Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.11 per cent higher at 17,741, signalling that Dalal Street was headed for a positive start on Thursday.

Most Asian shares rose, tracking Wall Street overnight, after a softer-than-expected US inflation report boosted investor sentiments. China’s Hang Seng jumped 1.32% and CSI 300 index rose 0.46%. Japan’s Nikkei 225 index fell 0.65% and Topix fell 0.17%.

The Indian rupee rose 14 paise to 79.52 against the US dollar on Wednesday.

The US Consumer Price Index (CPI) was flat in july after advancing 1.3% in June, the Labor Department said. In the 12 months through July, the CPI increased by a weaker-than-expected 8.5% following a 9.1% rise in June.

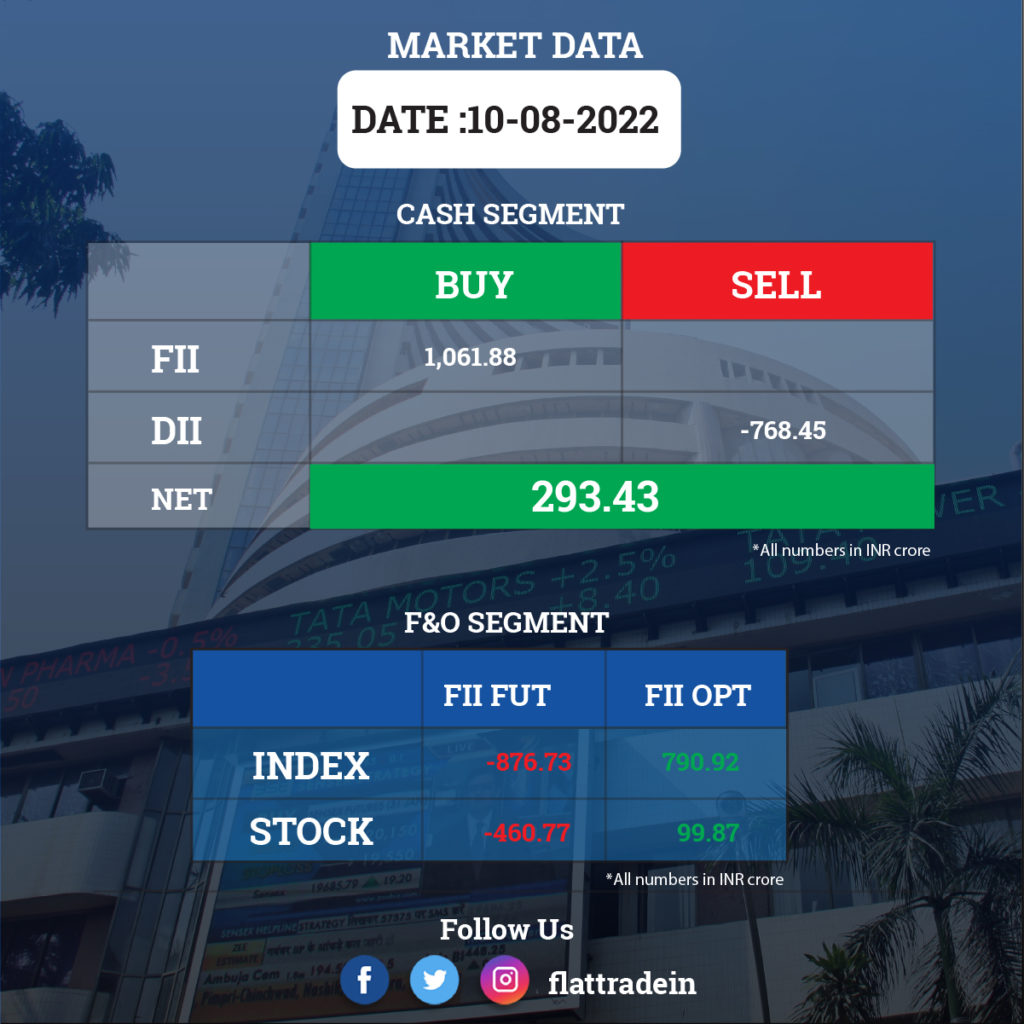

FII/DII Trading Data

Upcoming Results

Apollo Hospitals Enterprise, Page Industries, Aurobindo Pharma, Bata India, Bharat Forge, Greaves Cotton, Aster DM Healthcare, Gujarat Ambuja Exports, Garden Reach Shipbuilders & Engineers, Himadri Speciality Chemical, KNR Constructions, The Phoenix Mills, Puravankara, Quess Corp, Sapphire Foods India, Shilpa Medicare, Spencers Retail, Sunteck Realty, Trent, Vipul Organics, and Wonderla Holidays will report their quarterly earning on August 11.

Stocks in News Today

Coal India: The state-owned company registered a 178 percent year-on-year growth in consolidated profit at Rs 8,834.22 crore for the quarter ended June FY23. Revenue increased 39 percent to Rs 35,092 crore compared to the same period last year. The coal mining company produced 159.75 million tonnes of raw coal, up 29 percent YoY and its offtake of raw coal increased by 10.6 percent YoY to Rs 177.49 million tonnes for the quarter ended June FY23.

Tata Consumer Products: The company recorded a 38% year-on-year growth in profit at Rs 277 crore in Q1FY23, with revenue from operations rising 10.58 percent YoY to Rs 3,327 crore. Its EBITDA in the reported quarter increased 14 percent to Rs 460 crore compared to the year-ago period.

Eicher Motors: The company reported over twofold increase in consolidated net profit to Rs 611 crore for the first quarter ended June 30, driven by robust sales in the international markets. The company had posted a net profit of Rs 237 crore in the June quarter of the last fiscal. Revenue from operations rose to Rs 3,397 crore in the April-June period as compared with Rs 1,974 crore in the year-ago period, Eicher Motors said in a regulatory filing.

SAIL: The state-owned posted a 79 per cent fall in its consolidated net profit to Rs 804.50 crore during the June quarter, weighed down by higher expenses. It had posted a consolidated net profit of Rs 3,897.36 crore in the April-June period of 2021-22 fiscal. The company’s total income rose to Rs 24,199.51 crore from Rs 20,754.75 crore in the year-ago quarter. Its expenses grew to Rs 23,295.23 crore as against Rs 15,604.07 crore a year ago.

Vedanta Ltd: The company’s chairman, Anil Agarwal, said that the company was targeting $100 billion in revenue by 2030 as it continued to diversify its operations across the natural resources spectrum. Speaking to shareholders at the company’s 57th annual general meeting, Agarwal said that Vedanta had planned a capital expenditure of around $3 billion over the next two years for growth and vertical integration. Of this, $2 billion would be earmarked for the ongoing financial year.

PB Fintech (Policybazaar): The company recorded a consolidated loss of Rs 204.33 crore for the quarter ended June FY23, widening from a loss of Rs 110.84 crore in the corresponding period last fiscal. The company has reported a significant increase in employee expenses, and advertising and promotion expenses for the quarter. Revenue from operations stood at Rs 505.2 crore, up 112.5 percent over Rs 238 crore reported in the year-ago period.

Oil India: The state-owned company reported a 166 percent year-on-year growth in consolidated profit at Rs 3,230 crore in the quarter ended June FY23. Revenue grew by 86.5 percent to Rs 11,567 crore in Q1FY23, compared to Rs 6,202 crore in the same period last year.

Pidilite Industries: The company reported 64.27 per cent rise in consolidated net profit at Rs 357.52 crore in Q1FY23, aided by growth in sales and volume. The company which manufactures adhesives, sealants and construction chemicals had logged a profit of Rs 217.64 crore in the same period a year ago. Revenue from operations was up 60.11 per cent at Rs 3,101.11 crore during the quarter under review as against Rs 1,936.79 crore in the year-ago period.

Indian Railway Catering and Tourism Corporation (IRCTC): The company reported 196% surge in net profit at Rs 246 crore for the quarter ending June 2022. It had reported a net profit of Rs 82.5 crore in the year-ago period. The company’s revenue from operations surged 251% to Rs 853 crore in Q1FY23 from Rs 243 crore in Q1FY22.

NHPC: The state-owned the power company posted over 7 per cent increase in its consolidated net profit to Rs 1,053.76 crore in the June quarter as against a consolidated net profit of Rs 982.86 crore in the quarter ended on June 2021. Total income of the company rose to Rs 2,990.86 crore in the quarter from Rs 2,586.91 crore in the same period a year ago.

Zomato: The online food delivery platform is targetting to achieve the breakeven level in overall business between the fourth quarter of this fiscal and the second quarter of FY24 having cut losses gradually, according to company CFO Akshant Goyal. Zomato has now reduced its investment guidance to about $320 million for the next couple of years on quick commerce, from an earlier investment guidance of $400 million.

Bank of Baroda: The public sector lender said that it would raise the marginal cost of fund-based lending rates (MCLR) by 5-20 basis points (bps) across tenors, with effect from August 12. According to the new notification to the stock exchange, the overnight MCLR now stands at 6.85 per cent, up 5 bps; one-month MCLR has been increased by 20 bps to 7.40 per cent; three-month MCLR has been hiked by 10 bps to 7.45 per cent; six-month MCLR is up 10 bps to 7.55 per cent; and one-year MCLR is up 5 bps to 7.70 per cent.

Mahindra & Mahindra (M&M): Life Insurance Corporation of India sold 2 percent stake or 2.49 crore equity shares in the automobile company via open market transactions. With this, LIC’s stake in the company declined to 6.42 percent, down from 8.43 percent earlier.

Glenmark Pharmaceuticals: The company posted a 31 per cent decline in net profit for the first quarter of the financial year to Rs 211.1 crore. Its consolidated revenues dipped from Rs 2,965 crore in the previous corresponding quarter to Rs 2,777.3 crore in Q1FY23.

Zensar Technologies: Investment firm Plutus Wealth Management on Wednesday bought shares of the IT company for Rs 167 crore through an open market transaction. According to the bulk deal data available with BSE, Plutus Wealth Management purchased 75 lakh shares of the company at an average price of Rs 223 apiece.

Jammu & Kashmir Bank: The on Wednesday reported a 59 per cent jump in net profit at Rs 165.9 crore in the first quarter of FY23 on the back of higher income. It had reported a net profit of Rs 104.3 crore in the year-ago period. In the April-June quarter of FY23, total income increased to Rs 2,306.26 crore from Rs 2173.92 crore in the same period a year ago. During the quarter, the bank’s Net Interest Income (NII) rose 6.7 per cent on an annual basis to Rs 1,034.23 crore. The Net Interest Margin (NIM) was 3.46 per cent as against 3.41 per cent recorded at the end of March 2022 quarter.

Indiabulls Housing Finance: The company has reported 1.8 per cent year-on-year rise in its net profit to Rs 287 crore in first quarter of the current financial year. It had reported a net profit of Rs 282 crore in the same period last year. The housing finance company has disbursed Rs 2,260 crore of retail loans under the asset-light model in the quarter under review. Gross NPA stood at 2.96 per cent at the end of June 2022 quarter.

CESC: The company reported a 6 percent year-on-year growth in consolidated profit at Rs 297 crore in Q1FY23. Revenue increased by 27.5 percent YoY to Rs 4,102 crore in Q1FY23.