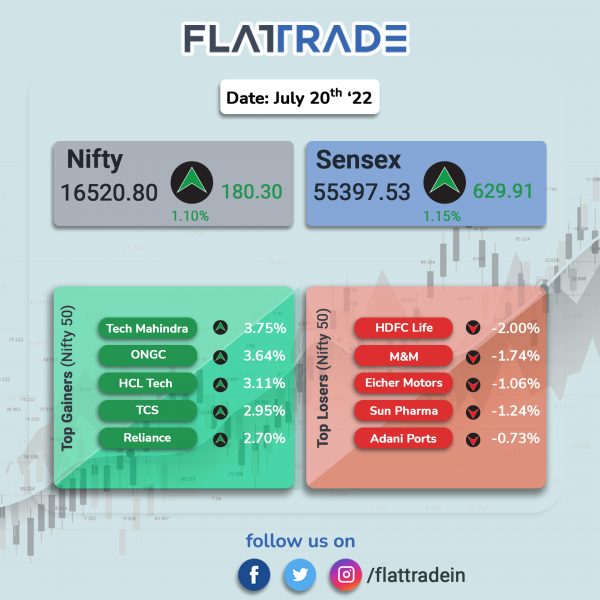

Major equity indices ended higher as information technology, FMCG, metal and energy stocks surged. The Sensex jumped 1.15% and the Nifty 50 index gained 1.1%.

Broader markets underperformed headline indices. The Nifty Midcap 100 index edged up 0.19% and the BSE Smallcap was up 0.42%.

Top gainers among Nifty sectors were IT [2.93%], FMCG [1.42%], Metal [1.12%] and Oil & Gas [1.02%]. Top losers were Media [-0.43%], Auto [-0.22%] and Realty [-0.17%].

Indian rupee was nearly flat at 79.99 against the US dollar on Wednesday.

Stock in News Today

Reliance Industries Ltd (RIL), ONGC and OIL: Shares of RIL, ONGC and OIL jumped about 2.5%-6% after the Indian government removed levies on gasoline exports and decreased windfall taxes on other fuels. In a notification, the government has cut windfall tax on diesel and ATF exports by Rs 2 per litre and eliminated Rs 6 per litre levy on gasoline exports.

Meanwhile, Rajarshi Gupta has taken over as Managing Director of ONGC Videsh Ltd (OVL), the overseas investment arm of state-owned Oil and Natural Gas Corporation (ONGC). He replaces Alok Gupta who superannuated recently.

ITC: The conglomerate said that the company will continue to deliver robust growth despite key concerns such as inflation. Speaking at the ITC’s AGM virtually, CMD Sanjiv Puri said that in the FMCG space, the firm has nurtured 25 brands and the newer ones will garner an annual consumer spend of Rs 24,000 crore. The company will also fortify and scale up new mega brands while investing in categories of the future, he said.

State Bank of India (SBI) and LIC of India: SBI has become the most valuable company by market capitalisation among public sector undertaking (PSU), surpassing insurance giant–Life Insurance Corporation of India’s (LIC) market cap. Shares of SBI have gained 17% in the last one month, while LIC shares have risen by 5%. SBI market cap stands at Rs 4.53 lakh crore.

Tata Steel: The company has signed an MoU with BHP to explore low carbon iron and steelmaking technology in India. Both the companies plan to collaborate on various ways to reduce emission intensity of blast furnace steel route. The two companies will focus on using biomass as source of energy in steel production.

Electric Bus manufacturers: Shares of electric bus manufacturers Tata Motors, Ashok Leyland, Sona BLW, JBM Auto, Olectra Greentech jumped after comments by state-owned Convergence Energy Services Ltd’s (CESL) MD Mahua Acharya said that the company is planning $10 billion tender for 50,000 electric buses, Bloomberg news reported.

Century Plyboards: The company’s standalone net profit rose year-on-year to Rs 96.47 crore in Q1FY23, from Rs 33.89 crore in the year-ago period. Its revenue increased to Rs 881.48 crore in the reported quarter from Rs 448.88 crore in the same period a year ago. The company’s EBITDA climbed to Rs 145.28 crore in Q1FY23, from Rs 61.21 crore in the corresponding quarter last fiscal.

Syngene International: The company reported a net income of Rs 73.9 crore in Q1FY23, down 4.4% from Rs 77.3 crore in the year-ago period. However, its revenue was up 8.4% to Rs 644.5 crore in the reported quarter, from Rs 594.5 crore in the same period a year ago.

Hatsun Agro: The company has posted a standalone net sales of Rs 2,014.61 crore in Q1FY23, up 30.42% from Rs 1,544.71 crore in the year-ago period. Its Q1FY23 net profit stood at Rs 51.95 crore in June 2022, down 10.93% from Rs. 58.33 crore in June 2021. Strong sales recovery in the domestic market post the COVID-19 pandemic with good summer sales led to highest ever quarterly sales volume, said the company’s chairman RG Chandramogan.

NHPC: The company has signed a Memorandum of Understanding (MoU) with Damoder Valley Corporation (DVC) to “Explore formation of Joint Venture company (JVC) for exploring and setting up Hydropower and Pump Storage Projects”.

Newgen Software Technologies: The company registered a revenue of Rs 167.70 crore in the Q1FY23, a rise of 15.99% from Rs 144.58 crore in the year-ago period. Its net profit declined slightly by 2.94% to Rs 18.84 crore in the reported quarter as against Rs 19.41 crore in the year-ago period.

Info Edge (India): The company has announced that it has invested an amount of Rs 15 crore in Smartweb Internet Services which is a wholly-owned subsidiary of the company. Info Edge said that the investment would allow its subsidiary to meet its working capital requirement and further strengthen it financially.

Krsnaa Diagnostics: The company said it has secured an order for supply, installation, operation and maintenance of CT Scan Centre at Raj – MES Medical College in Rajasthan. The company will set up 64-Slice-CT-Scanner Machine at Raj – MES Medical College. The tenure of the contract will be 10 years from issuance of letter of award.

Ramco Systems: Shares of the company closed 11% higher after the the company announced a deal with leading Saudi Arabian Restaurant Chain Kudu Company. The company will implement its global payroll and HR solution at Kudu Company.