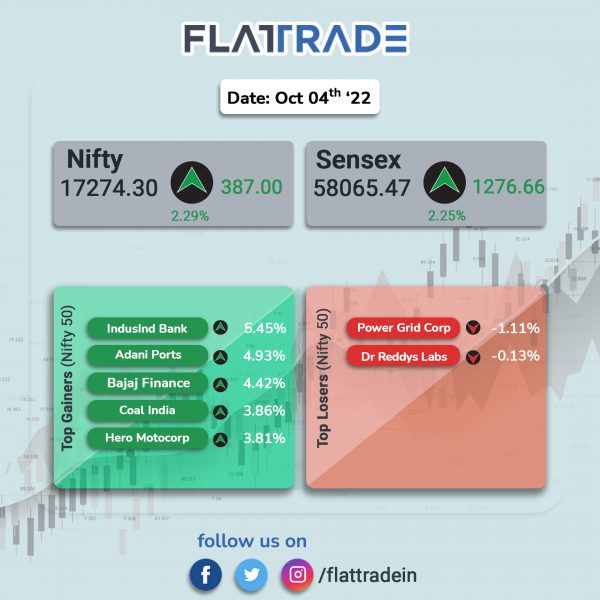

Dalal Street rallied during the session and ended over 2% higher, tracking positive sentiments in the global markets. The Sensex soared 2.25% and the Nifty 50 index zoomed 2.29%.

In broader markets, the Nifty Midcap 100 index surged 2.66% and the BSE Smallcap jumped 1.49%.

Top gainers among Nifty sectoral indices were Private Bank [3.16%], Metal [3.13%], PSU Bank [2.97%], IT [2.87%] and Bank [2.84%]. All indices ended in the green.

Indian rupee gained 36 paise to 81.52 against the US dollar on Tuesday.

India’s monthly value of merchandise export in September 2022 stood at $32.62 billion, down by 3.52% over $33.81 billion in September 2021. India’s merchandise export in April -September of FY23 was $229.05 billion with an increase of 15.54% over $198.25 billion in the same period last year.

Stock in News Today

Reliance Industries Ltd (RIL): Shares of the company rose 1.84% after Sanmina Corp, a US-based electronics contract manufacturer and RIL’s subsidiary, Reliance Strategic Business Ventures, completed the previously announced joint venture transaction. The partnership will leverage Sanmina’s 40 years of advanced manufacturing experience and Reliance’s expertise and leadership in the Indian business ecosystem.

The day-to-day business will continue to be managed by Sanmina’s management team in Chennai, which will be seamless from an employee and customer perspective. All the manufacturing will take place at Sanmina’s 100-acre campus in Chennai, with the ability for site expansion to support future growth opportunities as well as to potentially expand to new manufacturing sites in India over time based on business needs.

Tata Consultancy Services (TCS): The IT company has announced a major applied engineering and research partnership with The National Robotarium, the UK’s largest and most advance AI and robotics research centre.

TCS Research will work closely with the new centre along with Heriot-Watt University on innovation, support early-stage AI, robotics product development, entrepreneurship, job creation and building digital skills in the workforce.

Larsen & Toubro (L&T): The company said its power transmission and distribution business bagged multiple orders in India and abroad. L&T termed the orders ‘significant’ as the order value is between Rs 1,000 crore and Rs 2,500 crore. L&T secured an order to establish a 765 kV transmission line in Gujarat. The company also bagged an order to upgrade the distribution system in a state in North East India.

L&T also won repeat orders to build new 132 kV substations in the UAE. Further, an order has been secured to establish a 380 kV overhead line in Saudi Arabia to strengthen evacuation infrastructure and improve the reliability of the grid in the western region. L&T also bagged orders to establish two new 132 kV and 33 kV substations in Dhaka and Narayanganj in Bangladesh.

Induslnd Bank: The lender said that its net advances rose 18% to Rs 2,59,647 crore at the end of September 2022, from Rs 2,20,808 crore in the year-ago period. Total deposits rose 15% year-on-year to Rs 3.15 lakh crore. CASA deposit ratio stood at 42.4% at the end of September 2022 as against Rs 42.1%.

Yes Bank: The lender’s gross retail disbursements in the second quarter of FY23 stood at Rs 12,182 crore, compared with Rs 8,478 crore a year ago. Advances rose 11.6% YoY to Rs 1.93 lakh crore at the end of Spetmeber 2022. Deposits rose 13.2% YoY to Rs 2 lakh crore.

Easy Trip Planners: In an exchange filing, the company said that a meeting of the board of directors of the company is scheduled to be held on Monday(October 10) at 10:00 a.m. through video conferencing for considering the proposal for increase in authorised share capital, issue of bonus shares and/or sub-division/split of shares.

Deepak Fertilisers & Petrochemicals: Shares of the company 4.9% in intraday trade on the NSE after Asian Development Bank signed $30 million loan with Smartchem Technologies, a unit of Deepak Fertilisers. The loan will be used to finance capital expenditure and R&D of specialty fertilisers among other projects.

Zydus Lifesciences: The company’s US subsidiary Zydus Pharmaceuticals (USA) has received tentative approval from the United States Food and Drug Administration (USFDA) to market Amantadine Extended-Release Capsules USP 68.5 mg and 137 mg. The drug will be manufactured at the group’s formulation manufacturing facility at Ahmedabad SEZ. The capsules had an annual sales of $2.7 mn in the United States, according to latest IQVIA data.

Info Edge: Shares of the company rose 4% after the company’s board approved an investment of Rs 135.4 crore via a mix of primary and secondary purchase of shares in Sunrise Mentors Private. Info Edge will acquire 22,836 compulsorily convertible preference shares of face value Rs 10 each and 27,089 equity shares of face value Rs 10 each.

Angel One: Shares of the company rallied 13.7% in intraday trade after the brokerage company said its client base jumped 77.4% to 11.57 million in September 2022 as against 6.52 millions in the year-ago period. Gross client acquisition stood at 0.39 million in September 2022 compared with 0.44 million in August 2022. Angel’s overall average daily turnover rose to Rs 13,73,800 crore in September 2022, up 10.9% MoM and a rise of 116.4% YoY.

Natco Pharma: The company has launched two Chlorantraniliprole (CTPR) pesticide formulated combination products under the brand names — Natvol and Natligo. The market size of the CTPR combination products is estimated to be around Rs 800 crore in India.

Edelweiss Financial Services: The company’s subsidiary, Edelweiss Alternative Asset Advisors, said that it has raised about Rs 3,400 crore in its third Special Situations Fund (ISAF III). The Fund has received CRISIL Fund Management Grading -1 indicating very strong standards in investment process & management practices.

Goa Carbon: The company has approved raising of funds through the issuance and allotment of equity shares having face value of Rs 10 each, aggregating to Rs 200 crore, on rights basis. The company will notify the record date subsequently, the company said in an exchange filing.

Mahanagar Gas: The natural gas distribution company has hiked retail prices of CNG by Rs 6 per kg and PNG by Rs 4 per scm in and around Mumbai from Monday midnight, accordint PTI news agency report. After the price hike, CNG costs Rs 86 per kg, while PNG costs Rs 52.5 per unit.