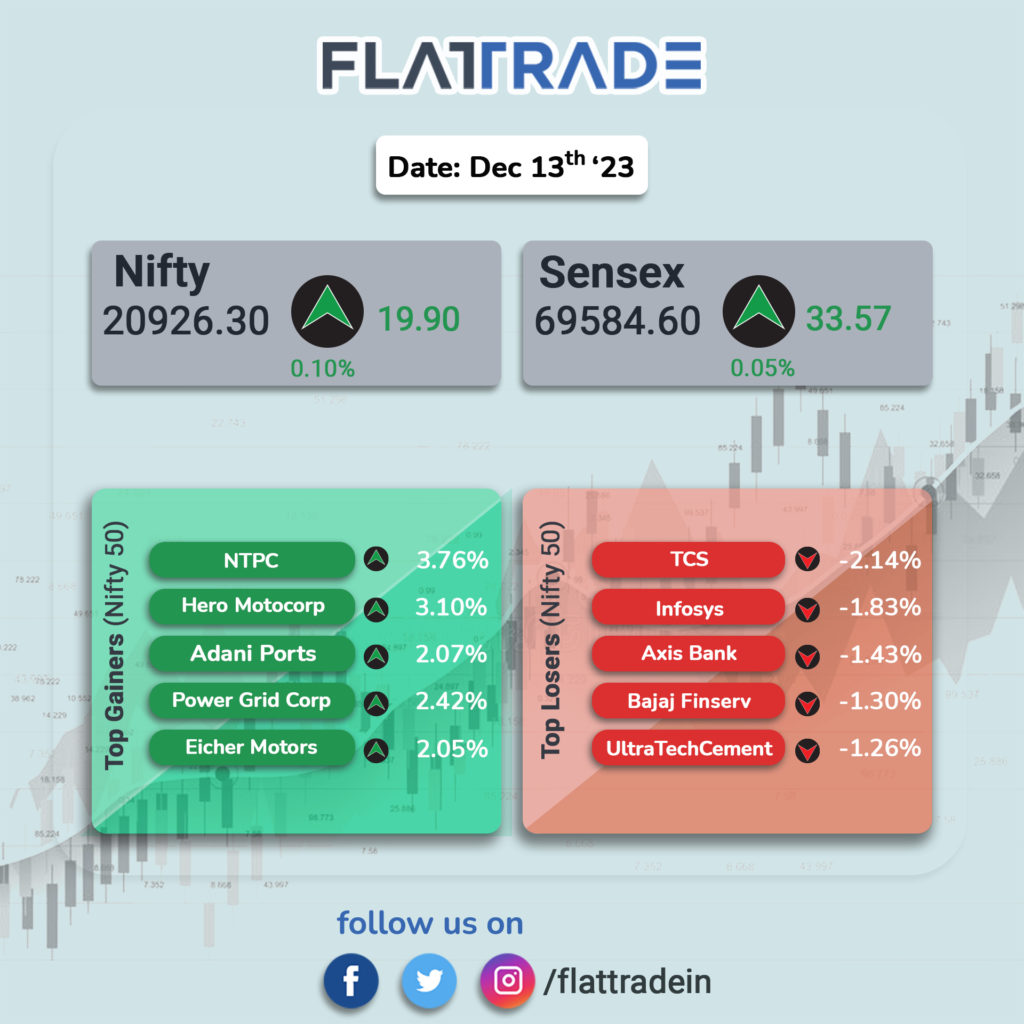

Dalal Street ended marginally in green, ahead of the US FOMC meeting outcome. At close, the Sensex was up 33.57 points or 0.05% at 69,584.60, and the Nifty was up 19.90 or 0.10% at 20,926.30.

In broader markets, The BSE Midcap index rose 1% to touch a fresh record high, while the BSE Smallcap index added 0.7%.

The Indian rupee was up by 5 paise to Rs. 83.46 against the US dollar on Wednesday.

Stock in News Today

Adani Total Gas: Shares tanked 10 percent, after a 90-percent rally in the last month, as investors booked profits. The BSE and the NSE have put the stock under the short-term ASM (Additional Surveillance Measure) framework.

HPL Electric & Power: Shares tanked 9.98 percent after the company bagged an order worth Rs 545 crore for smart meters, supporting India’s national metering initiative.

Sunteck Realty: Shares slumped over 4.19 percent after a large deal worth Rs 336.4 crore took place in the counter. Around 69 lakh shares, representing a 4.75 percent equity in the company changed hands on the exchanges at an average floor price of Rs 482 apiece.

Equitas Small Finance Bank: Shares of gained over 3 percent intraday after it announced the appointment of senior managerial personnel (SMP) Ashwini Biswal as its next chief compliance officer (CCO). The stock shed majority gains to end 0.3 percent higher.

Shilpa Medicare: Shares surged 5 percent intraday after the Therapeutics Goods Administration (TGA) Australia approved its Bengaluru Unit IV for manufacturing, labeling, packaging, and testing of medicinal oral mouth dissolving films. The stock shed some gains to end 2.13 percent higher.

Karur Vysya Bank: Shares of gained 3.3 percent intraday to hit a fresh 52-week high after SBI Mutual Fund purchased 1.2 crore equity shares via open market transactions. The stock, however, pared some gains later in the day to end 0.4 percent higher.

Bank of Baroda: Shares rose 2.21 percent after the lender said that its board will on December 15 review a proposal to raise funds. The board will discuss and finalise the quantum of the first tranche of Tier-2 or sub-debt instruments issued within the board-approved capital-raising plan.

KIOCL: share price fell 1.6 percent after the company temporarily suspended the operations at its Mangalore plant due to non-availability of iron-ore fines.

Cummins India: Shares gained 1.7 percent after the engine maker announced the launch of an intelligent fuel management system in collaboration with Repos Energy. Under the agreement, Cummins will market and distribute the Data Automated Teller Ultimate Machine range of products.

PI Industries: Shares fell 1.7 percent even as the management told media that the company had retained its FY24 growth guidance, as it sought to allay worries about growing competition. The commentary lifted the stock only for the selling to resume soon after.