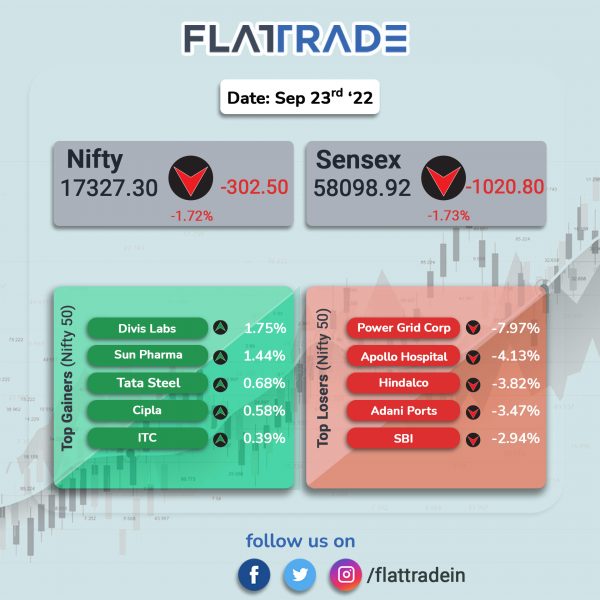

Benchmark stock indices fell as investors shunned risky assets due to weak global cues and hawkish stance by global central banks. The Sensex tanked 1.73% and the Nifty 50 index tumbled 1.72%.

Broader markets witnessed heavy selling. The Nifty Midcap 100 index plunged 2.35% and the BSE Smallcap slumped 1.92%.

Top losers among Nifty sectoral indices were PSU Bank [-3.97%], Media [-3.44%], Realty [-2.96%], Bank [-2.67%], Energy [-2.66%].

The rupee touched a lifetime low of 81.26 against the US dollar during the session on Friday. The rupee fell as the US dollar index strengthened as investors sought the safe-haven currency. However, the rupee recouped some losses to close 80.99, down 13 paise from Thursday’s closing, against the US dollar on Friday.

Stock in News Today

Vodafone Idea (VIL): The telecom operator is facing difficulties in finalising deals for 5G equipment as vendors are asking the company to clear previous dues first, according to a news report by Economic Time. The deals for 5G equipment supplies and tower tenancies have also hit a roadblock with vendors demanding advance payments, the report added.

Mahindra & Mahindra Financial Services: The company said that the Reserve Bank of India’s (RBI) action on the company barring it from outsourcing recovery agents will not materially impact their financials but it will temporarily bring down the repossession of vehicles by about 3,000 – 4,000. “The vehicles that are repossessed are mostly classified under Stage 3 and therefore, this temporary halt to repossession activity using the third-party agencies is not expected to have any material impact on the financials,” the company said in a statement.

Power Grid Corp: The state-owned company is planning to focus on setting up energy storage projects and is identifying investment opportunities in this area, according to Economic Times report. The company expects to benefit from the larger national ambition for renewable energy integration in the grid. “Power Grid is naturally poised for investing in this area because we have connectivity with the grid and land availability too. We also have asset management experience. So, we have entered into this segment,” Power Grid’s Director-Operations R K Tyagi said, speaking at ETEnergyworld Smart Electricity Conclave.

Meanwhile, global brokerage firm Jefferies said that Power Ministry is in talks with Power Grid to purchase PFC’s 52.63% stake worth Rs 14,400 crore in REC. The brokerage firm observed that the purchase of PFC’s stake in REC was a near-term dampener and could adversely impact FY23-25E EPS by 3-5%. Shares of the company tanked 7.97% on Friday.

Piramal Enterprises: The company announced that its board has approved fund raising up to Rs 750 crore via non-convertible debentures on private placement basis. The debentures are proposed to be listed on debt segment and capital market segment of NSE and BSE, respectively. The tenure for these debentures will be 32 months.

Tata Metaliks: The company’s board has taken note of resignation of Sandeep Kumar, Managing Director of the company with effect from 31 October 2022. Sandeep Kumar will take up a similar opportunity within the Tata Steel Group. The development comes after Tata Steel approved amalgamation of seven metal companies of Tata group including Tata Metaliks into Tata Steel

Glenmark Pharmaceuticals: The drug maker said that its subsidiary and Bausch Health have received the approval for RYALTRIS from the Canadian Public Health Agency. The nasal spray is used for the symptomatic treatment of moderate to severe seasonal allergic rhinitis (SAR) and associated ocular symptoms in adults, adolescents, and children aged 6 years and older.

IOL Chemicals and Pharmaceuticals: Shares of the company rose 6.81% after the company approved investing $2.1 million in USpharma Ltd. The investment is subject to compliance with regulatory rules. USpharma Ltd, is an USA based company that develop novel drug delivery technologies.

Sterling & Wilson Renewables: The company signed a Memorandum of Understanding (MoU) with the Nigerian government for the development, design, construction, and commissioning of solar PV power plants aggregating 961 MWp at five different locations in Nigeria along with battery energy storage systems with total installed capacity of 455 MWh. The US subsidiary of the company along with its consortium partner Sun Africa signed the MoU. These projects will be eventually owned and operated by Niger Delta Power Holding Company, a Nigerian Government owned entity.

Trident Group: The company has completed solar power project of 8.87 MWp at Budhni in Madhya Pradesh. The company has successfully completed the commissioning of 5.48 MWp solar power plant (phase I) for captive use and the remaining 3.39 MWp solar power plant (Phase II) is expected to be commissioned within next 15 days. The group aims to use renewable and clean energy for reducing carbon emission.

Aether Industries (AIL): The speciality chemical company said CRISIL Ratings has upgraded its ratings on the bank facilities of the company to ‘CRISIL A/Stable/CRISIL A1’ from ‘CRISIL A-/Stable/CRISIL A2+’. The rating agency upgraded the rating of the company as Aether infused Rs 757 crore via initial public offering, used proceeds to reduce outstanding debt and improved business risk profile.

TVS Motor Company: The two-wheeler manufacturer announced the launch of the new TVS Jupiter Classic. The new vehicle is a celebratory edition of the model as it clocked the fastest five million units on road milestone. TVS Jupiter Classic is priced at Rs 85,866 (ex-showroom).

Thomas Cook (India): The company and its group company, SOTC Travel, have introduced a range of attractive Bhutan holidays with attractive deals to accelerate travel demand for the destination. Customers can opt for the companies’ product portfolio of ready-to-book holidays including air-inclusive group tours or land only tours and personalised options.