chintan Pharma Chem: The specialty chemical company has reported a 49% year-on-year decline in consolidated profit at Rs 11.6 crore for quarter ended December FY23, impacted by weak operating performance. Revenue rose 15% YoY to Rs 120.6 crore and EBITDA fell by 25% YoY to Rs 17.9 crore for the quarter.