Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.22 per cent lower at 17,502, signalling that Dalal Street was headed for a negative start on Wednesday.

Asian shares fell as investors awaited the US inflation data to provide hints on the Fed’s monetary tightening plans. Japan’s Nikkei 225 index fell 0.83% and Topix fell 0.35%. China’s Hang Seng dropped 2.13% and CSI 300 index fell 0.94%.

The Indian rupee fell 43 paise to 79.66 against the US dollar on Monday.

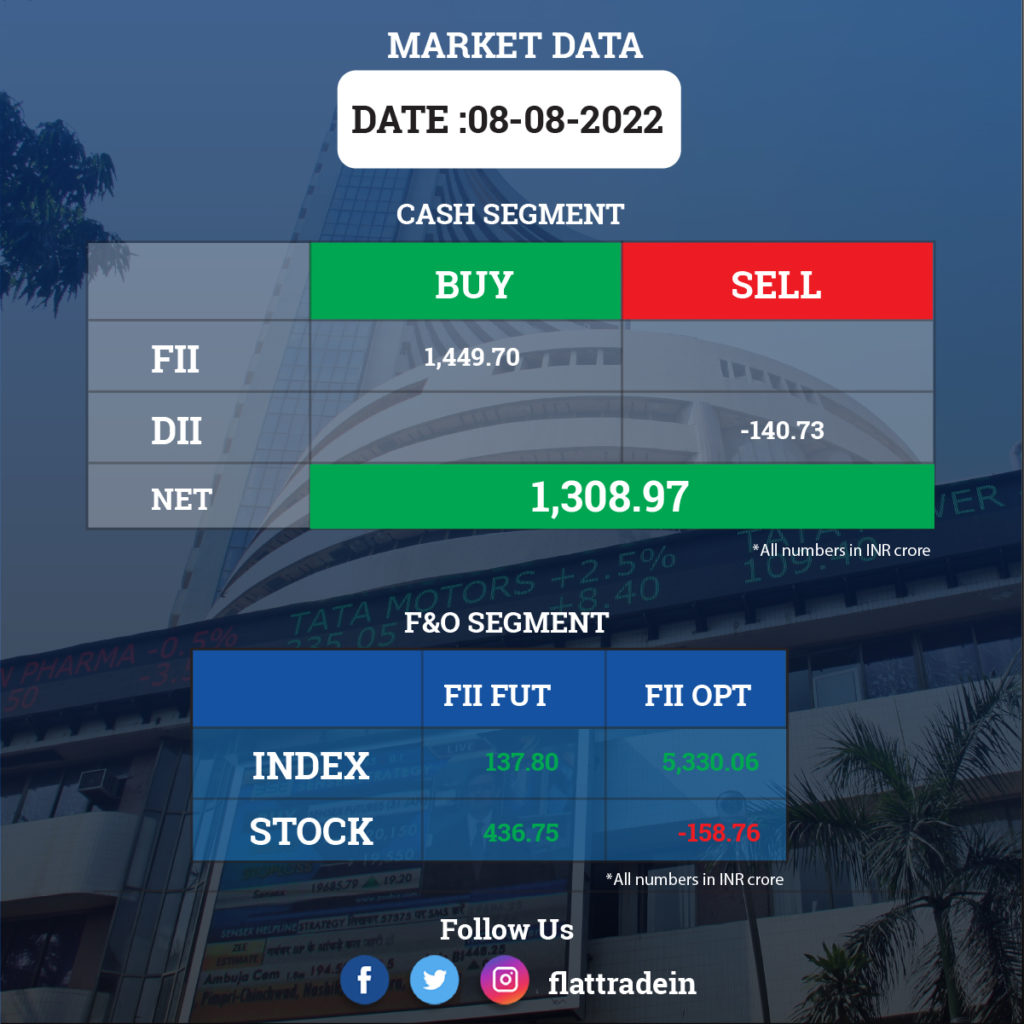

FII/DII Trading Data

Upcoming Results

Coal India, Eicher Motors, Hindalco Industries, Tata Consumer Products, IRCTC, Aarti Industries, Abbott India, Arvind Fashions, Ashoka Buildcon, CESC, Cochin Shipyard, Cummins India, Endurance Technologies, General Insurance Corporation of India, Glenmark Pharmaceuticals, Indiabulls Housing Finance, Ipca Laboratories, Indian Railway Finance Corporation, ITI, Jammu & Kashmir Bank, Jaiprakash Associates, Mazagon Dock Shipbuilders, Medplus Health Services, Metropolis Healthcare, NHPC, Oil India, Patanjali Foods, Pidilite Industries, PB Fintech, Radico Khaitan, Sadbhav Engineering, SAIL, and Zydus Lifesciences will post their June quarter earnings today.

Stocks in News Today

Bharti Airtel: The telecom major reported 466% surge in consolidated net profit (attributable to owners of the parent) at Rs 1,607 crore for the quarter ending June 30, 2022, boosted by subscriber additions. It reported a net profit of Rs 284 crore in the year-ago period. The company’s consolidated revenue from operations rose 21% to Rs 32,805 crore in Q1FY23 as compared to Rs 27,064 crore in Q1FY22. The company’s average revenue per user (ARPU) increased to Rs 183 in Q1FY23 as against Rs 146 in Q1FY22.

The company’s roll-out of 5G on a pan-Indian basis will cover every town and key rural areas by March 2024, the company’s chief executive officer and managing director, Gopal Vittal, said in a post-results conference call on Tuesday. Vittal did not give the launch date and added that the company was yet to decide on pricing its 5G plans.

Reliance Jio: The country’s largest telecom player has completed 5G coverage planning in top 1,000 cities and conducted field trials of its home-grown 5G telecom gears, Reliance Industries said in its annual report. In the report, Reliance Industries Limited, Jio’s parent company, said that Jio took major steps during 2021-22 in getting ready for 5G with its 100 per cent indigenous technology. The company was the biggest bidder in the recently-concluded 5G spectrum auction.

Power Grid Corporation of India: The company registered a 36.63 per cent decline in consolidated net profit to Rs 3,801.19 crore in Q1FY23 period compared to a profit of Rs 5,998.28 crore in the same quarter last year. Total income of the company increased to Rs 11,168.54 crore in the quarter under review from Rs 10,391.61 crore in the same period a year ago.

Tata Chemicals: The company reported an 86.25 per cent increase in consolidated net profit at Rs 637 crore during the quarter ending June. The company’s net profit stood at Rs 342 crore in the corresponding quarter of the previous fiscal. Revenue from operations of the company went up by 34.15 per cent during the quarter under review at Rs 3,995 crore compared to Rs 2,978 crore in the same period last fiscal.

GAIL (India): The company wants to double its share capital, also add specialty chemicals and clean energy to its line of business as it looks to diversify business beyond natural gas transmission and distribution. GAIL has sought shareholder approval to increase the authorised share capital of the company to Rs 10,000 crore from the current Rs 5,000 crore to help raise finance for its expansion plans over the next 3-4 years. The firm is laying natural gas truck pipelines to create a national gas grid as well as expand city gas distribution as part of the government’s target of more than doubling the share of natural gas in the primary energy basket to 15 per cent by 2030.

Delhivery: The logistics company reported widening of consolidated net loss by 208% YoY to Rs 399 crore in Q1FY23. Its total income grew 31% YoY to Rs 1,794.5 crore in the quarter under review. Delhivery’s total expenses grew more than 48% YoY to Rs 2,205.7 crore in the quarter under review. Freight, handling and servicing costs formed the bulk of the expenses at Rs 1,452.6 crore, up from Rs 867.9 crore a year ago. Employee expenses also surged nearly 70% YoY to Rs 350.1 crore in Q1FY23.

Apollo Hospitals Enterprise: the company announced its acquisition of a hospital asset in Gurugram from Nayati Healthcare and Research for a consideration of around Rs 450 crore. The acquisition marks the entry of Apollo in the state of Haryana and the upcoming integrated healthcare complex, which is located on the Golf Course Road, at Gurugram would be commissioned in a span of 24 months.

National Aluminium Company (Nalco): The company reported a 60.5 per cent rise in consolidated profit at Rs 557.91 crore for the quarter ended June 2022 on the back of higher revenue. It had posted a consolidated profit of Rs 347.48 crore in the year-ago period. The PSU’s consolidated revenue from operations increased to Rs 3,783.32 crore in Q1FY23 from Rs 2,474.55 crore in the same period last year.

Indian Hotels Company Limited (IHCL): The company reported a consolidated profit after tax (PAT) of Rs 170 crore for the quarter ended June 2022, mainly higher occupancy rates that exceeded pre-COVID levels. It had reported a loss of Rs 277 crore during the corresponding period of the previous financial year. The company’s revenue surged by 249.45 per cent to Rs 1,293 crore during the quarter under review, compared to Rs 370 crore in the year-ago period.

NTPC: The PSU will seek shareholders’ approval to raise up to Rs 12,000 crore through issuance of non-convertible debentures in annual general meeting on August 30. The funds to be raised will be used for capital expenditure, working capital and general corporate purposes.

City Union Bank: The bank reported a 30 per cent YoY jump in net profit at Rs 225 crore for the June 2022 quarter on double-digit growth in interest and non-interest income aided by fall in NPAs. Interest income rose 10 per cent YoY to Rs 1,099 crore, while the non-interest income grew by 12 per cent YoY to Rs 218 crore in Q1 FY23. Net NPAs or bad loans fell to 2.89 per cent (Rs 1,161 crore) from 3.49 per cent.

Dhanlaxmi Bank: The company reported a net loss of Rs 26.4 crore for the June 2022 quarter on higher expenses and increased provisioning. The private sector lender had posted a net profit of Rs 6.8 crore in the corresponding period of the previous fiscal. Total income was down at Rs 237 crore in the reported quarter as against Rs 246 crore in the year-ago period. The interest income was up at Rs 258 crore in Q1FY23 as against Rs 218 crore in Q1FY22. The net NPAs stood at 2.69 per cent, down from 4.58 per cent a year ago.

Dish TV India: The direct-to-home company reported a 63.67 per cent decline in consolidated net profit at Rs 17.85 crore in the April-June quarter of FY23, compared to a net profit of Rs 49.14 crore in the same quarter a year ago. Its revenue from the operation fell 16.73 per cent to Rs 608.63 crore during the quarter under review as against Rs 730.97 crore in the corresponding quarter.

Indraprastha Gas: The CNG and piped cooking gas retailer in the national capital reported a 72 per cent rise in the June quarter net profit on the back of a rise in sales volume. Its net profit stood at Rs 420.86 crore in April-June compared with Rs 244.29 crore in the corresponding quarter of last fiscal. The company registered an overall sales volume growth of 48 per cent over the corresponding quarter in the last fiscal, with the average daily sale going up from 5.32 million standard cubic meters to 7.89 mmscmd.

JSW Steel: The company posted 14 per cent year-on-year growth in crude steel output to 15.69 lakh tonne (LT) in July 2022. It has produced 13.82 LT crude steel in July 2021. The production of flat rolled products rose 15 per cent to 10.72 LT in July 2022, from 9.34 LT in the same month last year. Its long rolled products output also registered a 19 per cent rise to 3.65 LT against 3.06 LT a year ago.

Natco Pharma: The company reported a multifold rise in consolidated net profit to Rs 320.4 crore for the first quarter ended June 2022, on higher revenue from the pharmaceutical vertical. IT had posted a consolidated net profit of Rs 75 crore in the same period last fiscal. Its consolidated revenue from operations during the quarter under review stood at Rs 884.6 crore compared to Rs 410.3 crore in the same period last fiscal.

Reliance Capital: The company reported a consolidated net losses of Rs 491.40 crore in the quarter ended June 2022, down from a net loss of Rs 1,006 crore in the year-ago quarter. Total income of the company fell to Rs 3,604.39 crore in April-June 2022-23 from Rs 4,447.52 crore in the same quarter of 2021-22. The company is undergoing insolvency process due to its weak financial health and debt defaults.