Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.24 per cent higher at 18,869, signalling that Dalal Street was headed for a positive start on Monday.

Most Asian shares rose as China eased Covid-19 restrictions. The Nikkei 225 index rose 0.12%, while Topix fell 0.47%. The Hang Seng jumped 3.17% and the CSI 300 index gained 1.68%.

Indian rupee fell 10 paise to 81.32 against the US dollar on Friday.

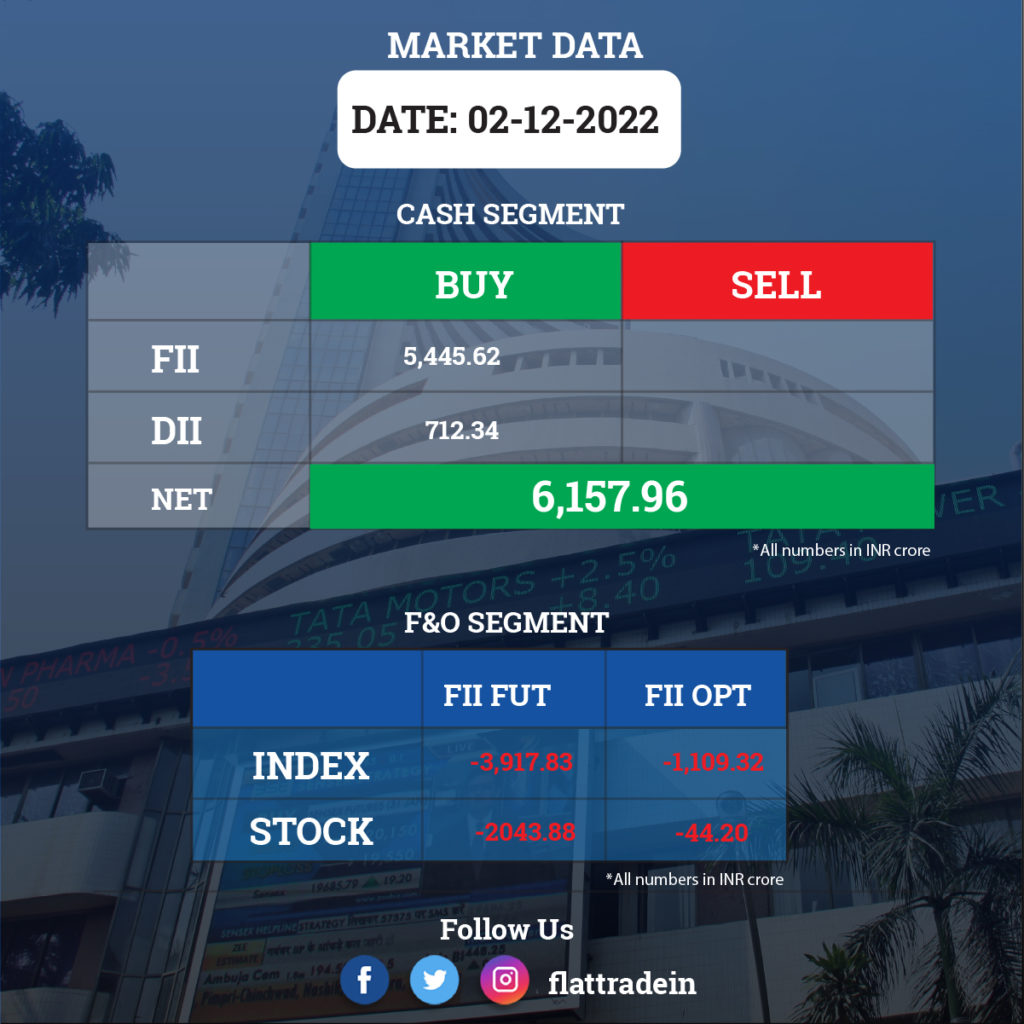

FII/DII Trading Data

Stocks in News Today

Bank of India: The public sector lender has raised Rs 1,500 crore by allotting Basel-III compliant additional Tier-I bonds to seven investors. The bonds issue, which opened on December 1, received bids worth Rs 6,367 crore against an offer size of Rs 1,500 crore.

Hindustan Aeronautics (HAL): The state-run defense company has received an income-tax refund order from the office of the deputy commissioner of income tax for the year 2011-12. The order allows an R&D expenditure of Rs 595.23 crore as capital expenditure, resulting in a refund of Rs 427.45 crore. The refund includes an interest of Rs 176.93 crore.

Tech Mahindra: The IT major has signed a Memorandum of Understanding (MoU) with the Information Technology Industry Development Agency (ITIDA) of Egypt to set up a global delivery centre in Cairo. The facility will serve clients across telecom, oil & gas, BFSI, Energy & Utilities and public sector.

Mahindra & Mahindra Financial Services (MMFS): The NBFC said that in November the business continued its momentum with the disbursement of approximately Rs 4,500 crore, delivering a 75 percent YoY growth on a positive macro environment. The year-to-date disbursement at Rs 31,050 crore grew by 99 per cent YoY. The collection efficiency was at 96 per cent for November 2022 against 94 per cent in the year-ago period. The company expects further improvement in Stages 2 and 3 assets in December.

NTPC: The state-owned company plans to raise capital for its subsidiary NTPC Green Energy Ltd. According to a report by PTI news agency, a source said NTPC Green Energy might get an investor by March 2023. “NTPC is in the process of roping in a strategic investor for its subsidiary NTPC Green Energy Ltd. The company wants to raise Rs 2,000 crore to Rs 3,000 crore through this transaction, which is likely to be completed during this fiscal year or by March 2023,” the agency reported citing a source.

Power Grid Corporation of India: The state-owned company is in the process of spinning off its telecom vertical to a new fully-owned subsidiary, Powergrid Teleservices, in a bid to have a ‘focused approach’ and to move up the value chain.

NMDC: The state-owned metal miner reported eight per cent growth compared to the same month last year in iron ore production at 3.61 million tonnes and 5.5 per cent jump in sales at 3.04 million tonnes in November. Its iron ore production for the period September-October-November 2022 is recorded as the best ever production.

Inox Green Energy Services: The company registered a net loss of Rs 11.87 crore on a consolidated basis for the quarter ended September FY23. The losses widened from Rs 11.58 crore in the previous quarter. Revenue from operations rose marginally to Rs 61.9 crore from Rs 61.79 crore in the same period.

Ion Exchange (India): The company has received a Rs 343.36 crore contract from Indian Oil Corporation. The work includes designing, engineering, manufacturing, supply, erection, testing, pre-commissioning, commissioning, performance guarantee test run and operation & maintenance for five years of zero liquid discharge plant at IOC’s Panipat refinery. The project is to be commissioned within 16 months from the date of the letter of acceptance.

Hatsun Agro Products: The company‘s board has approved rights issue up to Rs 301 crore, by way of issue of around 71.85 lakh equity shares. The company has set the rights issue entitlement in 1:30 ratio, i.e. one share on rights for every 30 shares held by a shareholder. The record date for ensuing eligibility of the shareholder is December 8, 2022. The rights issue will be open from December 19 till January 09.

Indus Towers: The mobile tower operator plans to raise up to Rs 2,000 crore through debentures to support business operations. According to sources, the maturities of these bonds are between two to three years. The company is likely to visit markets ahead of the repo rate decision by the RBI’s monetary policy Committee (MPC) on December 7.

Zydus Lifesciences: The USFDA granted the company the final permission to market Topiramate Extended-Release capsules. The company said Topiramate Extended-Release capsule is indicated to prevent and control seizures in people with epilepsy. The drug will be manufactured at the group’s formulation manufacturing facility at Ahmedabad SEZ, India.

GMR Airports Infrastructure: GMR Hyderabad International Airport Ltd (GHIAL) plans to raise Rs 1,250 crore through non-convertible debentures to be used for prepaying the USD bonds maturing in April 2024 or February 2026, said rating agency India Ratings & Research, as quoted by PTI. The rating agency stated that the USD bonds have bullet maturities in April 2024, February 2026, and October 2027. As on September 20 this year, GHIAL had a debt of Rs 7,050 which consisted of bonds of $950 million.

Krishna Institute of Medical Sciences: US-based equity firm General Atlantic offloaded 14.5 lakh shares or 1.8 per cent stake of hospital chain at average price of Rs 1,480 apiece for Rs 214.6 crore through an open market transaction, according to the bulk deal data available with the BSE.