Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.46 per cent higher at 17,519.50, signalling that Dalal Street was headed for a positive start on Thursday.

Most Asian stocks rose, tracking Wall Street overnight, as investors’ sentiments were boosted by upbeat corporate guidance and strong economic data. Japan’s Nikkei 225 index rose 0.53%, while Topix slipped 0.08%. China’s Han Seng jumped 2.01% and CSI 300 index wsa up 0.64%.

The Indian rupee fell by 45 paise to 79.16 against the US dollar on Wednesday.

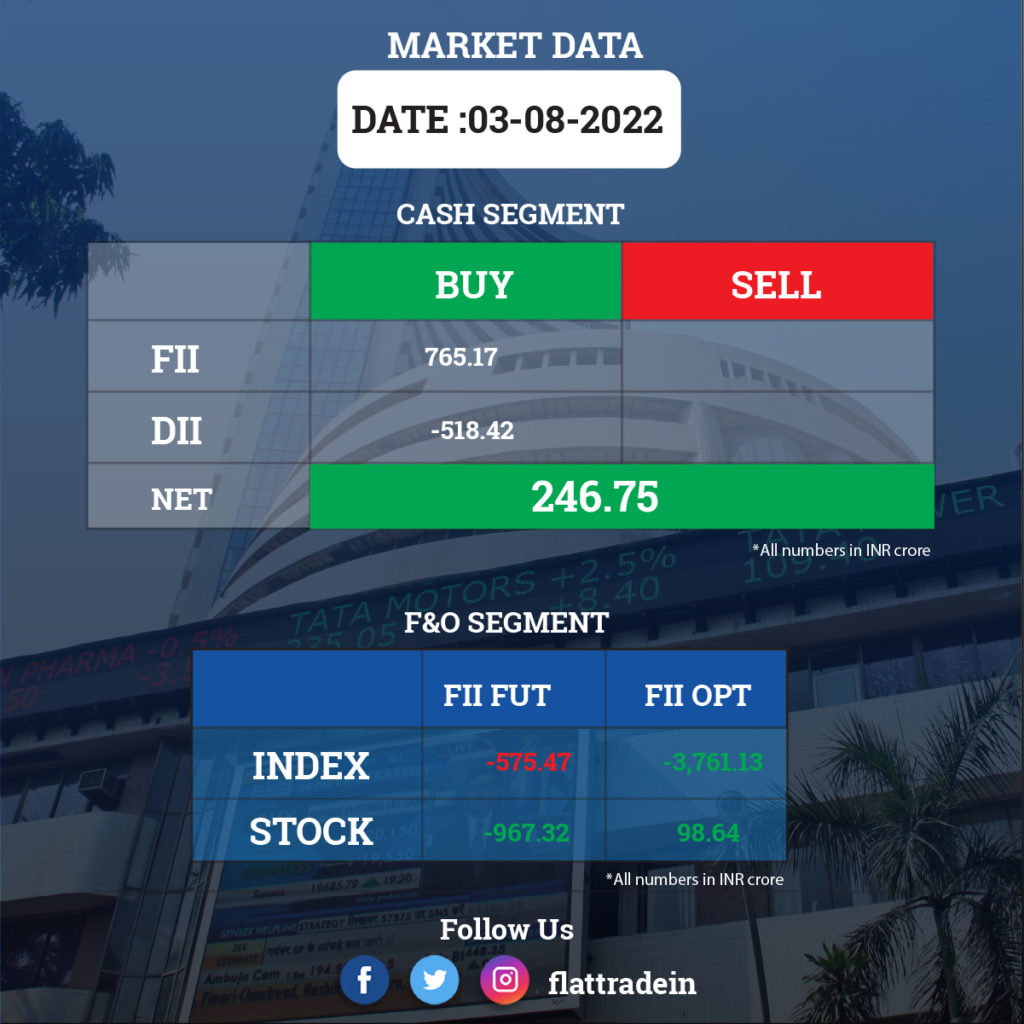

FII/DII Trading Data

Upcoming Results

Adani Enterprises, Adani Total Gas, Britannia Industries, Dabur India, GAIL India, LIC Housing Finance, Alembic Pharmaceuticals, Aarti Surfactants, Aptech, Balkrishna Industries, Balrampur Chini Mills, BEML, Berger Paints India, Bharat Heavy Electricals, Blue Star, Container Corporation of India, Dalmia Bharat, Edelweiss Financial Services, Glenmark Life Sciences, Gujarat State Petronet, ICRA, Kalpataru Power Transmission, Kalyan Jewellers India, Krsnaa Diagnostics, Manappuram Finance, Praj Industries, REC, Shankara Building Products, Spandana Sphoorty Financial, Suryoday Small Finance Bank, Ujjivan Financial Services, Welspun Corp, and Windlas Biotech will report quarterly results on August 4.

Stocks in News Today

InterGlobe Aviation (IndiGo): The company narrowed its net loss to Rs 1,064.3 crore in Q1FY23, compared with a net loss of Rs 3,174.2 crore in the year-ago period. The airline’s revenue from operations rose 328% to Rs 12,855.3 crore from Rs 3,007 crore in the year-ago period.

Reliance Industries and Adani Group: Both the groups are planning to invest Rs 500-600 crore each and set up compressed biogas (CBG) plants, according to The Economic Times news report. Adani New Industries (ANIL) is planning to set up 40-million tonne per annum (mtpa) plants in Uttar Pradesh and Gujarat, while Reliance Industries is still formalising the two locations, the report said.

Bharti Airtel: The telcom company announced it has signed 5G network agreements with gear makers Ericsson, Nokia and Samsung to start deploying 5G this month. Airtel highlighted its long-standing relationship for connectivity and pan-India managed services with Ericsson and Nokia, while stating that partnership with Samsung will begin this year onwards.

Adani Wilmar Ltd (AWL): Edible oil major reported a 10 per cent growth in consolidated net profit at Rs 193.59 crore for the quarter ended June on higher sales. It had posted a net profit of Rs 175.70 crore in the year-ago period. Total income rose to Rs 14,783.92 crore in the first quarter of this fiscal from Rs 11,369.41 crore in the corresponding period of the previous year. Angshu Mallick, Managing Director and CEO, Adani Wilmar, said the company has seen double-digit growth in sales through e-commerce and modern trade.

Vodafone Idea: The telecom firm’s net loss marginally narrowed to Rs 7,297 crore for the quarter ended June 2022, from a net loss of Rs 7,319 crore in the year-ago period. The company’s revenue from operations rose 14% to Rs 10,410 crore as against Rs 9,152 crore in Q1FY22. Average revenue per user (ARPU) for the quarter stood at Rs 128 in the quarter versus Rs 104 in Q1FY22, up 23.4% helped by tariff hikes.

BSE: The stock exchange reported a 23 per cent decline in net profit to Rs 40 crore in Q1FY23, compared to a net profit of Rs 51.9 crore in the year-ago period. Total revenues grew by 6.4 per cent to Rs 197.7 crore for the period under review from Rs 185.7 crore in the corresponding quarter previous year. BSE’s average daily turnover in the equity segment dropped 28 per cent YoY to Rs 4,057 crore and average daily turnover in the equity derivatives segment fell by 62 per cent YoY to Rs 1.2 lakh crore in Q1FY23. However, the company managed to increase average daily turnover in the currency derivatives segment by 4 per cent YoY to Rs 24,567 crore in Q1FY23.

Inox Leisure: Multiplex chain operator reported a consolidated net profit of Rs 57.09 crore for the quarter ended June 2022 due to higher footfalls at cinema halls. It had posted a net loss of Rs 122.28 crore in the year-ago period. Its revenue from operations during the quarter under review was at Rs 582.26 crore, up multi-fold from Rs 22.31 crore in the same period last fiscal. Total expenses increased two-fold YoY to Rs 513.01 crore in Q1FY23.

Reliance Capital: The lenders to debt-ridden company Wednesday granted the fifth extension of deadline for submission of resolution plans as bidders sought more time to complete the due diligence process, PTI news reported citing sources. The new deadline is August 28. Reliance Capital had initially received 54 Expressions of Interest (EoIs), but now only 5-6 bidders are active at the due diligence stage.

Adani Transmission: The company reported a consolidated net profit after tax (PAT) of Rs 168.46 crore for the quarter ended June 2022, as against a consolidated PAT of Rs 433.24 crore in the year-ago period. The company’s total income was at Rs 3,249.74 crore in the first quarter of the current fiscal, and Rs 2,935.72 crore in the same period last fiscal.

Sun Pharmaceutical: The drug major said its Chairman Israel Makov will retire from the company on August 29, 2022. Makov is retiring upon the completion of his current term post the company’s Annual General Meeting after having led Mumbai-based company for ten years.

Life Insurance Corporation (LIC): The company has broken into the latest Fortune Global 500 list. The nation’s biggest life insurer with revenue of USD 97.26 billion and a profit of USD 553.8 million, was ranked 98th on the just released Fortune 500 list. Meanwhile, Reliance Industries has jumped 51 places to 104 on the 2022 list. The list has nine Indian companies — five of them state-owned, and four from the private sector.