Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.37 per cent lower at 17,358.50, signalling that Dalal Street was headed for a negative start on Monday.

Asian shares were mixed as investors were worried about economic slowdown and expectations of higher interest rates. Japan’s Nikkei 225 index rose 0.23% and the Topix index was up 0.05%. China’s Hang Seng fell 0.6% and CSI 300 index fell 0.31%.

The Indian rupee rose 26 paise to 79.23 against the US dollar on Friday.

Meanwhile, Brent Crude hovered around $94 per barrel, whereas WTI Crude was at $88 per barrel.

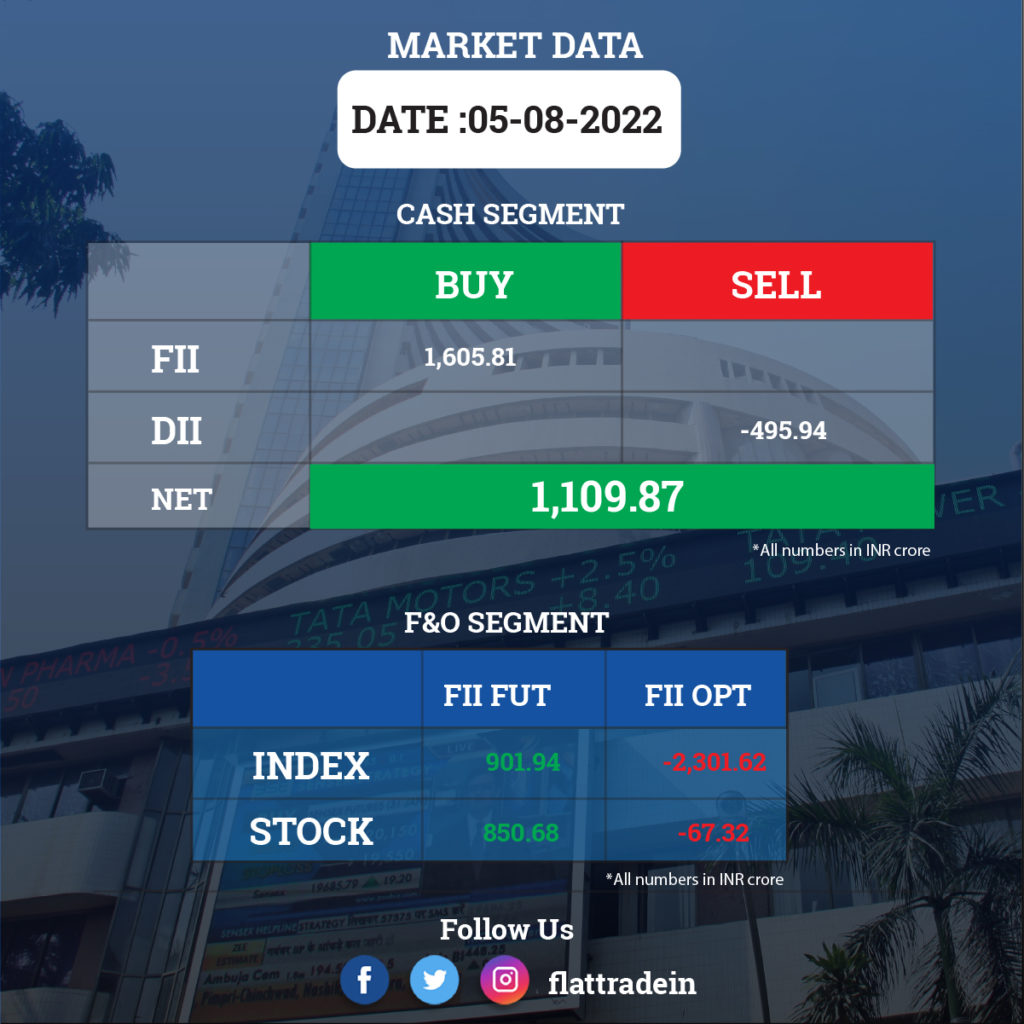

FII/DII Trading Data

Upcoming Results

Bharti Airtel, Adani Ports and SEZ, Power Grid Corporation of India, NALCO, Astrazeneca Pharma India, Chemcon Speciality Chemicals, Sun Pharma Advanced Research Company, City Union Bank, Delhivery, Dhanlaxmi Bank, Gujarat Narmada Valley Fertilizers & Chemicals, Housing & Urban Development Corporation, JK Tyre & Industries, Jaypee Infratech, Vedant Fashions, Samvardhana Motherson International, Sequent Scientific, Subex, Torrent Power, and Whirlpool will report quarterly earnings today.

Stocks in News Today

State Bank of India (SBI): The country’s largest lender reported a 6.7 percent year-on-year decline in profit at Rs 6,068 crore for the quarter ended June 2022 impacted by lower operating profit and other income. Net interest income during the quarter grew by 12.87 percent YoY to Rs 31,196 crore, but operating profit declined 32.8 percent on-year to Rs 12,753 crore and other income plunged 80% YoY to Rs 2,312 crore for the quarter ended June 2022. Loan loss provisions fell by 15.14 percent to Rs 4,268 crore during the same period.

Bharat Petroleum Corporation (BPCL): The oil marketing company posted a standalone loss of Rs 6,290.80 crore for the quarter ended June 2022, against a profit of Rs 3,192.58 crore in the corresponding period last fiscal, impacted by an increase in input cost. Revenue from operations grew by 54 percent year-on-year to Rs 1.38 lakh crore for the June FY23 quarter. The average gross refining margin (GRM) of the Corporation for the quarter was $27.51 per barrel against $4.12 per barrel in Q1FY22.

One 97 Communications (Paytm): The digital payments platform operator said its consolidated loss widened to Rs 644.4 crore in the first quarter ended June 2022. The company had recorded a net loss of Rs 380.2 crore a year ago. The consolidated revenue from operations increased 89 per cent to Rs 1,680 crore during the reported quarter from Rs 891 crore in the June 2021 quarter. The gross merchandise value more than doubled to Rs 3 lakh crore in the June 2022 quarter from Rs 1.5 lakh crore a year ago. Loans disbursed through Paytm grew by over eight-fold to Rs 5,554 crore from Rs 632 crore in the June 2021 quarter.

Hindustan Petroleum Corporation (HPCL): The oil retailer posted a big loss of Rs 10,197 crore for the quarter ended June 2022, against a profit of Rs 1,795 crore for the same period last year, impacted by erosion in the marketing margin on motor fuels and LPG. Revenue grew by 56 percent YoY to Rs 1.22 lakh crore during the same period.

Tata Motors: The company’s subsidiary, Tata Passenger Electric Mobility Ltd (TPEML), has bought the Ford India’s manufacturing plant situated at Sanand, Gujarat, including entire land and buildings, vehicle manufacturing plant along with machinery and equipment for a consideration of Rs 725.7 crore. The two companies signed a unit transfer agreement (UTA) for the same on Sunday. As part of the agreement all the eligible employees at the unit will be transferred to Tata Motors.

Maruti Suzuki India: The automaker will increase its production and aims to produce 20 lakh units in the ongoing fiscal with improving availability of semiconductors, said its company Chairman RC Bhargava. He added that the upcoming mid-sized SUV Grand Vitara will play a key role in the challenge to touch 20 lakh units.

Hindustan Aeronautics Ltd (HAL): The state-run aerospace behemoth is working on an AI-driven multi-role, advanced and long-endurance drone for strategic missions in high-altitude areas including along the frontiers with China, PTI news agency reported citing sources familiar with the development. The HAL has set a target of conducting the maiden test-flying of the unmanned aerial vehicle (UAV) by the middle of next year and plans to produce 60 such platforms in the first phase of the project.

Marico: The FMCG company reported a 3.3 percent YoY increase in consolidated profit at Rs 377 crore for the June FY23 quarter supported by higher operating performance. Revenue grew by 1.3 percent YoY to Rs 2,558 crore and EBITDA increased by 9.77 percent to Rs 528 crore compared to the year-ago period.

FSN E-Commerce Ventures: The Nykaa brand operator clocked a 42.24 percent year-on-year increase in consolidated profit at Rs 5.01 crore for the quarter ended June FY23, aided by better sales and operating performance. Revenue from operations for the June FY23 quarter stood at Rs 1,148.4 crore, a 40.56 percent growth compared to the same period last year. The consolidated gross merchandise value (GMV) has grown 47 percent year-on-year to Rs 2,155.8 crore for the quarter ended June FY23.

Motherson Sumi Wiring India Ltd (MSWIL): The company reported a two-fold increase in net profit at Rs 126 crore in the first quarter ended June 2022.The company had posted a net profit of Rs 79 crore in the April-June period of last fiscal. Total revenue from operations rose to Rs 1,671 crore compared to Rs 1,114 crore in the year-ago period, MSWIL said in a statement.

CE Info Systems (MapMyIndia): The digital map company posted nearly 18 per cent increase in consolidated profit at Rs 24.2 crore in the April-June quarter of FY23. It had recorded a profit of Rs 20.6 crore in the same period a year ago. The revenue from operations of MapMyIndia grew by about 50 per cent to Rs 65 crore during the reported quarter from Rs 43.35 crore in the June 2021 quarter.

Shipping Corporation of India Ltd (SCI): The PSU reported a 27.97 per cent decline in consolidated net profit to Rs 114.17 crore for the first quarter of this fiscal. The company had clocked a consolidated net profit of Rs 158.51 crore in the corresponding period a year earlier. Its total income rose to Rs 1,500.53 crore in the latest June quarter against Rs 1,048.47 crore in the year-ago period. The company’s total expenses during the quarter under review increased to Rs 1,390.13 crore from Rs 899.25 crore a year ago.

Bank of Baroda: The company is planning to raise Rs 1,000 crore through issuance of infrastructure and affordable housing bonds on August 12, IANS news agency reported citing sources. The auction for the infrastructure and affordable housing bonds is expected to be held on August 12 on the BSE’s bidding platform. The likely tenure is for seven years.

Cipla: The drug major is betting big on digitisation and emerging segments like biosimilars and mRNA aided medications to drive its next phase of growth. The drug maker is also bullish on maximising value opportunity in the complex generics in the US market. It is also looking to scale up its US core formulations sales on the back of respiratory and peptide franchises while monitoring upcoming complex product launches in the second half of the current fiscal.

Raymond: The textile company reported a consolidated net profit of Rs 81.93 crore for the first quarter ended June 2022 helped by an increase in sales. It had posted a net loss of Rs 157.10 crore during the April-June quarter of the previous fiscal. Its revenue from operations was at Rs 1,728.14 crore, up two-fold from Rs 825.70 crore in the year-ago period. The rise was attributed to strong wedding demand and expansion of distribution.

Affle India: The company recorded a 93.5 percent YoY growth in profit after tax at Rs 55.2 crore for the quarter ended June FY23 on broadbased growth in both CPCU business and non-CPCU business, across India and international markets. Revenue at Rs 347.5 crore grew by 128 percent YoY and EBITDA rose by 96 percent to Rs 68.7 crore compared to the year-ago period.

IRB Infrastructure Developers: The infrastructure developer reported a multi-fold increase in consolidated net profit at Rs 363.19 crore for the quarter ended June 2022. The company had clocked a consolidated a net profit of Rs 71.91 crore in the corresponding period of the previous fiscal. Total consolidated income during the quarter under review rose to Rs 1,995.40 crore as against Rs 1,670.48 crore in the year-ago period. The company’s board has approved sale of Vadodara Kim hybrid annuity model(HAM) project in Gujarat for Rs 342 crore.

Petronet LNG: India’s largest liquefied natural gas importer reported a 10 per cent rise in first-quarter net profit on processing larger volumes of imported fuel. Net profit in April-June stood at Rs 700.9 crore compared with Rs 635.67 crore in the same period a year back. The rise was mainly because its liquefied natural gas (LNG) import terminal at Dahej in Gujarat processed larger volumes. The company reported the highest-ever turnover of Rs 14,264 crore in the quarter as against Rs 8,598 crore in April-June 2021.

Computer Age Management Services (CAMS): The company reported a 2.4 per cent growth in profit after tax to Rs 64.78 crore for the April-June quarter of FY23. It had posted a PAT of Rs 63.24 crore in the same quarter of the last fiscal. Its revenue rose 17.6 per cent to Rs 236.65 crore in the quarter under review from Rs 201.18 crore in the three months to June 2021. The company said individual investor confidence remained high with strong equity net inflows supported by predictable, robust Systematic Investment Plan collections of nearly Rs 7,000 crore every month.

Fortis Healthcare: the company has reported 69 per cent decline in consolidated net profit at Rs 134 crore for the first quarter ended June 30. It had logged a net profit of Rs 431 crore, which included an exceptional gain of Rs 306 crore, in April-June 2021-22. Revenues in the period under review stood at Rs 1,488 crore as compared with Rs 1,410 crore in the year-ago period.

Indian Overseas Bank (IOB): The state-owned lender posted a 20 per cent rise in net profit to Rs 392 crore for the first quarter of the current financial year, helped by a decline in bad loans. It had reported a net profit of Rs 327 crore in the April-June quarter of 2021-22. Its interest income of the bank moved up to Rs 4,435 crore as against Rs 4,063 crore. Net interest margin (NIM) rose to 2.53 per cent as against 2.34 per cent at the end of first quarter of FY22. The bank’s gross non-performing assets (NPA) ratio declined to 9.03 per cent from 11.48 per cent at June-end last year. The company will be raising around Rs 1,000 crore through qualified institutional placements (QIP) to sustain business growth.

UCO Bank: The state-owned lender posted a 22 per cent rise in net profit at Rs 123.61 crore for the first quarter ended June 2022, helped by fall in bad loans. It had reported a net profit of Rs 101.81 crore in the same quarter of last financial year. The total income declined to Rs 3,796.59 crore, as against Rs 4,539.08 crore in the first quarter of the previous fiscal.

SJVN: The company has bagged the full quoted capacity of 200 MW solar project at Rs 2.90 per unit on a build, own and operate (BOO) basis through e-RA conducted on August 4. The power purchase agreement shall be executed after the issuance of a letter of intent from Maharashtra State Electricity Distribution Company Limited (MSEDCL). The ground-mounted solar project shall be developed by SJVN anywhere in Maharashtra through the EPC contract.