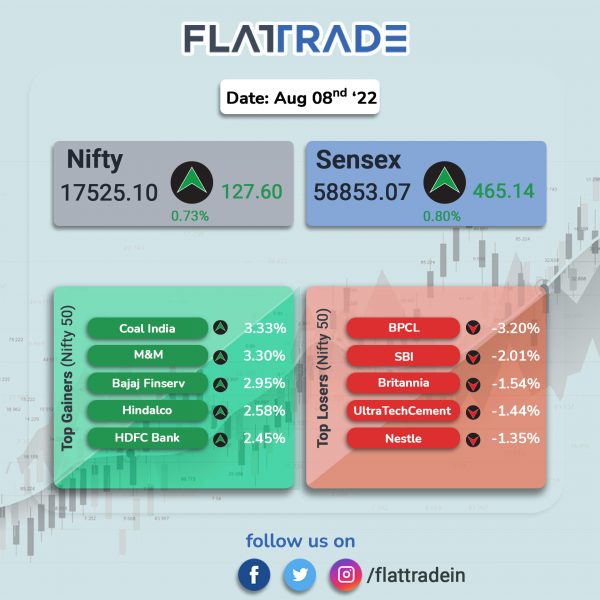

Benchmark equity indices ended higher, helped by gains in index heavyweights. The Sensex jumped 0.8% and the Nifty inched up 0.73%.

Broader markets rose but underperformed headline indices. The Nifty Midcap 100 fell 0.36% and BSE Smallcap increased 0.28%.

Top Nifty sectoral gainers were Metal [1.29%], Pvt Bank [1.23%], Energy [1.17%], Auto [0.97%] and Financial Services [0.93%]. Top losers were PSU Bank [-0.45%] and IT [-0.02%].

The Indian rupee fell 43 paise to 79.66 against the US dollar on Monday.

Stock in News Today

Reliance Industries (RIL): The conglomerate’s green energy business is expected to emerge as a growth engine for the company in the next 5-7 years, Chairman and Managing Director Mukesh Ambani told shareholders in the company’s recent annual report. “Over the next 12 months our investments across the green energy value chain will gradually start going live, scaling up over the next couple of years. This new growth engine holds great promise to outshine all our existing growth engines in just 5-7 years,” Ambani said.

JSW Steel: The company will invest over Rs 48,000 crore in the next three years as part of its capex plan, the company’s Chairman and Managing Director (CMD) Sajjan Jindal said. Besides, JSW Steel is also eyeing to amalgamate JSW Ispat Special Products with it by the end of the current fiscal. Jindal addressing a shareholder’s said that the Rs 48,700 crore will include Rs 20,000 crore planned for this current financial year.

Adani Ports and SEZ (APSEZ): The company reported a 16.86% decline in consolidated net profit to Rs 1,091.56 crore in Q1FY23, as against a consolidated net profit of Rs 1,312.9 crore in the corresponding period a year ago. Its total income during the April-June quarter rose to Rs 5,099.25 crore, as against Rs 5,073 crore in Q1FY22.

HDFC Bank: The private sector lender has raised its marginal cost of funds-based lending rate (MCLR) by up to 10 basis points (bps) across loan tenors, with effect from August 8. The interest rate hike comes after the six-member monetary policy committee (MPC) hiked the benchmark repo rate by another 50 bps to 5.4% last week. Accordingly, HDFC Bank’s overnight and one-month MCLR now stands at 7.80%; 3-month MCLR is at 7.85%; 6-months is at 7.95%; 1-year at 8.10%; 2-year at 8.20%; and 3-year at 8.30%.

Paytm: Shares of the company jumped 6.5%, its highest levels in nearly six months, after the company’s parent firm One 97 Communications posted robust results. The consolidated revenue from operations increased 89% to Rs 1,680 crore during the reported quarter from Rs 891 crore in the June 2021 quarter. The gross merchandise value more than doubled to Rs 3 lakh crore in the June 2022 quarter from Rs 1.5 lakh crore a year ago. Loans disbursed through Paytm grew by over eight-fold to Rs 5,554 crore from Rs 632 crore in the June 2021 quarter.

AstraZeneca Pharma: The company posted a consolidated revenue of Rs 232 crore in Q1FY23, up 32% from Rs 175 crore in the year-ago period. It net profit soared 97% to Rs 20 crore in Q1FY23 as against a net profit of Rs 10 crore in the year-ago period. Its Ebitda stood at Rs 28 crore in Q1FY23 compared with Rs 16 crore in the year-ago period.

HFCL: The company and Qualcomm have entered an agreement for design and development of 5G millimeter wave FWA (Fixed Wireless Access) products. Shares of HFCL closed 9.48% higher after the agreement was announced on the exchanges.

Zensar Technologies: The IT firm reported a 25% drop in net profit at Rs 75.1 crore in Q1FY23 as against Rs 100 crore in the same period a year ago due to higher employee costs. Revenue grew 28% to Rs 1,200 crore while subcontracting costs weighed as total costs grew 40%.

Tarsons Products: The company reported a net profit of Rs 20.3 crore in Q1FY23, down 18% year-on-year. Revenue was down 0.8% YoY to Rs 68.6 crore in Q1FY23. The company’s EBITDA fell 15.5% YoY to Rs 31.1 crore.

Blue Star: The air conditioning maker said that it is entering water projects business with orders totalling Rs 375 crore. The company has secured three rural water supply orders from the Department of Rural Water Supply and Sanitation, Government of Odisha. The scope of the orders include field investigation, total station survey, soil investigation, hydraulic and structural design, procurement, construction, and erection of electro-mechanical equipment, testing and commissioning, and operation as well as maintenance. The projects are expected to be completed within 24 months.