Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.07% higher at 17,002, signalling that Dalal Street was headed for muted start on Wednesday.

Most Asian shares rose on Wednesday as Chinese technology stocks gained after news reports said that Alibaba plans to split into six units. The Nikkei 225 index rose 0.37% and Topix gained 0.48%. The Hang Seng index jumped 2.01% and the CSI 300 index inched up 0.05%.

Indian rupee gained 18 paise to 82.19 against the US dollar on Tuesday.

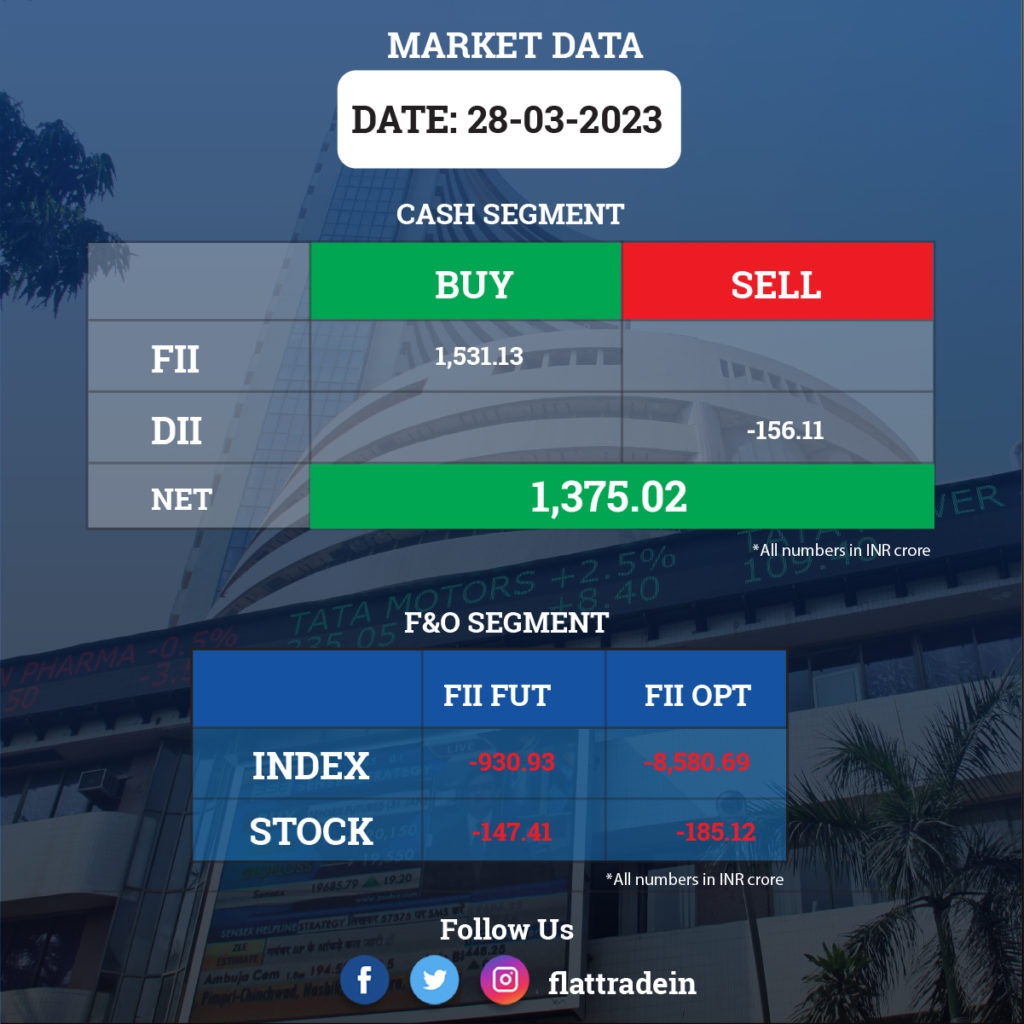

FII/DII Trading Data

Stocks in News Today

Vedanta: The mining major said the board of directors has approved the fifth interim dividend of Rs 20.50 per equity share on face value of Re 1 per share for FY23, which amounted to Rs 7,621 crore. Meanwhile, Ajay Goel has resigned from the post of acting Chief Financial Officer of the company effective from April 9, to pursue career outside of the Group.

Larsen & Toubro (L&T): The infrastructure major issued 2 lakh non-convertible debentures (NCDs) to raise Rs 2,000 crore. The NCDs will mature on April 28, 2028. The said NCDs are proposed to be listed on the National Stock Exchange of India. The interest rate is set at 7.725% and the interest will be paid on an annual basis.

Jindal Stainless: The stainless steel manufacturing company has signed an agreement with New Yaking Pte Ltd for the investment in development, construction and operation of a nickel pig iron (NPI) smelter facility in Halmahera Islands, Indonesia. JSL will acquire a 49% equity interest in nickel pig iron company for $157 million.

Reliance Jio: The company recently launched a new broadband backup plan that includes unlimited data and voice. The new JioFiber backup connection will be available starting March 30, 2023. The plan includes a recharge of Rs 1,490 which will give users five month-service (Rs 990) and installation charges (Rs 500) and an entertainment upgrade at Rs 100/200 per month for five months which will give them access to up to 550 live TV channels, 14 OTT apps and YouTube.

G R Infraprojects: The company has received letter of acceptance from East Coast Railway for a project worth Rs 587.59 crore for construction of tunnel work between Adenigarh-Purunakatak and allied works of Khurda-Bolangir new rail line project.

Adani Transmission and REC: REC’s wholly owned subsidiary — REC Power Development & Consultancy — has transferred the entire shareholding of Khavda II·A Transmission to the successful bidder, Adani Transmission.

NBCC (India): The company has received two work orders totalling 146.39 crore, from SIDBI and Ghani Khan Choudhary Institute of Engineering and Technology in West Bengal.

Zydus Lifesciences: The pharma company has received final approval for Loperamide hydrochloride capsules (USP 2 mg) from the United States Food and Drug Administration (USFDA). Loperamide hydrochloride capsule is indicated for the control and symptomatic relief of acute nonspecific diarrhea and chronic diarrhea associated with inflammatory bowel disease.

RPP Infra Projects: The company has received a letter of acceptance for a project – repair & construction works of old buildings for reopening of old district jail at Bareilly Uttar Pradesh on EPC basis. The project worth Rs 148.08 crore is expected to be completed by October 31, 2024.

SML Isuzu: The company announced that it will increase the prices of trucks & buses by up to 4% and 6%, respectively, with effect from April 1.

JSW Energy: The company’s wholly-owned subsidiary, JSW Neo Energy, will acquire additional 12 special purpose vehicles of Mytrah Energy (India) for Rs 1.82 crore.

Aster DM Healthcare: The company has acquired additional 1.87% stake in subsidiary Malabar Institute of Medical Sciences for a cash consideration of Rs 18.65 crore, taking its overall shareholding to 76.01%.

Inox Wind Energy: The company’s board has approved the transfer of the company’s wind energy business to its holding company Inox Leasing and Finance in a slump sale for Rs 17 crore.

NHPC: The company’s board has approved raising funds worth Rs 5,600 crore during the fiscal 2024 via corporate bonds and/or term loans or external commercial borrowings.

DB Corp: The company has appointed Lalit Jain as chief financial officer, with effect from April 1, 2023. Jain will replace Pradyumna Mishra, who is retiring from close of business hours on March 31, 2023.

Apollo Tyres: The company’s board has approved the incorporation of a wholly-owned subsidiary company, to create an online D2C (Direct to Customer) platform. The online platform will cater to passenger vehicle aftermarket services on site for convenience of customers.

PNB Housing Finance: The company’s board has approved Rights Issue worth Rs 2,494 crore. The company plans to issue 90.68 million fully paid-up equity shares each for Rs 275. The company has set Wednesday, April 05, 2023 as the record date for determining the eligibility of shareholders for participation in the rights issue. Subscription for the Rights Issue will be open from April 13 – April 27, 2023.

IFCI: The company plans preferential issue of equity share capital for FY23 aggregating up to Rs 400 to the promoters i.e., Government. of India.

Tube lnvestments of lndia: The company’s subsidiary TI Clean Mobility has received an investment of Rs 266.67 crore from Multiples Private Equity Fund lll and Rs 133.33 crore from State Bank of lndia.

South Indian Bank (SIB): The Kerala-based lender will constitute a search committee to identify candidates for the position of MD and CEO after Murali Ramakrishnan requested not to be re-elected for the position.