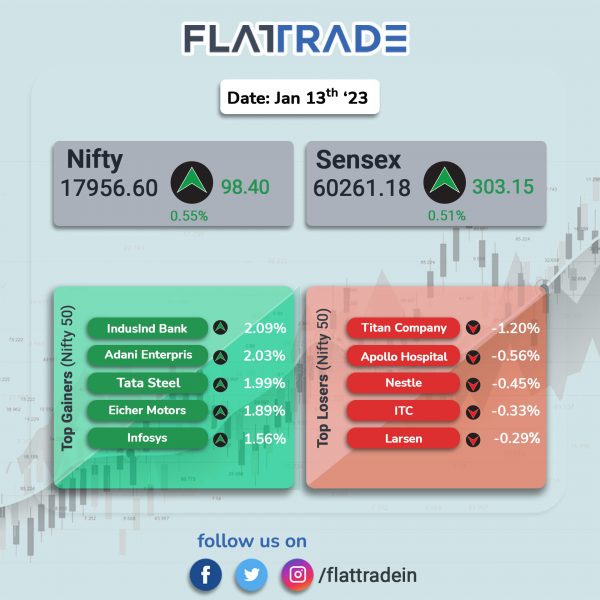

Benchmark equity indices closed higher, helped by gains in select index heavyweights and cooling inflation in India and the US. The Sensex jumped 0.51% and the Nifty 50 index rose 0.55%.

In broader markets, Nifty Midcap 100 index fell 0.1% and the BSE Smallcap rose 0.22%.

Top gainers among Nifty sectoral indices were PSU Bank [1.35%], Metal [1.27%], Private Bank [0.74%], IT [0.74%] and Bank [0.69%]. FMCG and Pharma indices inched down 0.02%, each.

Indian rupee rose 22 paise to 81.32 against the US dollar on Friday.

India’s Consumer Price Index (CPI)-based inflation rate eased to 5.72% in December. It was 5.88% in November, and 6.77% in October 2022. The latest inflation reading is within the Reserve Bank of India’s comfort zone of 2%-6% for the second month in a row, according to data released by the India’s statistical agency.

Stock in News Today

Wipro: The company said that its revenue from operation rose to Rs 23,229 crore in Q3FY23 from Rs 20,313.6 crore in the year-ago period. The net profit rose to Rs 3,053 crore in the reported quarter from Rs 2,969 crore in the year-ago period. It has declared an interim dividend of Rs 1 per equity share. The revenue expectations from IT Services business for the full year is expected to be in the range of 11.5% to 12%, in constant currency terms. The attrition has been recorded at 21.2% during the quarter.

Mahindra & Mahindra (M&M): The company said that the total production in December 2022 was 45,009 units, up by 80% from 24,970 units produced in the same period last year. Revenue was up 48% YoY to 53,577 units in December 2022. Exports during the period under review was 3100 units, up 3% YoY. Separately, Mahindra & Mahindra has announced the dissolution of Mahindra Tractor Assembly Inc., a wholly owned subsidiary of Mahindra Overseas Investment Company (Mauritius) Limited (MOICML) which is a wholly-owned subsidiary of M&M.

Larsen & Toubro (L&T): The infrastructure conglomerate announced that it has signed an MoU with the Norway-based H2Carrier (H2C) to co-operate towards developing floating green ammonia projects for industrial-scale applications. According to the terms of the MoU, L&T will become a partner for engineering, procurement, construction, installation & commissioning (EPCIC) of the topsides for H2C’s floating process plants. H2C plans to build the P2XFloater hull at yards in Asia and L&T will design and fabricate the topside process and utility modules to produce green hydrogen & green ammonia, including electrolysers, nitrogen generation plant, and ammonia synthesis unit.

Godrej Properties: The company said that it has purchased 60 acres on an outright basis at Oragadam Junction, Chennai. The proposed project is estimated to have a developable potential of approximately 1.6 million square of saleable area, comprising primarily of residential plotted development. The site is strategically located in between GST road and NH-4, just off Oragadam Junction (on the 6-lane SH-48) offering access to other parts of the city via Chennai Bypass Road, Chennai Tiruvallur High Road and Red Hills Road.

Mahindra Lifespaces: The company has acquired a 4.25 acre land parcel with a development value of Rs 400-crore in Bengaluru. The land is estimated to have a developable potential of 4.6 lakh square feet of saleable area. The site is located off Hosur Road close to Electronics City. The first phase of the project will be launched in 2023.

Rail Vikas Nigam Ltd (RVNL): The company informed that it has been awarded a letter of award (LoA) by Southern Railway for automatic block signaling in Taduku-Renigunta section and replacement of EI/RRI at Taduku, Pudi and Sri Venkata Perumal Raju Puram stations of Chennai Division. The total cost of the project is Rs 38.97 crore and it is expected to be executed in 15 months.

Den Networks: The cable TV distributor reported a 7.9% rise in consolidated net profit to Rs 49.02 crore despite of 5.9% fall in net sales to Rs 276.90 crore in Q3FY23 over Q3FY22. Consolidated profit before tax increased by 14.1% to Rs 49.72 crore in Q3FY23 from Rs 43.57 crore in Q3FY22. EBITDA dropped 26% to Rs 37 crore in the reported quarter as compared to Rs 50 crore posted in the same quarter previous year. EBITDA margin slipped to 14% in Q3FY23 as against 17% in Q3FY22.

Kolte-Patil Developers: The company recorded 28% jump in sales value to Rs 716 crore in Q3FY23 from Rs 561 crore in Q3FY22, while sales volume increased by 31% to 1.13 million square feet in Q3FY23 from 0.86 million square feet in Q3FY22. The company posted a realization amount of Rs 6,339 per square feet, down 2% YoY and down 4% QoQ. Collections grew by 3% YoY and 8% QoQ during Q3FY23 to Rs 435 crore.

Heritage Foods: The company said its board has approved a rights issue of 4,63,98,000 equity shares of Rs 5 each totalling Rs 23.19 crore. The rights issue will open on January 30, 2023 and close on February 13, 2023. The last date for renunciation of rights entitlements will be February 8, 2023. The rights entitlement ratio is fixed at 1:1.

Advik Capital: The company said its net profit rose 23-times to Rs 3.68 crore in the quarter ended December 2022 as against Rs 0.16 crore during the quarter ended December 2021. It revenue from operations surged to Rs 37.58 crore in the quarter ended December 2022 as against Rs 10.37 crore during the quarter ended December 2021.

Rama Steel Tubes: The company said that it has signed a memorandum of understanding (MOU) with the Government of Uttar Pradesh for setting up of steel processing unit. Under this MOU, the proposed investment will be of Rs 600 crore, which would be invested in phased manner. The steel processing unit would be for MS Pipes, STP Poles, Gl Pipes, CR Coils, GP Coils, Colour Coated Coils.

International Travel House: The company’s net profit rose 99.09% to Rs 4.38 crore for the quarter ended December 2022 as against Rs 2.20 crore during the same quarter last fiscal. Revenue rose 42.32% to Rs 45.94 crore in the reported as against Rs 32.28 crore during the same period last fiscal.

Cressanda Solutions: The company said that it has bagged an order for in-coach digital advertising in the Kolkata Metro for a period of five years and the contract is renewable for an additional 5 years. The company aims to serve 7-8 lakh passengers daily with an annual target of 15 crore passengers and above. The company is in advance stages for the contract for providing in-coach wi-fi services.

Anup Engineering: The company said that its consolidated net profit jumped to Rs 13.88 crore in Q3FY23 as against Rs 6.06 crore in Q3FY22. Revenue from operations surged 142.37% YoY to Rs 114.42 crore for the quarter ended December 2022. Its consolidated EBITDA improved to Rs 22.6 crore during the reported quarter as compared to Rs 11 crore in the year-ago period. Its cost of raw materials consumed rose 52.86% YoY to Rs 54.48 crore. The company’s order book stood at Rs 565.6 crore the end of December 2022.

Atishay Ltd: The company said that it has received an order worth Rs 1.89 crore from Central Pollution Control Board (CPCB) for implementation of centralized barcode system for tracking biomedical waste. The project entails maintaining the system for five years by assistance and deploying at least one programmer/ IT Engineer at CPCB. The tenure of the project is eight months and all modules of the project are expected to be fully functional in eight months.