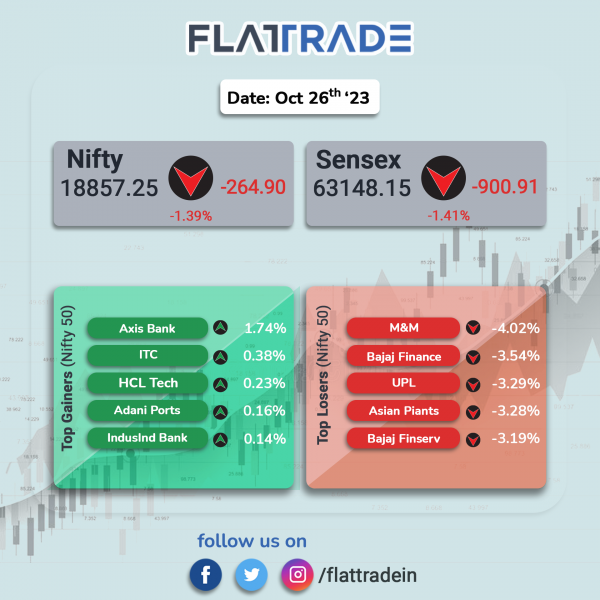

Benchmark indices ended with deep losses due to multiple headwinds such as fear of higher interest rate for a longer period of time, higher inflation, Israel-Hamas conflict, elevated oil prices, and rising US Treasury Yields. The Sensex fell 1.4% and the Nifty 50 index plummeted 1.39%.

In broader markets, the Nifty Midcap 100 index dropped 1.16% and the BSE Smallcap fell 0.32%.

Top losers were Metal [-1.62%], Auto [-1.59%], Financial Services [-1.57%], Oil & Gas [-1.5%], and Bank [-1.29%]. All the nifty sectoral indices closed in the negative zone.

The Indian rupee depreciated by 4 paise to close at 83.23 against the US dollar on Thursday.

Stock in News Today

Asian Paints: The company reported a 53.3% YoY rise in consolidated net profit for the quarter ended September 2023 to Rs 1,232.4 crore from Rs 803.8 crore in the year-ago period. Consolidated revenue from operations remained nearly flat as it rose 0.2% to Rs 8,478.6 crore in Q2FY24. EBDIT increased by 39.8% YoY to Rs 1,716.2 crore in Q2FY24 from Rs 1,227.7 crore in Q2FY23. The board has recommended an interim dividend of Rs 5.15 per share and the record date has been fixed as November 3. The dividend will be paid to eligible shareholders on or after November 13, 2023.

Canara Bank: The public sector lender reported a net profit of Rs 3,606 crore in Q2FY24, up 43% from the year-ago period. NII rose 19.76% to Rs 8,903 crore in Q2FY24, from Rs 7,434 crore in the year-ago quarter. The bank’s net interest margin (NIM) expanded to 3.02 per cent in Q2FY24, compared to 2.83 per cent in Q2FY23. The bank’s gross non-performing asset (NPA) was at 4.76%, down from 6.37% in year-ago period. Net NPA improved to 1.41% in Q2FY24 from 2.19% in the year-ago period.

Infosys: The IT major announced that it has signed a five-year collaboration with smart Europe GmbH to refine its Direct-to-Customer (D2C) business model in Europe and provide enhanced customer experience, data-driven personalization and engagement for the existing model smart #1, the newly announced smart #3, and other upcoming all-electric models from the iconic brand. Through this strategic collaboration, Infosys will help smart Europe GmbH redefine the online EV buying experience and apply state-of-the-art Machine Learning (ML) models to accurately forecast sales and aftersales demand.

ACC: The cement maker said that its standalone net profit stood at Rs 384.29 crore in Q2FY24 as against a loss of Rs 91.09 crore in Q2FY23. The standalone revenue from operations for the quarter under review stood at Rs 4,434.67 crore, up 11.2% from Rs 3,987.34 crore in the year-ago period. Segment wise, the cement sales stood at Rs 4,151.29 crore in Q2FY24 as against Rs 3,691.20 crore in Q2FY23. Ready mix concrete segment reported sales of Rs 308 crore in Q2FY24 as against Rs 353.26 crore in Q2FY23.

Punjab National Bank (PNB): The state-owned lender said its standalone net profit jumped multifold to Rs 1,756 crore during the quarter ended September 2023. The standalone net profit was Rs 411 crore in the corresponding period last fiscal. Net interest income (NII) during the quarter under review rose 20% YoY to Rs 9,923 crore in Q2FY24 as against Rs 8,271 crore in the year-ago period. The lender’s asset quality improved in the July-September period with gross NPAs falling to 6.96% and net NPAs declining to 1.47%.

Indian Bank: The public sector lender reported a 62% rise in net profit at Rs 1,988 crore for the quarter ended September 2023. The bank had posted a net profit of Rs 1,225 crore in the year-ago period. Interest income rose to Rs 13,743 crore in Q2FY24, from Rs 10,710 crore in the same period of previous fiscal. The gross non-performing assets (NPAs) ratio improved to 4.97% at the end of September 2023 as against 7.30% in the year-ago period.

J.B. Chemicals & Pharmaceuticals: The company informed that Maharashtra GST department has commenced inspection at company’s registered and corporate offices. The company further said that the operations of the company continue as usual and operations are not impacted.

Affle India: The company said it will raise funds worth Rs 749 crore through a preferential issue of shares to the Government of Singapore. The company will issue 69 lakh equity shares at a price of Rs 1,085.54 per share, which is 6% premium to Wednesday’s closing price.

Macrotech Developers: The company has signed an agreement to sell its entire stake in Palava Induslogic 3 Private to NewCold India Holding B.V., Netherlands, for Rs 153.65 crore. The transaction is expected to be completed by January 8, 2024. Palava Induslogic 3 Private is wholly owned subsidiary of the company.

GVK Power & Infrastructure: The company said in an exchange filing that the High Court of Justice Business and Property Courts of England and Wales Commercial Courts has ordered the company to pay $2.19 billion to consortium of banks against a loan classified as NPA in financial year 2016. The consortium of overseas branches of Indian banks was led by ICICI Bank. The company added that it is awaiting the detailed judgment to evaluate the next course of action to be taken by them.

Zen Technologies: The company announced that it has won an order valued at Rs 100 crore from the Ministry of Defence, India, for its state-of-the-art Force-On-Force Tank training system. This innovative system empowers Tank Units and Sub-Units to engage in training on real terrains under authentic conditions using their equipment, without the necessity for live ammunition. The system has been designed, developed, and tested in-house by the company.

Symphony: The company said its consolidated revenue was almost flat at Rs 275 crore in Q2FY24 compared with Rs 274 crore in the year-ago period. Its consolidated EBITDA was up 10.81% at Rs 41 crore in Q2FY24 as against Rs 37 crore in Q2FY23. The net profit for the quarter under review was up 9.37% at Rs 35 crore in Q2FY24 from Rs 32 crore in Q2FY23.

Apar Industries: The company’s consolidated revenue was up 21.36% YoY at Rs 3,925.98 crore in Q2FY24 compared with Rs 3,234.88 crore in the eyar-ago period. Consolidated Ebitda rose 54.84% to Rs 349.76 crore in Q2FY24 from Rs 225.88 crore in Q2FY23. Its consolidated net profit was up 69.42% YoY at Rs 173.88 crore in the quarter under review.

Steel Strips Wheels: The company’s consolidated revenue was up 4.86% YoY at Rs 1,133.72 crore in Q2FY24 as against Rs 1,081.09 crore in Q2FY23. Ebitda grew 6.21% to Rs 124.43 crore in Q2FY24 from Rs 117.15 crore in Q2FY23. Its consolidated net profit for the period fell 4.21% to Rs 52.3 crore in Q2FY24 from Rs 54.6 crore in Q2FY23.

Westlife Foodworld: The company’s consolidated revenue was up 7.39% YoY at Rs 614.73 crore in Q2FY24 as against Rs 572.42 crore in Q2FY23. Consoliadted Ebitda rose 2.38% to Rs 98.21 crore in Q2FY24 as against Rs 95.92 crore in Q2FY23. Its consolidated net profit for the period fell 29.05% to Rs 22.37 crore in Q2FY24 as against Rs 31.53 crore in Q2FY23.

Somany Ceramics: The company said its board has approved to buyback 15.18% stake at Rs 850 per equity share aggregating up to Rs 125 crore. Shares of the company closed at Rs 658.8 per share on Thursday.

IRM Energy: The company had a tepid stock market debut. Shares of the company got listed at Rs 477.25 apiece on the NSE compare to its issue price of Rs 505. Shares touched a low of Rs 450.20 and closed at Rs 472.45 per share.