Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 1.03% higher at 15,863.50, indicating that Dalal Street was headed for a positive start on Monday.

Asian stocks gained as technology stocks rose amid improved risk sentiment after Wall Street advanced at the end of last week and oil prices eased. Japan’s Nikkei 225 index 1.03% and Topix rose 0.81%. China’s Hang Seng climbed 2.36% and CSI 300 index was up 1.4%.

Indian rupee fell 5 paise to 78.35 against the US dollar on Friday.

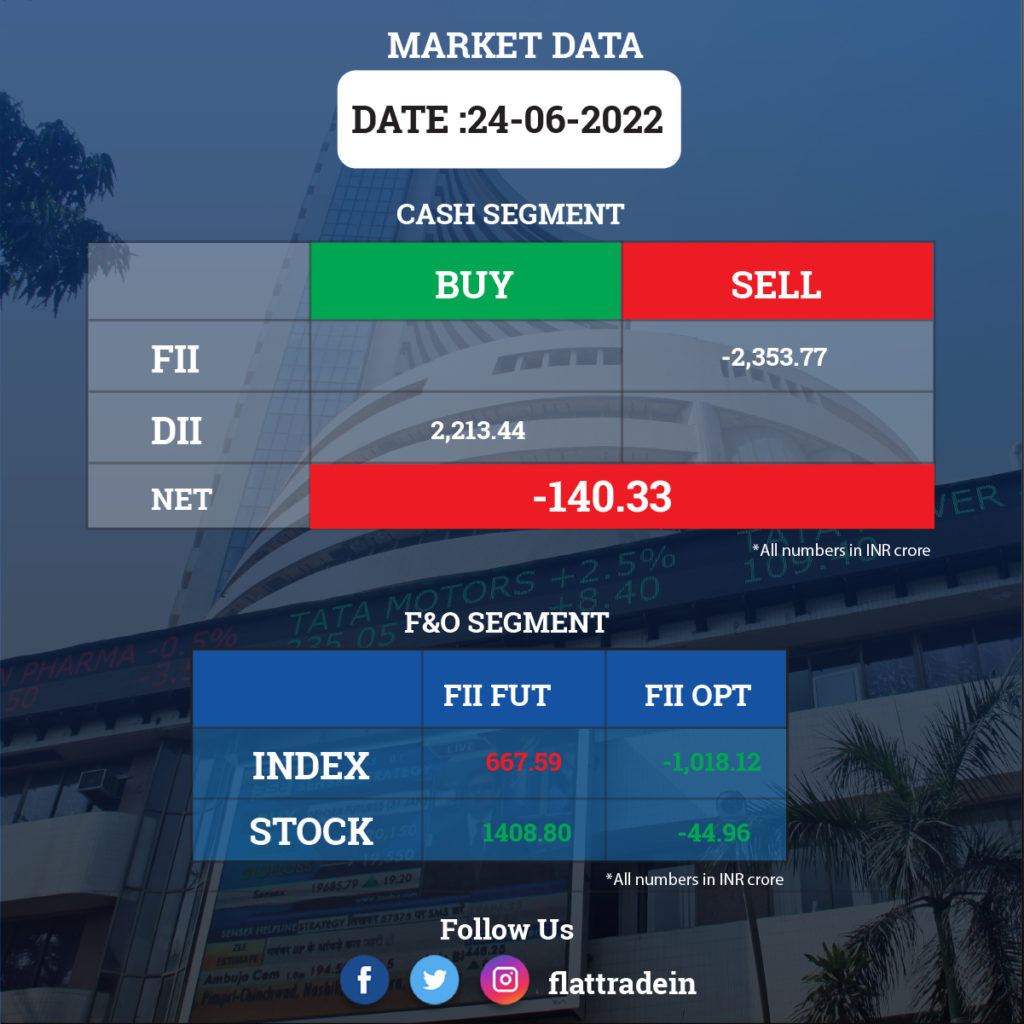

FII/DII Trading Data

Stocks in News Today

Adani Enterprises: The company’s subsidiary, Kutch Copper, is setting up a greenfield copper refinery project to produce one MTPA (million tonnes per annum) in two phases. The firm has achieved financial closure of Rs 6,071 crore for the first phase. Phase-1 of the project will have a capacity 0.5 MTPA at Mundra, Gujarat.

Tata Power: The company’s arm Tata Power Solar Systems said it has commissioned India’s largest floating solar power project of 101.6 Megawatt Peak (MWp) in Kerala backwaters. The project is installed on a 350-acre water body in Kayamkulam, Kerala.

Axis Bank: The private lender said the Reserve Bank of India has approved the reappointment of Rajiv Anand as the Deputy MD for a period of three years until August 2025. In January this year, the private sector lender had re-appointed Anand as the Deputy Managing Director for a further period of three years, from August 4, 2022, to August 3, 2025.

Zomato: The online food delivery platform said it will acquire Blink Commerce (formerly known as Grofers) for Rs 4,447.48 crore in a share swap deal as part of its strategy of investing in quick commerce business.

Hindustan Copper: The state-owned company’s board will meet this week to consider a proposal to raise up to Rs 500 crore by issuing debentures. The board will also consider raising funds through a qualified institutional placement method, it added.

Dish TV: Managing Director Jawahar Lal Goel stepped down after the proposal to reappoint him failed to receive requisite majority at the Extra Ordinary General Meeting. Anil Kumar Dua also stepped down as Whole Time Director after he was rejected for reappointment at the EGM. Rajagopal Chakravarthi Venkateish also vacated office of Director after the proposal for reappoint was rejected.

Dr Reddy’s Laboratories: The homegrown drug maker announced that it has acquired a portfolio of branded and generic injectable products from USA-based Eton Pharmaceuticals, Inc for $50 million.

Welspun Corp: The company has secured various orders of around 47,000 MT amounting to Rs 600 crore. These orders will be executed from India and the USA across the oil & gas and water sector. These include, receipt of an order for the supply of onshore coated pipes and bends for a pipeline project in Australia.

Oil India: The state-owned oil firm said it has completed a beta demonstration of the hydrogen-powered bus developed by Ohm Cleantech under the ‘Startup Nurturing, Enabling and Handholding (SNEH)’ programme of the company.

GHCL: The company has inaugurated a new spinning unit in Tamil Nadu set up at an investment of Rs 200 crore. With the setting up of the unit at Manaparai in Madurai district, the company would be able to cater to premium segments both in domestic and international markets.

Reliance Capital: Lenders of debt-ridden Anil Dhirubhai Ambani Group decided to extend the resolution process timeline by another two months to November 2 as there has been a tepid response from bidders for its acquisition.

Biocon: According to reports, the pharma company has engaged an external law firm to review its governance process that involves consultants as well as vendors. This moves follows as CBI named five persons for allegedly offering bribe to waive phase-3 clinical trials at Biocon Biologics.

Future Enterprises Ltd (FEL): The debt-ridden company has defaulted on interest payment of Rs 4.1 crore for its non-convertible debentures. The due date for payment was June 24, 2022, FEL said in a regulatory filing.