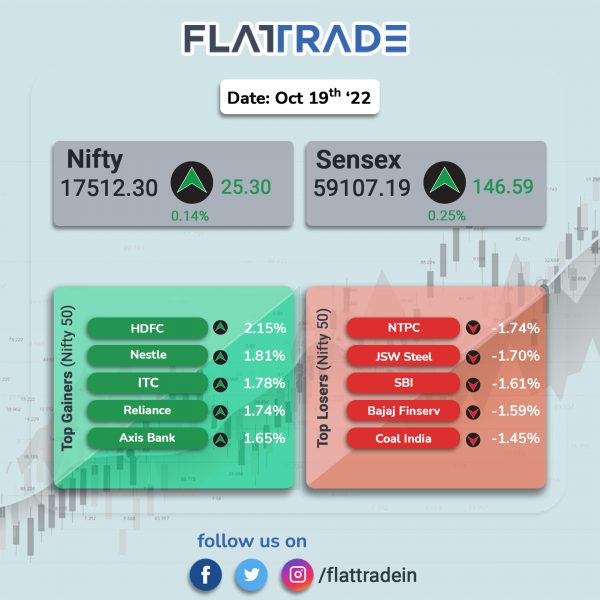

Dalal Street ended slightly higher as energy and FMCG stocks gained. The Sensex closed 0.25% higher and the Nifty ended 0.14% higher.

In broader markets, the Nifty Midcap 100 index rose 0.25% and the BSE Smallcap slipped 0.03%.

Top gainers among Nifty sectoral indices were Oil & Gas [0.57%], FMCG [0.4%], Realty [0.4%], Financial Services [0.4%] and Private Bank [0.29%]. Top losers were IT [-0.9%], Metal [-0.67%], PSU Bank [-0.58%] and Media [-0.28%].

The Indian rupee fell 66 paise to a record low of 83.02 against the US dollar on Wednesday, as rising US Treasury yields led to a broad rally in the greenback.

Stock in News Today

UltraTech Cement: The company reported a decline of 42.09% in its consolidated net profit at Rs 758.70 crore for the second quarter ended on September 30, 2022. The company had posted a net profit of Rs 1,310.34 crore in the same period a year ago. Its revenue from operations rose 15.61% to Rs 13,892.69 crore during the quarter under review as against Rs 12,016.78 crore in the corresponding period last fiscal. The second quarter is traditionally a weak quarter for the cement sector, with lower demand due to monsoon season and low construction activity.

HDFC Asset Management (HDFC AMC): The company’s consolidated revenue was up 0.4% YoY to Rs 544.72 crore in Q2FY23 as against Rs 542.33 crore in the year-ago period. Its net Profit gained 5.7% YoY to Rs 363.85 crore in the reported quarter from Rs 344.38 crore in the same period last fiscal.

KPIT Technologies: The company’s net profit rose 28.23% to Rs 83.48 crore in Q2FY23 as against Rs 65.10 crore in the year-ago period. Sales rose 26.06% to Rs 744.83 crore in the quarter ended September 2022 as against Rs 590.87 crore in the year-ago quarter. The company’s EBITDA stood at Rs 138.16 crore in Q2FY23, registering a growth of 3.75% QoQ and 32.77% YoY. EBITDA margin was at 18.5% in Q2FY23 compared with 19.4% in Q1FY23 and 17.6% in Q2FY22.

Vedanta: The mining company’s unit Bharat Aluminium Company (BALCO) emerged as the successful bidder for Barra Coal Block in Chhattisgarh. The block has estimated reserves of 900 million tonnes and the block is an optimal fit given its logistical location, the company said.

Nestle India: The FMCG company said its net profit rose 8.26% to Rs 668.34 crore in the quarter ended September 2022 as against Rs 617.37 crore in the same period last year. Revenue increased 18.15% to Rs 4566.60 crore in the quarter ended September 2022 as against Rs 3864.97 crore in the year-ago period. Meanwhile, the board of directors have declared second interim dividend for 2022 of Rs 120 per equity share, which will be paid from November 16, 2022.

Besides, the company launched direct to consumer (D2C) platform – www.mynestle.in. Initially, MyNestle will be launched in Delhi NCR and will be expanded to other parts of the country.

Syngene International: The company said that its consolidated revenue rose 26% YoY to Rs 768 crore in Q2FY23 from Rs 610 crore in the year-ago period. Net profit surged 53% YoY to Rs 102 crore in the reported quarter compared with Rs 67 crore in the same period last year. EBITDA increased 41% YoY to Rs 235 crore in Q2FY23. Margins at stood at 30.6% in the reported quarter as against 27.4% in the year-ago period.

Zee Entertainment: The Bombay High Court has directed Axis Finance to raise its concerns over Sony-Zee merger before NCLAT, which will hear the matter on November 3. Axis Finance had approached the High Court to secure a debt of Rs 150 crore owed to it by Zee Entertainment.

Piramal Pharma: The company made its stock market debut at Rs 200 per share on the NSE. Piramal Pharma (PPL) said that it had received an approval from the Securities and Exchange Board of India (Sebi) to list the shares on BSE and NSE. In August, the National Company Law Tribunal (NCLT) approved the demerger of Piramal Enterprises’ (PEL) Pharma business as the company aimed to simplify its corporate structure. The shares closed at Rs 190 apiece.

Under the demerger scheme, the company said four fully paid-up equity shares of PPL of Rs 10 each to be issued to PEL shareholders for every one fully paid-up equity share in PEL with face value of Rs 2 each held by them.

Hitachi Energy India: The company said that it has been awarded a contract by NTPC Renewable Energy to supply power transformers for their upcoming 4.75 GW renewable energy park in Gujarat. which is part of India’s largest solar park. As part of this project, Hitachi Energy will provide ten numbers of 315 MVA 400/33/33 kV transformers manufactured at its Transformers factory in Vadodara.

Vodafone Idea: The company’s board of will meet on October 21 to consider a proposal for issuance of debenture securities convertible into equity shares on a preferential / private placement basis. The issue is subject to regulatory and other statutory approvals.

Prerna Infrabuild: The company’s net profit rose 61.59% to Rs 2.65 crore in the quarter ended September 2022 as against Rs 1.64 crore during the quarter last fiscal. Sales declined 16.47% to Rs 4.97 crore in the quarter ended September 2022 as against Rs 5.95 crore in the year-ago period.

Rane Brake Lining: The auto ancillary company said its net profit rose 19.78% to Rs 6.48 crore in the quarter ended September 2022 as against Rs 5.41 crore during the same quarter last year. Sales rose 15.22% to Rs 141.15 crore in Q2FY23 as against Rs 122.50 crore in the same period last fiscal.

Bharat Electronics (BEL): The company has signed a memorandum of understanding (MoU) with Munitions India (MIL) at the Defexpo in Gandhinagar, Gujarat. Both the companies will jointly address the requirements of Indian Defence and Export markets in the areas of ammunition, explosives and related systems.

Rhi Magnesita India (RHIM): The company announced that it will acquire refractory business of Hi-Tech Chemicals through a slump sale for a cash consideration of Rs 621 crore. It said that the acquisition will strengthen its position in the domestic & international flow-control refractory business.

Shalby: The company’s net profit rose 70.62% to Rs 18.41 crore in the quarter ended September 2022 as against Rs 10.79 crore during the previous quarter ended September 2021. Revenue rose 11.11% to Rs 201.80 crore in the reported quarter as against Rs 181.62 crore during the same quarter last fiscal.

Schaeffler India: The company reported 26.1% YoY jump in net profit to Rs 215.4 crore on a 18.1% YoY increase in net sales at Rs 1,756.43 crore in Q3 of 2022. Net profit margin in the third quarter stood 12.3% as compared with 11.5% during the corresponding quarter of 2021.