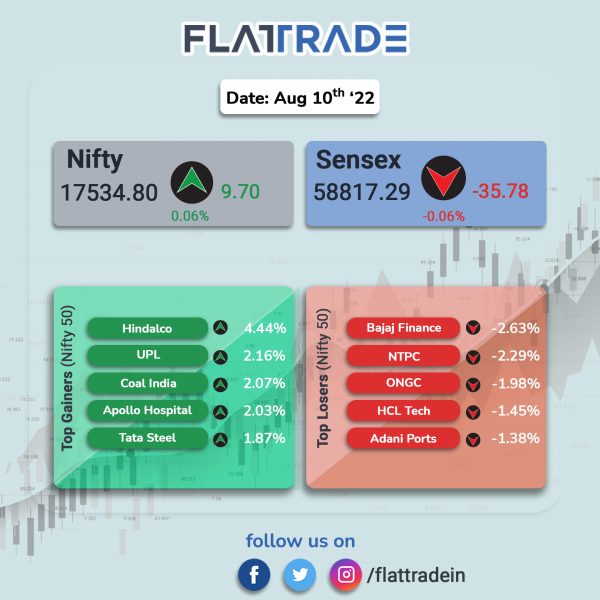

Benchmark equity indices struggled for direction and ended nearly flat as investors were on the sidelines ahead of the US inflation data. The Sensex fell 0.06% and the Nifty inched up 0.06% .

The Nifty Midcap 100 fell 0.16% and BSE Smallcap dropped 0.10% .

Top Nifty sectoral gainers were Metal [1.62% ], Pvt Bank [0.66 ], Auto [0.18% ] and Bank [0.13% ]. Top losers were IT [-0.89%], Realty [-0.87%], PSU Bank [-0.46%] and FMCG [-0.37%].

The Indian rupee rose 14 paise to 79.52 against the US dollar on Wednesday.

Stock in News Today

Hindalco Industries: The company’s quarterly profit jumped by 48% YoY, on the back of strong US sales and higher revenue that offset the impact of higher raw materials. Hindalco reported a 47.7% rise in consolidated profit after tax (PAT) at Rs 4,119 crore for the quarter ended June 2022. It had posted a consolidated PAT of Rs 2,787 crore in the year-ago period. Sales climbed 40% on-year to Rs 58,020 crore.

JSW Energy: The company said that its arm JSW Neo Energy will buy a portfolio of 1.75 gigawatt (GW) renewable energy assets from Mytrah Energy for Rs 10,530 crore. With this acquisition, JSW Energy’s current operational generation capacity will increase by over 35% to 6.53 GW from 4.78 GW. The transaction is subject to approval by the Competition Commission of India (CCI), the company said.

One97 Communications Ltd (Paytm): The company has tied up with Piramal Capital and Housing Finance to expand distribution of merchant loans to small cities. The partnership will expand Paytm’s loan distribution business, supported by Piramal Finance’s wide network of over 300 branches across India. Piramal Finance plans to leverage and bring ease of credit to small business owners through data-driven underwriting along with credit sanctions based on business income.

Larsen and Toubro (L&T): The infrastructure company has secured a significant order from Nuclear Power Corporation of India to build natural draught cooling towers and a cooling water pump house for the Rawatbhata atomic power project 7 and 8. The project is expected to be completed in 36 months. According to the company, ‘significant’ contracts as those contracts which are valued between Rs 1,000 crore and Rs 2,500 crore.

Zydus Lifesciences: The company said its consolidated revenue was up 2% at Rs 4,072.7 crore in Q1FY23 from Rs 4,002 crore in the year-ago period. Its consolidated net profit fell 12% to Rs 518 crore in Q1FY23 as against Rs 587 crore in the year-ago period. The company’s EBITDA dropped 14% to Rs 833 crore in the reported quarter from Rs 972 crore in the same period last year.

Pfizer Ltd: The drugmaker said the pharma company’s managing director S Sridhar tendered his resignation. Sridhar has expressed his intention to take an early retirement and He will continue to serve in his current position for as long a period as required until the identification, selection and transition to the new leadership takes place, the company said.

Max Healthcare: The company’s revenue was up 7% to Rs 1,066 crore in Q1FY23 from Rs 1,000 crore in the year-ago period. Its net profit rose 18% to Rs 173 crore in the quarter under review from Rs 147 crore in the same period last year. The company’s EBITDA was up 8% to Rs 264 crore in Q1FY23 from Rs 244 crore in the year-ago period.

IPCA Labs: The company’s consolidated revenue inched up 1% YoY to Rs 1,585.74 crore in Q1FY23 as against Rs 1,565.79 crore in Q1FY22. Its consolidated net profit more than halved to Rs 143 crore in Q1FY23 from Rs 307 crore in Q1FY22.

EKI Energy Services: Shares of the company tanked 17.5% , after Renewable Energy Minister RK Singh said there will be no exports of carbon credits until India’s commitment of reduction of 45% emission intensity of GDP is met.

Fine Organic Industries: The company’s revenue was up 110% YoY to Rs 747.7 crore in Q1FY23. It profit soared 344% to Rs 159.7 crore in the quarter under review.

Vedant Fashions: The company registered a 123% YoY growth in profit at Rs 100.87 crore for the quarter ended June FY23 on a low base. The Q1FY22 earnings were affected by second Covid wave. Revenue grew by 103% to Rs 325 crore compared to corresponding period last fiscal.

Dilip Buildcon: The construction company through its joint venture Dilip Buildcon-Skyway Infraprojects has received letter of acceptance (LOA) for new project ‘Gandhisagar-2 multi-village water supply scheme’ in Madhya Pradesh. The order is worth Rs 1,400.04 crore.

JK Tyre & Industries: The tyre manufacturer reported a 20.4% year-on-year decline in consolidated profit at Rs 35.13 crore for the June FY23 quarter dented by higher input cost and exceptional loss. Revenue from operations grew by 40% to Rs 3,643 crore compared to year-ago period.

Gujarat Narmada Valley Fertilizers & Chemicals: The company clocked a 136% year-on-year growth in consolidated profit at Rs 571.43 crore for the quarter ended June FY23 despite higher input cost, aided by strong top line and operating performance. Revenue grew by 93% to Rs 2,696 crore compared to corresponding period last fiscal and operating EBITDA increased by 94% to Rs 762 crore.

Samvardhana Motherson International: The company reported a 51% year-on-year decline in consolidated profit at Rs 181.55 crore during the quarter ended June FY23. Revenue grew by 9% to Rs 17,614.4 crore, compared to corresponding period last fiscal. The company said the board has approved fund raising of Rs 1,000 crore by issuing non-convertible debentures, on a private placement basis, in one or more series or tranches.

Whirlpool India: The company registered a 232% year-on-year increase in consolidated profit at Rs 84.6 crore for the June FY23 quarter. Revenue grew by 55% to Rs 2,081 crore compared to same period last year.

Torrent Power: The company recorded a 142% year-on-year increase in consolidated profit at Rs 502 crore in the quarter ended June FY23, led by healthy revenue. Revenue grew by 110% to Rs 6,510 crore compared to corresponding quarter of previous fiscal. Profitability was supported by increase in contribution from renewable generation, gain from trading of LNG, improved performance of licensed distribution businesses, and increase in contribution from franchised distribution business.

Varun Beverages: The company has agreed to invest 19.20% of equity share capital of Utryan Energy Puri Private Limited, a special purpose vehicle engaged to supply solar power to consumers in Uttar Pradesh. The completion of the transaction is expected on or before November 15, 2022.

AU Small Finance Bank: The small finance bank closed its qualified institutional placement issue on August 8 and approved the issue price of Rs 580 per share, which is at a discount of 1.83% to floor price of Rs 590.84 per share. The company also finalised the confirmation of allocation note to be sent to the eligible QIBs.

Strides Pharma Science: The US Food and Drug Administration has completed inspection of Singapore facility, with zero 483 observations. Its formulation facility at Singapore underwent a USFDA inspection that ended on August 8.

IRCON International: The company registered a 63% year-on-year increase in profit after tax at Rs 145 crore for the quarter ended June FY23, as revenue grew by 75% to Rs 2,002 crore. The company’s EBITDA increased 45.6% to Rs 173 crore compared to corresponding period last fiscal.

Narayana Hrudayalaya: The healthcare services provider clocked a 45% YoY growth in consolidated PAT at Rs 110.6 crore for the quarter ended June FY23. Revenue for the quarter grew by 20.2% YoY to Rs 1,033.4 crore and EBITDA increased 42.5% to Rs 200 crore compared to corresponding period last fiscal.

NALCO: The aluminium company reported a 60.5% YoY growth in consolidated profit at Rs 558 crore for the quarter ended June FY23 driven by strong top line as well as operating performance, though power and fuel cost increased significantly. Revenue increased 53% YoY to Rs 3,783.32 crore in Q1FY23.