Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.69% lower at 17,383.50, signalling that Dalal Street was headed for a negative start on Thursday.

Asian share markets fell on Thursday as investor were concerned over a looming recession. Nikkei 225 index fell 1.11% and Topix was down 0.63%. Hang Seng tanked 2.31% and CSI 300 index was down 0.72%.

The Indian rupee fell 66 paise to a record low of 83.02 against the US dollar on Wednesday.

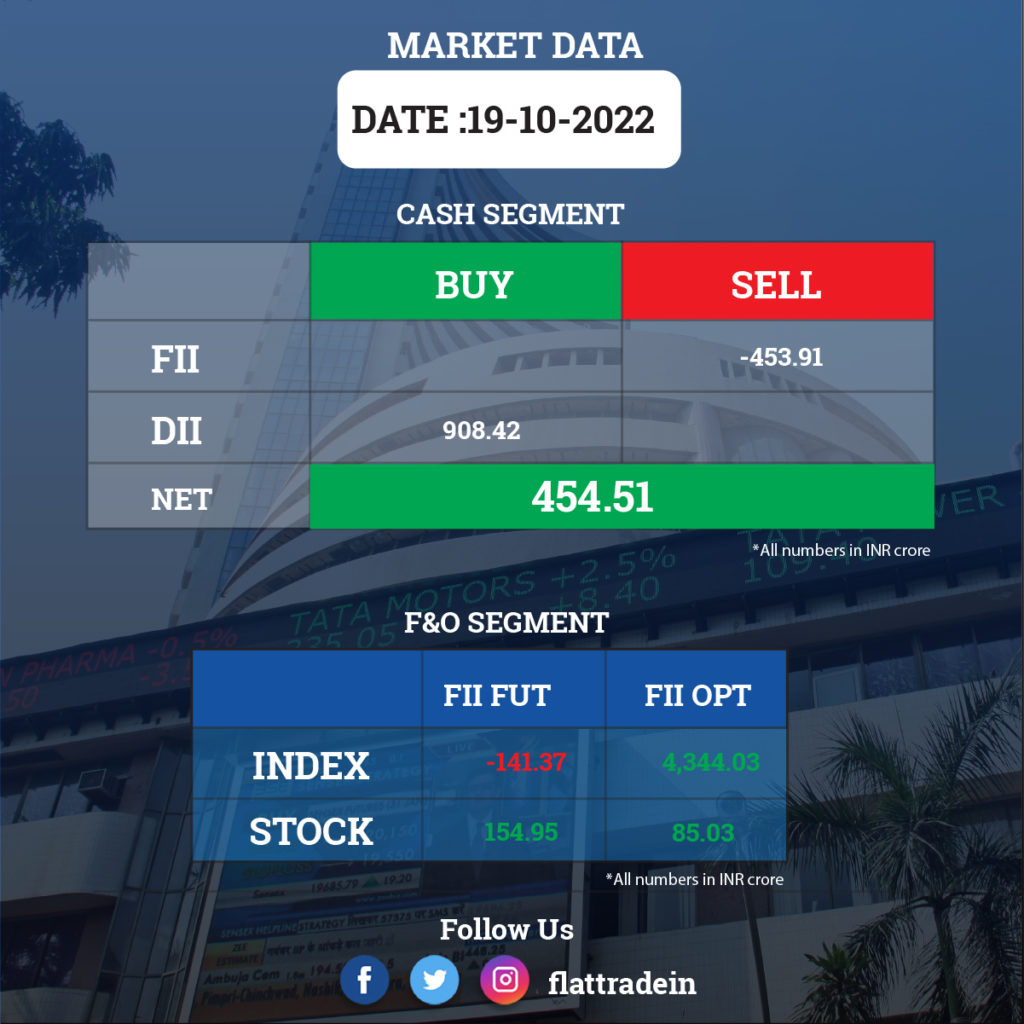

FII/DII Trading Data

Upcoming Results

ITC, Asian Paints, Axis Bank, Bajaj Finance, Tata Consumer Products, Aarti Drugs, Canara Bank, Union Bank of India, Central Bank of India, Clean Science and Technology, Colgate Palmolive, Coforge, Dixon Technologies, Happiest Minds Technologies, ICRA, Indian Energy Exchange, ICICI Securities, L&T Finance Holdings, Mphasis, Nazara Technologies, Shriram Transport Finance, Symphony, Tanla Platforms, United Breweries, and UTI Asset Management Company will report their quarterly earnings on October 20.

Stocks in News Today

IndusInd Bank: The private sector lender reported a net profit of Rs 1,787 crore in the June-September quarter, up 60% from the same period last year, aided by higher income and lower provisions. The bank’s total provisions during the period stood at Rs 1,141 crore, a 33% decline from a year earlier. The lender also reported a net interest income (NII) of Rs 4,302 crore in Q2 FY23, a rise of 18%. Its net interest margin stood at 4.24%, higher than the preceding quarter. The bank reported an 18% growth in overall advances from a year ago to Rs 2.6 trillion at the end of September FY23. The net NPA ratio fell to 0.61% from 0.67% in the prior quarter and 0.80% the year-ago period.

AU Small Finance Bank: The lender reported a 23% rise in its net profit at Rs 343 crore in the July-September quarter on healthy growth in loan disbursals and consistent fall in bad loans. It had posted a net profit of Rs 279 crore in the same period in the year ago fiscal year. Bank’s net interest income grew by 44% to Rs 1,083 crore during July-September period of FY23, as against Rs 753 crore in same period of last fiscal. Total income of the bank was up by 40.3% YoY at Rs 2,240 crore in the reported quarter.

Bharat Electronics: Electric vehicle maker Triton Electric India has issued a letter of intent to defence public sector unit Bharat Electronics for the procurement of battery packs for its semi-truck project in India at an estimated value of Rs 8,060 crore, according to a regulatory filing. The 300 kilowatt lithium-ion battery packs are to be delivered by Bharat Electronics (BEL) to Triton in 24 months commencing from January 2023, the filing stated.

Persistent Systems: The IT services company recorded a 4% sequential growth in profit at Rs 220 crore for the quarter ended September FY23 on revenue of Rs 2,048.6 crore that grew by 9.1% QoQ. Revenue in dollar terms increased 5.8% QoQ to $255.56 million and constant currency growth was 6.6% QoQ. The order booking for the quarter was at $367.8 million in total contract value (TCV) and at $271.2 million in annual contract value (ACV).

Metro Brands: The footwear retail chain will acquire 100% shareholding of Cravatex Brands to expand its presence in the sports and athleisure space in India, a regulatory filing said. BSE-listed Cravatex Brands is a retail, brand licensing, distribution and sourcing company that has the exclusive long-term license for the Italian sportswear brand FILA, owns sportwear brand Proline, and represents other international brands.

NHPC: Life Insurance Corporation of India has offloaded 2.02% stake in the company via open market transactions. With this stake sale, LIC’s shareholding in the company has reduced to 5.2%, from 7.23% earlier.

Jindal Steel & Power: The company has signed an MoU with Greenko Group to facilitate 1,000 MW of carbon-free energy for its steel-making operations at Angul, Odisha. This is in line with its goal to become a net-zero steel company by 2035.

5paisa Capital: The company reported a 672% year-on-year growth in consolidated profit at Rs 10.74 crore in the quarter ended September FY23, driven by strong operating performance and lower expenses. Revenue grew by 17% to Rs 79.54 crore compared to same period last year.

Delhivery: The company said Express Parcel volumes remained stable in Q2FY23 and picked up towards the end of the quarter, driven by festive season sales, especially in the heavy goods category. Overall service line volumes for the business grew in the high teens in Q2FY23 over a large base of the same quarter last year (Q2FY22). The company also onboarded 200+ new customers in Q2FY23, driven by improving service metrics. It expects volumes to continue to show a gradual scale up through FY23.

REC and Power Finance Corp: The state-owned REC and Power Finance Corporation have inked a pact to provide Rs 8,520.92 crore finance for setting up a 1,320 MW thermal power plant at Buxar by SJVN Thermal Private Ltd. According to the statement, the total estimated project cost is Rs 12,172.74 crore with debt requirement of Rs 8,520.92 crore, which will be funded by both the companies.

Havells India: The consumer electrical goods maker reported a 38.15% decline in its consolidated net profit to Rs 187.01 crore for the second quarter of FY23 as commodity inflation hit its margins. The company had posted a consolidated net profit of Rs 302.39 crore in the year-ago period. Its revenue from operations rose by 13.63% to Rs 3,679.49 crore during the period under review as against Rs 3,238.04 crore in the corresponding period last fiscal.

Inox Leisure: The multiplex chain operator reported a consolidated net loss to Rs 40.37 crore for the second quarter of FY23, as against a net loss of Rs 87.66 crore in the year-ago period. The decline in net loss was due to rising footfalls at cinema halls. Its revenue from operations during the quarter under review was at Rs 374.12 crore compared with Rs 47.44 crore in the same period last year. Total expenses incresed two-fold to Rs 434.24 crore.

Max Financial Services: The company recorded a 29% year-on-year growth in consolidated profit at Rs 61.61 crore for the quarter ended September FY23 aided by better operating performance and higher other income. Revenue from operations was almost flat at Rs 9,316 crore in the reported quarter as against Rs 9,325.4 crore in the same period a year ago.

Rallis India: The Tata Group company has registered a 26% YoY growth in consolidated profit at Rs 71 crore for the quarter ended September FY23 driven by higher revenues. Revenues increased by 30.7% YoY to Rs 951.2 crore in Q2FY23.

Navin Fluorine International: The company’s consolidated profit for the quarter ended September FY23 declined by 8.6% YoY to Rs 57.81 crore impacted by higher raw material cost. Revenue increased by 23.7% to Rs 419.2 crore compared to same period last year.

NDTV: Adani Group said that it is committed to completing the process and has asked SEBI to provide comments on its draft open offer letter. The development comes after Adani Group missed the date for the launch of an open offer to buy an additional 26% stake in NDTV.

Shoppers Stop: The company’s revenue grew 57.7% to Rs 1,012.7 crore in Q2FY23 compared with Rs 642 crore in the same quarter last year. The firm also posted a profit of Rs 16.2 crore as against a loss of Rs 3.6 crore in the year-ago period.