Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.18% higher at 16,528.5, signalling that Dalal Street was headed for a positive start on Thursday.

Asian stocks were lower as investors were concerned over the latest corporate earnings and probable interest rate hike. Japan’s Nikkei 225 index slipped 0.08% and Topis fell 0.28%. China’s Hang Seng dropped 1.09% and CSI 300 index edged down by 0.38%.

Indian rupee stood at 79.99 against the US dollar on Wednesday.

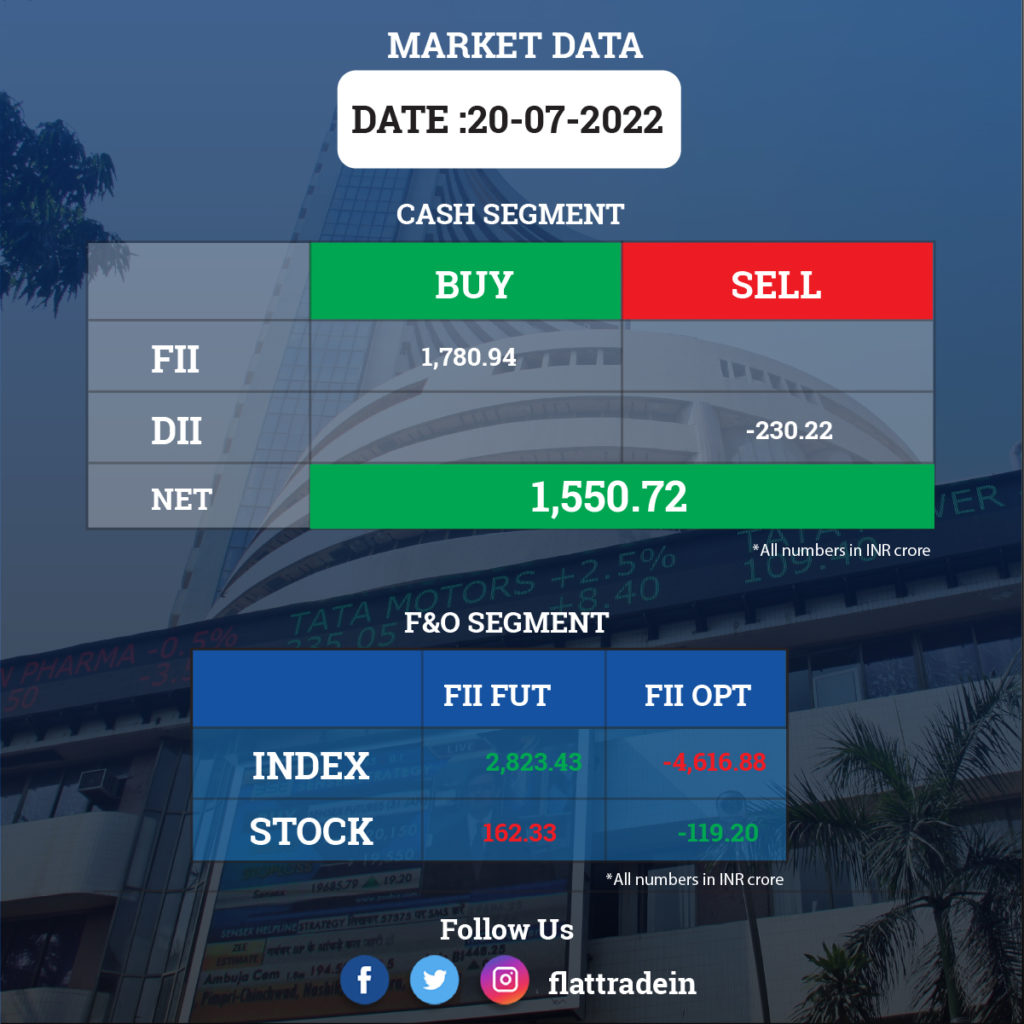

FII/DII Trading Data

Upcoming Results

JSW Energy, Happiest Minds Technologies, IDBI Bank, RBL Bank, IndiaMART, ICICI Securities, Hindustan Zinc, CRISIL, Mphasis, CSB Bank, Can Fin Homes, Cyient, Elecon Engineering, Embassy Office Parks REIT, Gujarat State Fertilizers & Chemicals, Himadri Speciality Chemical, Kajaria Ceramics, Meghmani Finechem, Orient Bell, Persistent Systems, Hitachi Energy India, PVR, Quick Heal Technologies, Ramkrishna Forgings, and SRF will report their quarterly earnings on July 21.

Stocks in News Today

Wipro: The company’s net profit in Q1FY23 declined 21% YoY to Rs 2,563.6 crore due to acquisition, higher cost of talent, and taxes. The revenue for the quarter under review was Rs 21,528 crore, up 17.9% YoY. Its IT services revenue stood at $2.73 billion, an increase of 13.3% YoY.

State Bank of India (SBI): The lender received the board’s approval to raise up to Rs 11,000 crore through issuance of bonds. The bank’s , at its meeting held on Wednesday, approved raising capital by way of issuance of Basel lll compliant debt instrument in USD/INR and/or any other convertible currency in FY23, according to a regulatory filing.

IndusInd Bank: The private sector lender reported a 60.5% jump in net profit at Rs 1,631.02 crore for the quarter ended June, helped by a decline in bad loans. It had posted a net profit of Rs 1,016.11 crore in the year-ago period. The bank’s total income increased to Rs 10,113.29 crore as against Rs 9,298.07 crore in the same period a year ago. Interest income in the June quarter rose 9.5% to Rs 8,181.77 crore compared to the year-ago period. Its gross NPA stood at 2.35% of the gross advances at the end of June as against 2.88% in the year-ago period.

AU Small Finance Bank: The company’s net profit rose 32% YoY to Rs 268 crore in Q1FY23, helped by higher net interest income. The lender had posted a net profit of Rs 203 crore in Q1FY22. The lender’s net interest income (NII) was up 35% in Q1FY23 to Rs 976 crore from Rs 924 crore in Q1FY22. Its net interest margin (NIM) declined to 5.9% in Q1FY23 from 6% a year ago. Its gross non-performing assets (GNPAs) declining to 1.96% in June 2022 from 4.31% till the year-ago quarter.

JSW Steel: The company is undertaking various initiatives to reduce carbon footprint in line with India’s net zero ambitions, its Chairman Sajjan Jindal said. According to Jindal, his company has already earmarked a sum of Rs 10,000 crore to increase the use of renewable energy to replace thermal power and other green initiatives.

Havells India: The company reported an slight increase of 3.13% in consolidated net profit to Rs 243.16 crore for the June quarter due to commodity cost fluctuation. It had posted a consolidated net profit of Rs 235.78 crore in the April-June quarter a year ago. Its revenue from operations was up 62.62% to Rs 4,244.46 crore during the period under review as against Rs 2,609.97 crore in the corresponding period last fiscal.

Gland Pharma: The pharma company recorded a 35% year-on-year decline in profit at Rs 229.2 crore for the quarter ended June 2022 on lower topline growth and weak operating performance. Revenue declined by 26% YoY to Rs 856.9 crore during the quarter, and EBITDA fell by 31% to Rs 344.3 crore for the quarter, impacted by continuing supply disruptions in the midst of challenging macro environment.

Ceat: The tyre manufacturer reported a 62.3% year-on-year decline in consolidated profit at Rs 8.68 crore for the quarter ended June 2022, dented by higher input cost. Revenue jumped 48% YoY to Rs 2,818.4 crore during the same period.

Tata Communications: The company posted an increase of 83.63% in consolidated profit to Rs 543.76 crore in the June quarter. It had reported a profit of Rs 296.11 crore in the same period a year ago. The consolidated revenue from operations 5% to Rs 4,310.52 crore during the reported quarter from Rs 4,102.79 crore in the year-ago period.

NTPC: The state-owned power giant has inked a pact with Moroccan Agency for Sustainable Energy (MASEN) for cooperation in renewable energy. Through this collaboration, it is intended to support services for capacity building, share experience, know-how and expertise in the areas of mutual interest, especially in the field of research and development.