Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.98% lower at 17,162, signalling that Dalal Street was headed for a negative start on Monday.

Japanese shares were trading lower, tracking Wall street last week, as fears of faster inflation and global recession dampened investors’ optimism. Japan’s Nikkei 225 index tanked 1.98% and Topix tumbled 1.99%. Meanwhile, Chinese markets were trading higher with the Hang Seng rising 0.55% and CSI 300 index gaining 0.71%.

The rupee touched a lifetime low of 81.26 against the US dollar during the session on Friday. However, the rupee recouped some losses to close 80.99, down 13 paise from Thursday’s closing, against the US dollar on Friday.

Harsha Engineers International will make its debut on the bourses on September 26. The offer price has been fixed at Rs 330 per share.

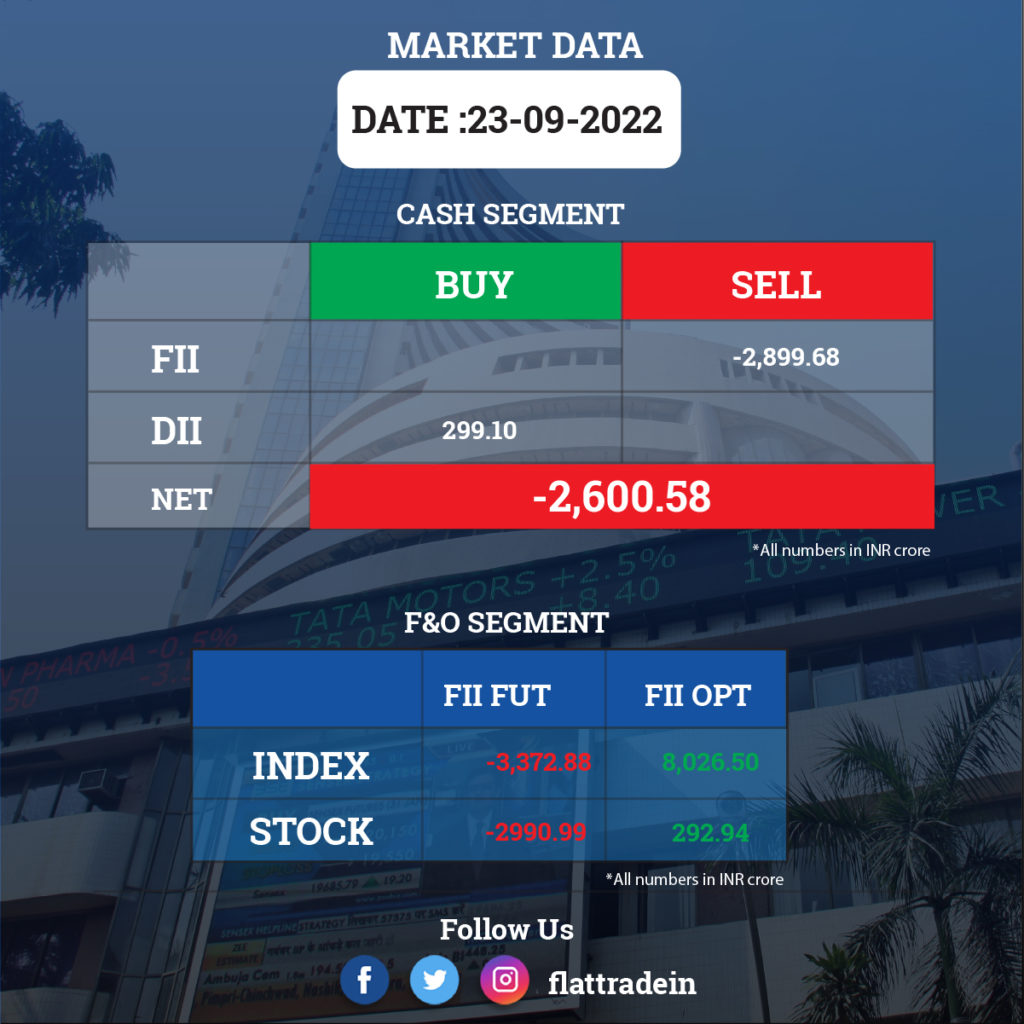

FII/DII Trading Data

Stocks in News Today

Bharat Petroleum Corporation Ltd (BPCL): The state-owned company said it has signed an agreement with Brazilian national oil company Petrobras for sourcing crude oil from the Latin American nation as part of plans to diversify its sourcing needs. The company’s chairman and managing director Arun Kumar Singh said the association with Petrobras will help in achieving the goal of energy security for the country. “Strengthening India’s foothold in Brazil will further open business avenues in neighbouring Latin American countries,” he said.

Coal India Ltd (CIL): The PSU will sign agreements with three public sector enterprises — Bharat Heavy Electricals Ltd (BHEL), Indian Oil Corporation Ltd (IOCL) and GAIL (India)– in order to set up four surface gasification projects. The government aims to achieve 100 million tonnes of coal gasification in the next eight years in order to reduce the import of crude oil. The proposed projects would reduce forex outgo and create around 23,000 jobs, it said.

Vedanta: The company proposes to reorganise capital and transfer Rs 12,587 crore from general reserves to retained earnings and it has won the backing of US-based proxy advisory firm Glass Lewis. In a notice to shareholders, Vedanta said that the firm had over the years built up significant reserves through transfer of profits and these excess funds can be utilised to create further shareholders’ value.

Oil India: The company is expecting a “healthy profit” for the quarter ending September 30 despite a levy of windfall tax on crude sales, Harish Madhav, head of finance at India’s state-run oil producer, said. The windfall tax has averaged around $25-$26 per barrel during the quarter, leading to Oil India realising $80 a barrel, Madhav added.

Britannia Industries: The company has appointed Rajneet Kohli as chief executive officer and executive director with effect from September 26. It has also elevated Varun Berry to executive vice chairman with immediate effect. Berry will continue the hold of managing director at the company, according to its stock exchange filing.

Embassy Office Parks REIT: US-based Blackstone will sell a stake worth up to $400 million in the real estate investment trust, via stock exchange block deals, REuters reported citing sources familiar with the matter. Abu Dhabi’s sovereign wealth fund is likely to pick up at least half of the stake that Blackstone will sell, one of the sources said. The block trade will be Blackstone’s third stake sale in Embassy, following two such sales aggregating to $500 million in 2020 and 2021.

Infibeam Avenues: The fintech & payment infrastructure company has consolidated its international business to aggressively tap and expand its global digital payment gateway infrastructure market. The company plans to increase its global play in the digital payments space by going aggressively with its flagship brand CCAvenue.

Unichem Laboratories: The company has completed its sale of 19.97% equity shares in Optimus Drugs to Sekhmet Pharmaventures. The company has received its payment towards completion of sale of first tranche.

Sterlite Technologies: Mihir Modi has tendered his resignation as Chief Financial Officer and key managerial personnel of the company. He will be relieved from his duties with effect from October 15.

Spandana Sphoorty Financial: The non-banking finance company has raised Rs 40.35 crore through its non-convertible debentures issue. The board members have approved an allotment of 402 non-convertible debentures of face value of Rs 10,03,924 each, on a private placement basis. The date of maturity for the said NCDs is April 1, 2024.

Laxmi Organic Industries: The company has resumed its operations at its Mahad plant in Maharashtra. It will continue to increase the capacity utilisation in next few weeks as the plant was shut down for 21 days to undertake maintenance activities.

PI Industries: The company’s promoter offloaded 10 lakh shares of the firm for Rs 315 crore through open market transactions. The shares were picked up by domestic mutual funds houses, foreign investors and an insurance company.

Suzlon Energy: The company said its board has approved raising Rs 1,200 crore via a rights issue of 240 crore shares. The Securities Issue Committee of the Board, at its meeting held on Sunday, approved the rights issue, the company said in a regulatory filing. The company will raise Rs 1,200 crore through issuance of 240 crore shares with face value of Rs 2 each at an issue price of Rs 5 per share.

GG Engineering: Uttam Kumar has resigned as Chief Financial Officer of the motor and generator manufacturing company, citing personal and unavoidable circumstances.