Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.34% higher at 17,079, signalling that Dalal Street was headed for a positive start on Tuesday.

Most Asian stocks were trading higher as investors bargain-hunted for beaten down stocks following a steep fall in the previous session. Japan’s Nikkei 225 index was up 0.83%, while the broader Topix index rose 0.96%. China’s CSI 300 index inched up 0.03%, while Hang Seng fell 0.57%.

Indian rupee depreciated 63 paise to 81.62 against the US dollar on Monday. It touched a lifetime low of Rs 81.65 against the US dollar on Monday.

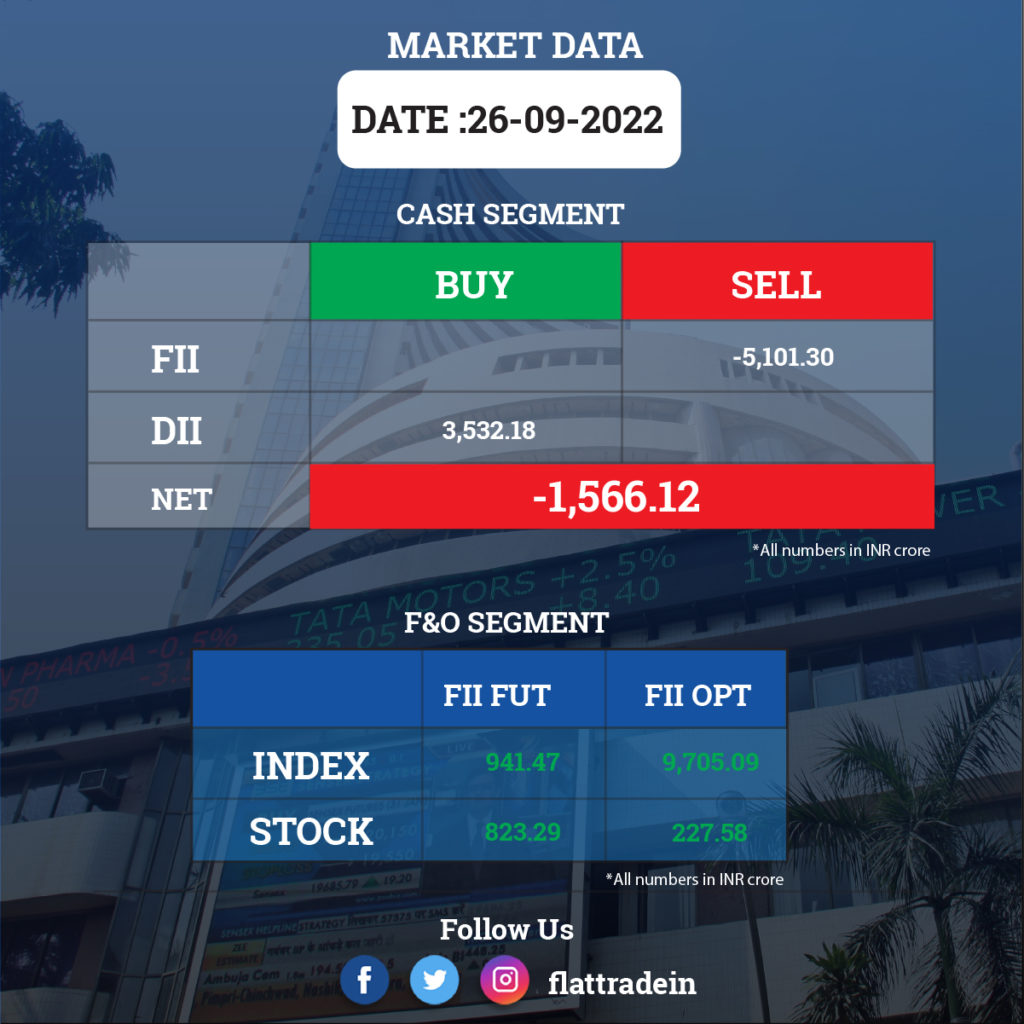

FII/DII Trading Data

Stocks in News Today

HCL Technologies: The IT services firm launched its new brand identity and logo, HCLTech, with a new brand statement ‘Supercharging Progress’. The company’s new ‘HCLTech’ brand and logo will be at the heart of its go-to-market strategy and represent its differentiated portfolio of services and products that supercharge digital transformation for enterprises at scale.

Mahindra Logistics: The company announced the acquisition of the B2B express business of Gurugram-based logistics firm Rivigo Services. The company expects the acquisition will help Mahindra to accelerate its capabilities in this space. Mahindra Logistics will acquire the express business through a business transfer agreement (BTA), including the customers, team and assets of Rivigo’s B2B express business and its technology platform.

Bharat Petroleum Corporation Ltd (BPCL): The state-owned company is likely to incur gross marketing losses in the current fiscal as it is unable to pass cost to consumers, Fitch Ratings said. The rating agency affirmed ‘BBB-‘ rating on BPCL with stable outlook. The rating agency believed that near-term prices will remain a function of the government’s efforts to balance OMCs’ financial health with inflationary and fiscal pressures.

Jubilant FoodWorks: The company had acquired 29.42% stake in Roadcast and the acquisition of the remaining 10.58% stake is likely to be completed by October 26, according to the agreement signed between the two companies.

Vodafone Idea: The telecom operator and state-owned Energy Efficiency Services Limited will install 33.3 lakh additional smart meters in Uttar Pradesh and Haryana, the two companies said in a statement. The Internet of Things (IoT)-enabled smart meters have resulted in substantial improvement in monthly meter readings, according to the statement.

Tata Motors: The company plans to invest about Rs 2,000 crore in its commercial vehicle business per annum going ahead in order to drive in new models based on various kinds of powertrains, according to company’s Executive Director Girish Wagh. The company strengthened its pickup line with the launches of Yodha 2.0, Intra V20 bi-fuel and Intra V50 models as it is looking to transition to electric mobility through vehicles powered by CNG and other alternative fuel options.

DLF: The realty major will develop a new luxury housing project in Gurugram with an estimated sales realisation of about Rs 1,800 crore, its Group Executive Director Aakash Ohri said. DLF has launched its project ‘The Grove’, which is located at DLF phase-5. Ohri said that the company has launched a new project which will be a low-rise luxury development comprising 292 residences and the total developable area in this project will be 8.5 lakh square feet.

Dish TV: The direct-to-home (DTH) company, which is part of the Essel Group, rejected four of the six resolutions at the company’s annual general meeting held on Monday. This development comes amid the ongoing dispute between Yes Bank, the largest shareholder in the company, and the promoters of Dish TV over the reconstitution of the firm’s board. The board strength is now down to two members, Dish TV said in a regulatory filing.

Hindustan Construction Company (HCC): The company has completed its debt resolution plan, duly supported by 23 banks. The resolution plan has carved out a significant portion of HCC’s debt along with commensurate assets from its balance sheet. Under the debt resolution plan, HCC has transferred Rs 2,854 crore of lenders’ liability along with beneficial economic interest in arbitration awards and claims of Rs 6,508 crore as consideration to a Special Purpose Vehicle (SPV). This SPV will have an external investor controlling at least 51% stake and HCC holding the remaining stake.

Amara Raja Batteries: The company said the board has given approval for demerger of plastic component for battery business with the name of Mangal Industries. The turnover of the said business as of March 2022 was Rs 569.4 crore.

BSE: The stock exchange has received the market regulator SEBI’s approval to launch an electronic gold receipt segment on its platform.

Orient Bell: The company announced completion of expansion at its Hoskote plant in Bengaluru district. This expansion involved capex of around Rs 34 crore well ahead of schedule. With this the total capacity of the company has increased from 32 MSM per annum to 33.8 MSM per annum including 10 MSM per annum of the associated entities.

Filatex India: The company has commissioned its project for debottlenecking melt capacity of 50 MT per day and manufacturing lines of 120 MT per day at Dahej Plant.

Jyoti Structures: The company has bagged a contract from Sterlite Power Transmission for turnkey supply and construction of 400 KV & 220 kV double circuit transmission line in Goa & Karnataka. The contract is valued at Rs 237 crore and it will be commissioned in phased manner by December 2023 and July 2024.

Shakti Pumps: The company has received an advance worth $6 million from EXIM Bank on behalf of the Government of Uganda to supply solar‐powered water pumping system.

Filatex India: The company has commissioned its project for debottlenecking a melt capacity of 50 MT per day and manufacturing lines of 120 MT per day at Dahej Plant.