Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.42% higher at 17,942, signalling that Dalal Street was headed for a positive start on Monday.

Asian shares were trading higher amid reduced liqidity as many markets were closed for holidays. The Nikkei 225 index rose 0.44%, Topix inched up 0.07% and the CSI 300 index was up 0.42%.

Indian rupee depreciated by 10 paise to 82.86 against the US dollar on Friday.

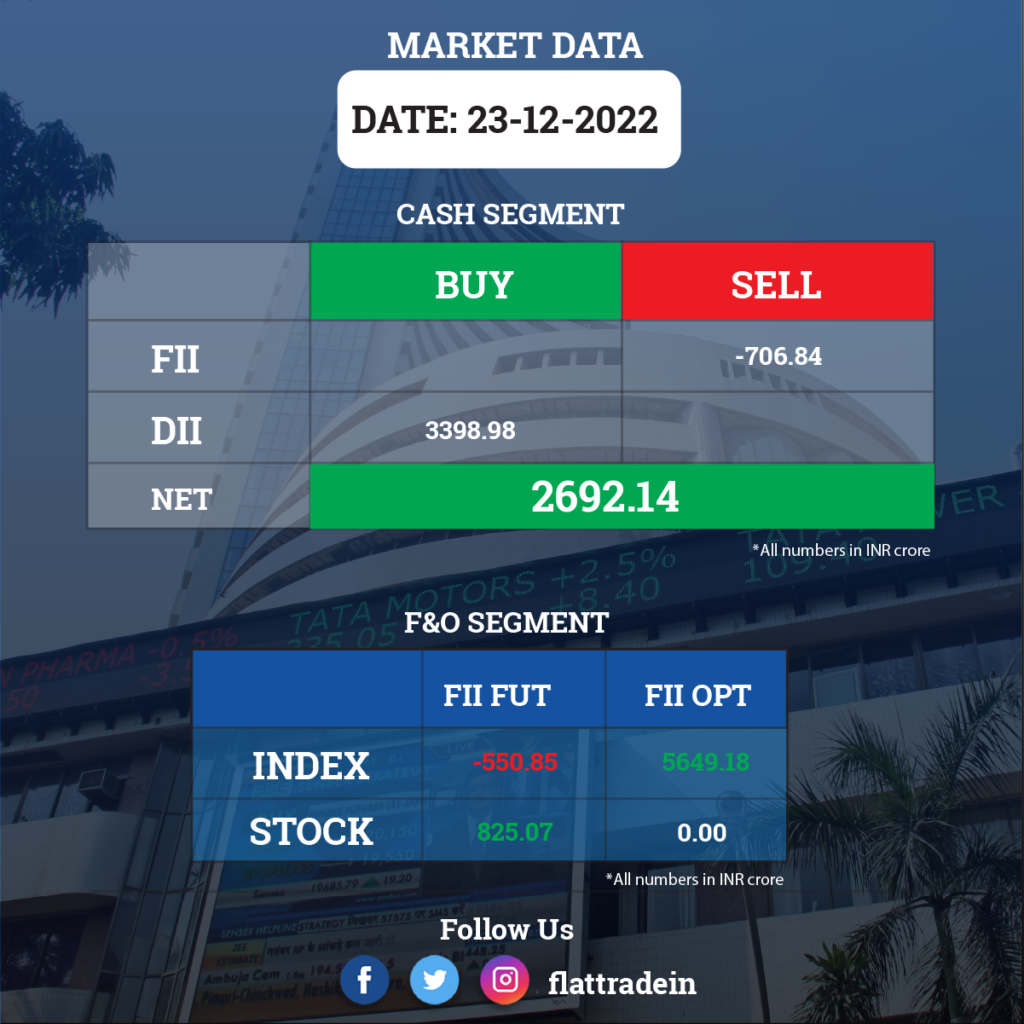

FII/DII Trading Data (23-Dec-22)

Stocks in News Today

Tata Motors: The company’s subsidiary, Tata Motors subsidiary TML CV Mobility Solutions, has signed a contract with the Delhi Transport Corporation (DTC) for the operation of 1,500 electric buses in New Delhi. TML will supply, operate, and maintain 1,500 12-metre, low-floor, air-conditioned electric buses for a period of 12 years.

New Delhi Television: Gautam Adani will control 64.71% stake in NDTV as founders Prannoy Roy and Radhika Roy have decided to transfer 27.26% stake in the company to Adani. Post this development, the founders will hold a 5% stake in NDTV.

Quess Corp: The company has said that the board has decided to withdraw its proposal for the amalgamation of Allsec Technologies with the company due to the changed market scenario. The board has appointed Kamal Pal Hoda as the Group CFO of the company with effect from January 10, 2023, in place of N Ravi Vishwanath.

Alkem Laboratories: Eight Roads Ventures India Healthcare IV LP, and F-Prime Capital Partners Life Sciences Fund VI LP will buy 8% stake in Alkem subsidiary Enzene Biosciences for Rs 161.48 crore. The transaction is expected to be completed by January 2023. The funds will be used for capacity expansion in India and the United States.

Punjab National Bank (PNB) and Union Bank of India: PNB has raised Rs 582 crore via allotment of Additional Tier-1 bonds to 10 investors, at a coupon rate of 8.4% per annum on a private placement basis.

Meanwhile, Union Bank of India has raised Rs 663 crore via allotment of Basel III compliant Additional Tier 1 bonds.

Wipro: The IT company has bought a minority stake in US-based Kibsi Inc for $1.5 million. The acquisition is to build a partnership in computer vision applications.

Gateway Distriparks: The company has completed its acquisition of 99.92% shareholding in Kashipur Infrastructure and Freight Terminal (KIFTPL) from its majority shareholders – Apollo Logisolutions, India Glycols, and Kashipur Holdings — for Rs 144.47 crore. India Glycols has transferred 42.31% shareholding in joint venture company to Gateway Distriparks, and has received Rs 61.17 crore. Its affiliate also transferred 6.61% stake in JV to Gateway. Additionally, India Glycols has signed an agreement to sell 7.544 acres land which forms part of the private freight terminal owned and operated by JV, for Rs 8.97 crore.

SJVN: The company has expanded its footprint in wind energy as it has won the full capacity of the 100 MW wind power project at Rs 2.90 per unit on a build-own-and-operate basis through an e-reverse auction.

Infibeam Avenues: The fintech firm has received a perpetual license from the Reserve Bank of India for its bill payments business, BillAvenue. With this, BillAvenue will operate as a Bharat Bill Payment Operating Unit (BBPOU) under the Bharat Bill Payment System (BBPS). As a BBPOU, BillAvenue will operate both as customer onboard billers and agent institutions to service customers.

DB Realty: The company’s wholly-owned subsidiary Neelkamal Realtors Tower has entered into a 50:50 joint venture with Godrej Properties NSE -4.43 % for development of land parcels measuring 19,434 sq meters in Mumbai.

Siemens: The company has received a letter of award from the railways ministry for a 9,000 horsepower electric locomotives project in Gujarat.

Equitas Small Finance Bank: The lender has extended the term of managing director and chief executive officer P N Vasudevan by three years.

Suven Pharmaceuticals: Advent International has signed a binding agreement with the promoter to acquire a significant stake in the company. The private equity firm will make an open offer to acquire an additional 26% stake in the drugmaker.

Veranda Learning Solutions: The company’s subsidiary Brain4ce Educations Solutions (under brand name Edureka) has signed an agreement with PURDUE University USA to collaborate and provide online certification for post graduate programs (PGP). Under this collaboration, Edureka has already enrolled over 850 students to date.

Deep Industries: The company has received Letter of Award from Oil and Natural Gas Corporation, for hiring of gas compression services at Balol GGS I for a period of three years. The total estimated value of the said contract is Rs 135.19 crore.

Dhani: The company has acquired Juventus Estate Limited and Mabon Properties Limited at an enterprise value of Rs 240 crore. The two companies collectively hold 35 acres of land parcels in Gurugram, Haryana. The acquisition will provide new business opportunities in the real estate sector.

Lasa Supergenerics: The company’s merger with merger of Harishree Aromatics Chemicals Pvt Ltd has been approved by the National Company Law Tribunal.