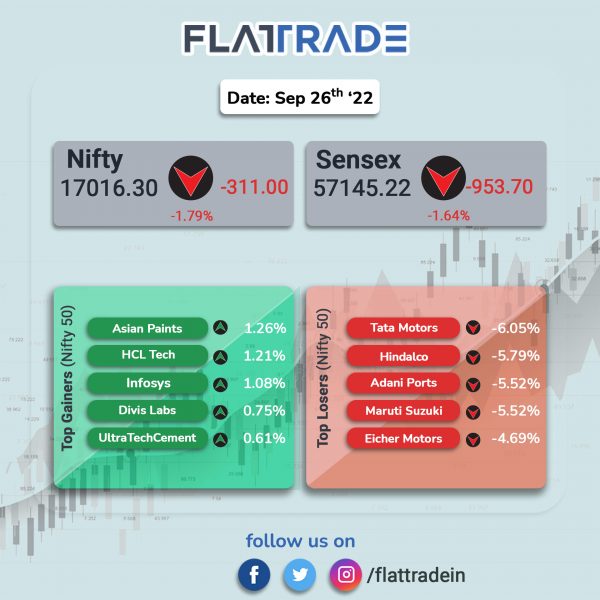

Benchmark stock indices fell as index heavyweights witnessed selling pressure due to weak global economic growth outlook. Stocks related to IT sector rose at the fag-end of the session as investors bought beaten down stocks. The Sensex closed 1.64% lower and the Nifty 50 index tanked 1.8%

Broader markets underperformed benchmark indices. The Nifty Midcap 100 index plunged 3.11% and the BSE Smallcap tumbled 3.33%.

Top losers among Nifty sectoral indices were Realty [-4.25%], Metal [-4.13%], Auto [-3.81%], PSU Bank [-3.69%] and Oil & Gas [-3.24%]. Top gainer was IT [0.57%].

Indian rupee depreciated 63 paise to 81.62 against the US dollar on Monday. It touched a lifetime low of Rs 81.65 against the US dollar today.

Stock in News Today

Tata Group: Shares of Tata Group companies fell after the Economic Times newspaper reported that Tata Sons plans to halve the number of listed companies to an estimated 15 from 29 in the coming months, citing sources close to the development. The report quoted the sources saying that it is speeding up its simplification to focus better on growth as well as scale of the company, and also it may lead to better cash inflow in larger companies.

Hindustan Aeronautics Limited (HAL): The company has set up a Rs 208 crore Integrated Cryogenic Engine Manufacturing Facility (ICMF) in Bengaluru that would cater to the entire rocket engine production under one roof for Indian Space Research Organisation. The state-of-the-art ICMF is set up over an area of 4,500 square metres housing over 70 hi-tech equipment and testing facilities for manufacturing cryogenic (CE20) and semi-cryogenic (SE2000) engines of Indian rockets. President Droupadi Murmu will inaugurate the facility on Tuesday.

PVR: Multiplex operator is planning to invest up to Rs 350 crore and open 100 new screens in FY23, PVR’s chief executive Gautam Dutta said. The company also expects the merger with Inox Leisure to close by end of February 2023.

Bharti Airtel: The company has launched Xsafe, an advanced home surveillance solution. Xsafe offers smart tracking, multi-person access to video feeds, smart alerts, perimeter zoning and seven-day cloud storage. Xsafe has three cameras, Sticky Cam, 360 degree and active defence priced at Rs 2,499, Rs 2,999 and Rs 4,499 respectively. Xsafe is available in 40 cities including metro cities. Customers can pay an annual subscription charge of Rs 999 with the first month’s subscription for free.

Axis Bank: Samsung India announced its first-ever credit card in India in partnership with Axis Bank and Visa, that will give customers 10% cashback across all Samsung products and services round the year. Axis Bank and Samsung India have partnered with key merchants — Bigbasket, Myntra, Tata 1mg, Urban Company and Zomato — to bring more rewards to cardholders on their daily spends. “The consumer electronics and technology space is open for disruption and we are the first, along with Samsung, to distrust this space,” Sanjeev Moghe, President and Head, Cards and Payments at Axis Bank.

Hester Biosciences: The company in an exchange filing said that it recognised early signs of a potential outbreak of lumpy skin disease and initiated manufacture of goat pox vaccine in anticipation of surge in demand. The company added that it will be able to meet the complete demand for the supply of goat pox vaccine in the country.

Harsha Engineers International: The company made a strong stock market debut, with its shares listing at Rs 450, a 36% premium over its issue price of Rs 330 on the NSE. The shares ended at Rs 486.5 per equity share.