Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.87% lower at 16,027, signalling that Dalal Street was headed for a negative start on Thursday.

Asian shares fell, tracking Wall Street numbers overnight, on renewed fears of surging inflation. Japan’s Nikkei fell 0.84%, Topix dropped 0.28%. China’s Hang Seng tanked 1.41% and CSI 300 was down 0.38%.

Consumer prices in the US jumped 8.3% in April from 12 months earlier, according to government data released on Wednesday. That was below the 8.5% YoY surge in March, which was the highest rate since 1981.

Indian rupee rose 10 paise to 77.24 against the US dollar on Wednesday.

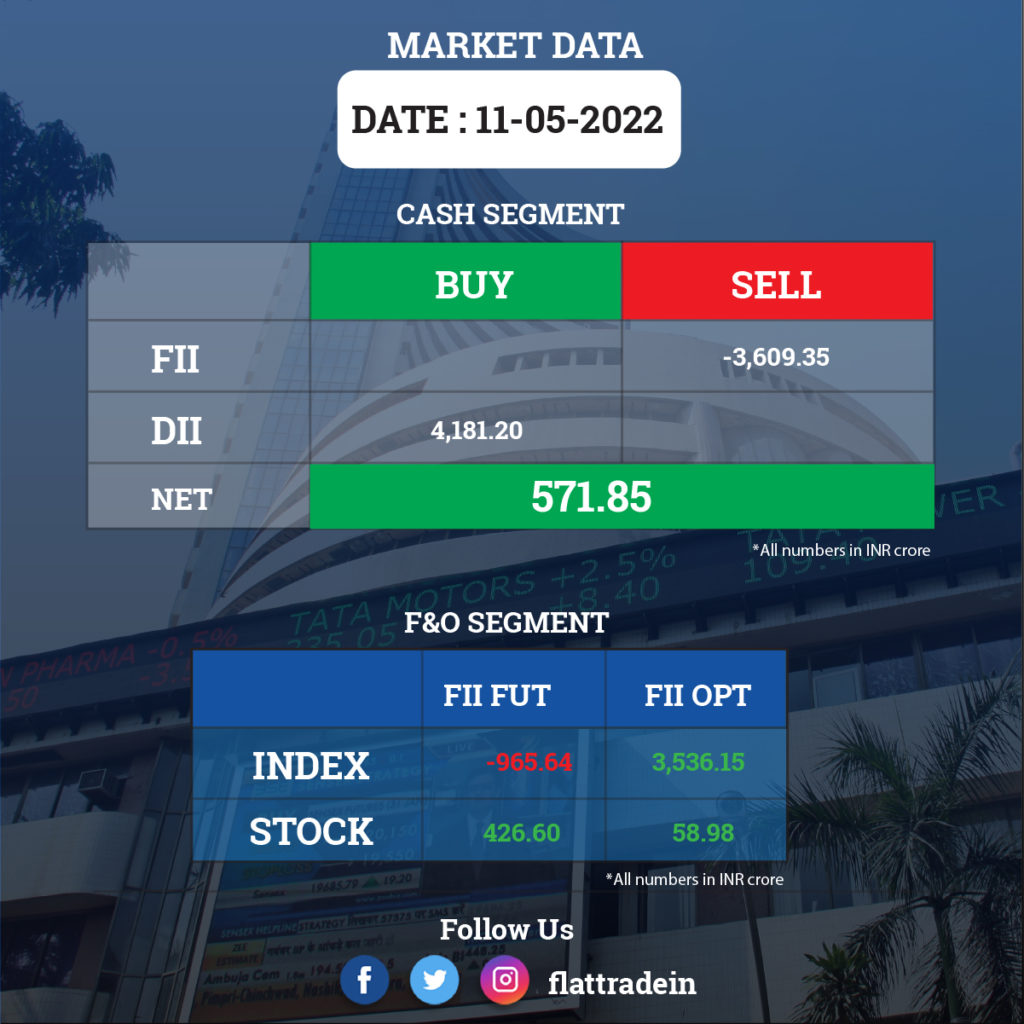

FII/DII Trading Data

Upcoming Results

Larsen & Toubro, Tata Motors, RBL Bank, Siemens, Aditya Birla Capital, Anupam Rasayan India, Apollo Tyres, Coforge, Greaves Cotton, Gujarat State Petronet, Honeywell Automation India, Poonawalla Fincorp, Ujjivan Small Finance Bank, Windlas Biotech, Avanti Feeds, Brigade Enterprises, CreditAccess Grameen, Genus Power Infrastructures, HP Adhesives, ICRA, Jammu & Kashmir Bank, JMC Projects, Lumax Auto Technologies, Matrimony.com, Mindspace Business Parks REIT, South Indian Bank and Spencers Retail will release their quarterly results.

Stocks in News Today

Tata Group: The conglomerate is drawing up plans to launch a battery company in India and abroad, its chairman N Chandrasekaran said, as Tata deepens its push to build electric vehicles, Reuters reported. The group is making a transition towards sustainability across businesses which includes a clean mobility push at Tata Motors and its British luxury unit Jaguar Land Rover, Chandrasekaran said at an industry event.

Tata Motors plans to launch 10 electric models by 2025, whereas Jaguar Land Rover’s luxury Jaguar brand will be entirely electric by 2025 and the carmaker will launch e-models of its entire lineup by 2030, he added.

Punjab National Bank (PNB): The lender’s standalone net profit dropped 66% year-on-year to Rs 201 crore in Q4FY22 as the bank set aside Rs 325 crore on account of fraud. Its profit in the same quarter last year was Rs 586 crore. Net interest income grew 5% YoY to Rs 7,304.1 crore against Rs 6,956.8 crore in the same period previous fiscal. Net NPA stood at 4.88% as against 5.73% in the year-ago period.

Relaxo Footwears: The company reported a decline of 38.4% in its net profit at Rs 62.93 crore for the fourth quarter ended March 2022. It had posted a net profit of Rs 102.17 crore in the year-ago period. Its revenue from operations was down 6.6% to Rs 698.19 crore during the period under review as against Rs 747.68 crore in the corresponding period of the previous fiscal. The compaby’s board recommended a final dividend of Rs 2.50 per equity share of face value of Rs 1 each for FY22.

Indian Bank: The lender’s net profit dropped 43% in the fourth quarter of FY22 to Rs 984 crore, compared to Rs 1,709 crore the same period last fiscal year. The bank’s total income was up 9% YoY to Rs 11,405 crore in the quarter under review. Net interest income (NII) grew 28% YoY to Rs 4,255 crore in Q4FY22 from Rs 3,334 crore in the year-ago period. Net NPAs stood at 2.27% in Q4FY22, as against 3.37% in Q4FY21.

Lakshmi Machine Works: The company recorded a healthy 218 percent year-on-year growth in consolidated profit at Rs 82.72 crore in quarter ended March 2022, driven by strong topline and operating income. Revenue increased by 46 percent to Rs 998.5 crore compared to same period last year.

Birla Corporation Ltd: The company reported a 55% drop in consolidated net profit at Rs 111 crore for the quarter ended March 2022, compared to Rs 249 crore in the same period last year. The decline in profitability was due to high fuel costs. Consolidated revenue from operations grew 6%% YoY to Rs 2,264 crore.

CoForge: The company reported 63.6% rise in net profit at Rs 224.80 crore for the fourth quarter ended March 2022 as against Rs 137.40 crore in the same period last year. Total income grew by 38.2 % YoY to Rs 1,766.10 crore from Rs 1,278 crore.

JSW Ispat Special Products: The company’s Q4 net profit plunged to Rs 10.92 crore for the quarter ended March 2022, compared with Rs 80.91 crore in the year-ago period. Total income was up 15% YoY at Rs 1,703.26 crore.

Reliance Capital: Lenders have agreed to extend the deadline to submit bids for the resolution of debt-ridden Reliance Capital by a month till June 30 after bidders’ cold response. So far only eight out of 54 Prospective Resolution Applicants (PRAs) have engaged with lenders, sources said.

Canara Bank: The PSU lender plans to invest about Rs 1,000 crore over the next three years for building a digital banking ecosystem including a super app.

Kalpataru Power Transmission: The company has won new orders worth Rs 2,126 crore. It pertains to orders from India and Africa in the T&D business of Rs 1,569 crore. Its international subsidiary T&D project wins in Europe and Brazil worth Rs 388 crore. It also won oil and gas pipeline projects in India and Middle East worth Rs 169 crore.

Macrotech Developers: The company announced partnership with Bain Capital and Ivanhoé Cambridge to develop a green digital infrastructure platform. The platform will jointly invest $1 billion to create 30 million sq. ft. of operating assets in India.