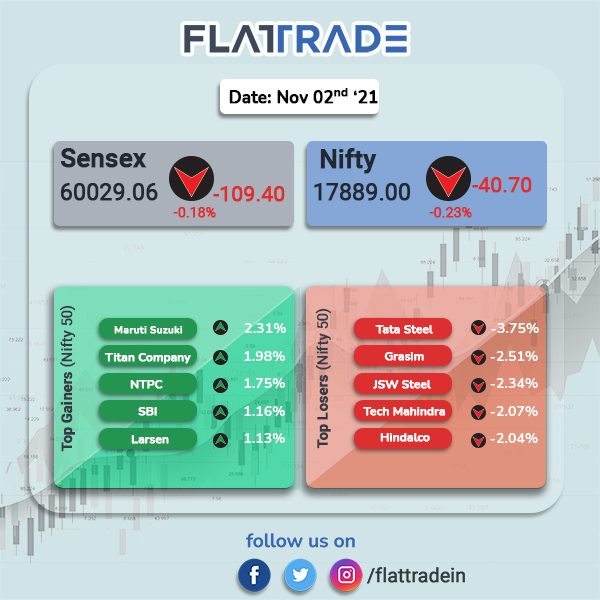

Benchmark Indian equity indices closed lower, weighed by metals, energy, pharma and IT stocks, in a volatile session. The Sensex closed down 0.18% to 60029.06 and Nifty closed 0.23% lower at 17888.95.

Top losers sector-wise were Nifty Metal (-1.58%), BSE Energy (-1.20%), Nifty Pharma (-0.40%), Nifty IT (-0.32%).

Indian rupee gained 19 paise to close at 74.68 against the US dollar on Tuesday.

Investor focus also shifted to the two-day FOMC meeting which begins later today, as analysts and investors expects the Fed to announce its plan for tapering.

Stock in News Today

Sun Pharma: The drugmaker reported a 12.92% rise in its consolidated net profit to Rs 2,047.01 crore in Q2FY22, from a net profit of Rs 1,812.79 crore in the year-ago period. Its consolidated operating revenue stood at Rs 9,625.93 crore in the reported quarter, as against Rs 8,553.13 crore in the same quarter last fiscal year.

HDFC Bank, BSE: Both the companies have signed an MoU to encourage and promote listing of start-ups and SMEs across India. They will evaluate banking and lending solution for start-ups undergoing listing process on start-ups and SME platform.

Godrej Properties: The realty firm posted a jump in its consolidated net profit to Rs 35.72 crore in Q2FY22, from a net profit of Rs 7.10 crore in the year-ago period. Total income rose to Rs 334.22 crore in the second quarter, from Rs 250.23 crore in the corresponding quarter last year.

Bank of India: The lender reported nearly 100% rise in its net profit at Rs 1,051 crore in Q2FY22, from a net profit of Rs 526 crore in the same quarter a year ago. Net interest income (NII) stood at Rs 3,523 crore for the quarter Q2FY22. Net NPAs fell to 2.79% in the reported quarter, from 2.89% year-ago period.

Procter & Gamble Hygiene and Health Care: The personal care products manufacturer reported a 14% decline in net profit to Rs 218.29 crore in July-Septmber quarter due to higher commodity prices. The company, which follows July-June fiscal, had posted a net profit of Rs 253.86 crore in the same quarter last year.

PI Industries Ltd: Shares of the company closed 7.23% lower after the company cancelled its proposal to buy Ind Swift Laboratories. The deal was called off due to ISLL not being able to complete several of the pre-agreed conditions precedents.

Bajaj Consumer Care: The company’s revenue was down 5% YoY to Rs 216.17 crore, from Rs 226.91 crore in the year-ago period. Net profit was down 18% to Rs 46.50 crore in the second quarter, from Rs 56.92 crore in the same period last year. Its Ebitda fell 23% to Rs 48.05 crore in the reported quarter, from Rs 62.41 crore in the same quarter of FY21.