Market Opening - An Overview

Nifty futures on Singapore Exchange were trading nearly flat, indicating a muted start for Dalal Street on Wednesday.

Asian stocks were trading lower as investors were cautious amid rising Covid-19 cases in China and the country’s response to contain its spread. Japan’s Nikkei 225 index fell 0.67% and the Topix declined 0.63%. China’s CSI 300 index slipped 0.09% and the Hang Seng index was down 0.28%.

Indian rupee fell 5 paise to 81.72 against the US dollar on Tuesday.

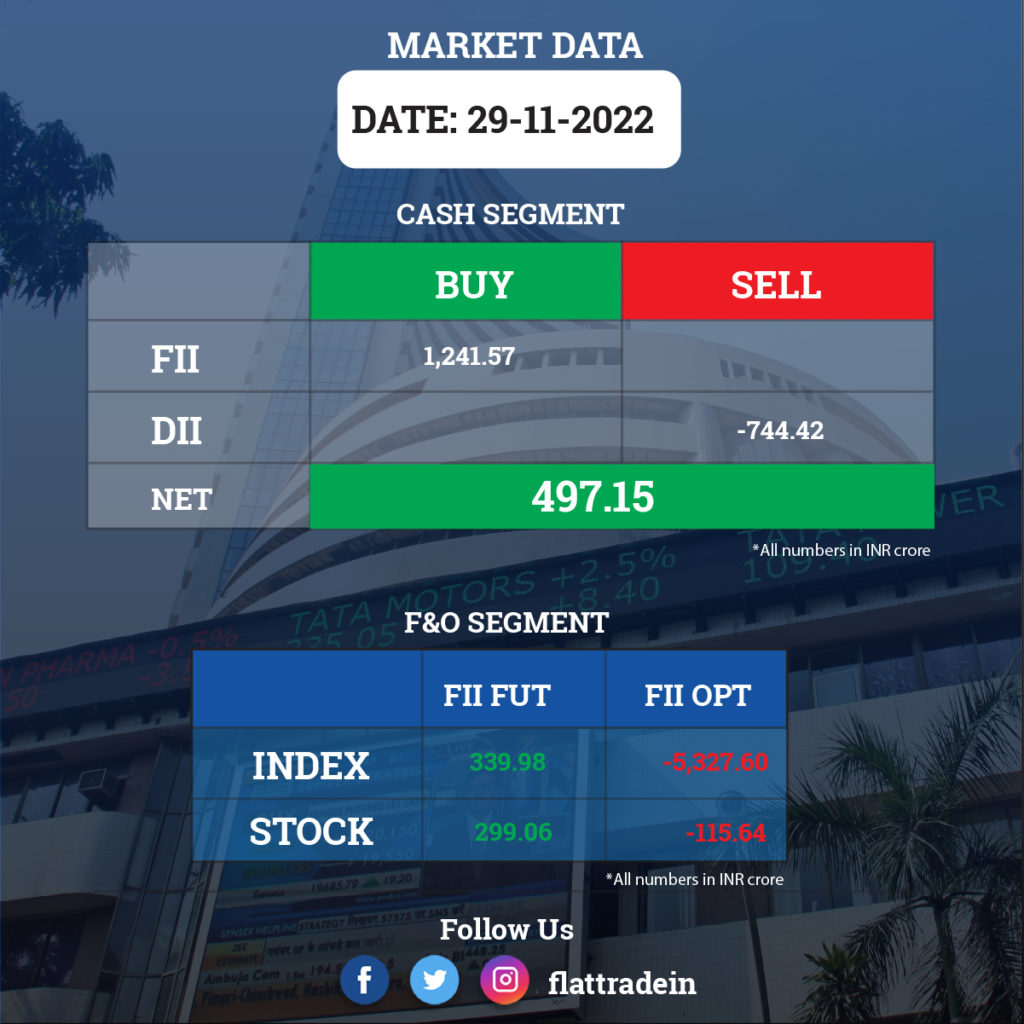

FII/DII Trading Data

Stocks in News Today

NDTV: The company’s founders Prannoy Roy and Radhika Roy have resigned as directors of promoter group RRPRH with immediate effect, the company said in a regulatory filing. NDTV had said on Monday an entity backed by the founders had issued shares of the company to a unit of Adani Group, taking Gautam Adani-led conglomerate a step closer to control of the media firm.

Zomato: Chinese e-commerce giant Alibaba Group Holding plans to offload a stake of about 3% worth $200 million in the company through a block deal, Reuters reported. Investment bank Morgan Stanley would be the broker of the deal, according to reports. Alibaba Group is likely to offer the shares at a 5-6% discount to Tuesday’s closing price.

ONGC and Reliance Industries (RIL): The Kirit Parikh panel on gas pricing is set to recommend the gradual lifting of the price ceiling on gas produced from difficult fields when it submits its report on Wednesday, Livemint reported. The price of gas from difficult fields, including deepwater, ultra-deepwater, and high pressure-high temperature areas such as Reliance Industries currently has a cap. The panel would recommend a floor price and a cap for the legacy or old fields operated by state-run ONGC and Oil India Ltd (OIL).

Gland Pharma: The company said it will buy French pharmaceutical firm Cenexi for 120 million euros (approximately Rs 1,015 crore) as it plans to expand in European markets. Singapore-based unit Gland Pharma International PTE has entered into a ‘Put Option Agreement’ to buy 100% of Cenexi Group for an equity value not exceeding EUR 120 million, the company said in a regulatory filing. Cenexi, along with its subsidiaries, is engaged primarily in the business of contract development and manufacturing organisation (CDMO) of pharmaceutical products with expertise in sterile liquid and lyophilized fill finished drugs.

Biocon: The company’s subsidiary, Biocon Biologics, announced that it has successfully completed its buyout of Viatris. The company, in a statement, said that both the firms have obtained all applicable approvals from key global regulators including the U.S. Federal Trade Commission, the Competition Commission of India, India’s central bank, and its investors. In February 2022, Biocon Biologics inked a pact to acquire Viatris Inc’s biosimilars business for consideration of up to $3.33 billion.

Aditya Birla Capital: Aditya Birla Sun Life AMC said it has received approval from IFSCA to act as a registered fund management entity and carry out Alternative Investment Fund (AIF) and Portfolio Management Services (PMS). The approval has been granted by the International Financial Services Centres Authority (IFSCA) and the firm can carry out services through a branch office in International Financial Services Centre (IFSC) in Gujarat’s GIFT City.

Cipla: The drug maker has launched Leuprolide Acetate Injection Depot 22.5 mg, which is used in the treatment of prostate cancer. The product was earlier approved by the US Food and Drug Administration based on a New Drug Application (NDA) regulatory pathway.

GR Infraprojects: National Capital Region Transport Corporation (NCRTC) has cancelled the construction of elevated viaduct project due to administrative reasons. The company had emerged as L-1 bidder for construction of the elevated viaduct in Delhi in April 2020.

IDFC: Market regulator, SEBI, has approved the change in control of IDFC Mutual Fund. In April 2022, the board of directors of IDFC and IDFC Financial Holding Company had approved the divestment of IDFC Asset Management Company and IDFC AMC Trustee Company to the consortium. The consortium comprised Bandhan Financial Holding, Lathe Investment Pte. Ltd. (affiliate of GIC), Tangerine Investments, and Infinity Partners (affiliates of ChrysCapital).

Usha Martin: Promoter Peterhouse Investment Ltd and PACs offloaded 2.5 lakh shares or 0.08% stake in Usha Martin via open market transactions. With this, its shareholding in the company reduced to 1.13%, down from 1.21% earlier.

Kilpest India: The company’s subsidiary, 3B BlackBio Biotech India, has signed a non-binding letter of intent to acquire 100% stake in a Europe-based life science products manufacturer. A period of 60 days has been agreed upon between the parties to complete due diligence.

Inox Green Energy Services: Inox Wind and its subsidiary Inox Green Energy Services, as part of their initiative to deleverage their respective balance sheets, have recently paid Rs 250 crore and Rs 161 crore towards reducing their debt. Consequently, the corporate guarantees given by Gujarat Fluorochemicals, have also got reduced to that extent. Both companies are in the process of further reducing their debt in the coming months.

Sanghi Industries: Kotak Special Situations Fund will invest Rs 550 crore in cement maker Sanghi Industries from its $1 billion fund. The investment would be made in the form of non-convertible debentures, according to a statement by Kotak. Kotak has invested Rs 500 crore in the NCDs of Sanghi Industries, and the remaining Rs 50 crore in the NCDs of a promoter-owned entity, according to the Kotak statement.

Bharat Bijlee: Life Insurance Corporation of India (LIC) has sold a 2.15% stake in Bharat Bijlee via open market transactions. With this, LIC’s shareholding in the company reduced to 4.54%, from 6.69% earlier. Bharat Bijlee provides turnkey solutions for EHV switchyards, HV and MV substations, Electrical Balance of Plant, Industrial Power Distribution and Illumination Systems.