Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.62% higher at 17,421.5, signalling that Dalal Street was headed for a positive start on Tuesday.

Most Asian stocks rose as investor sentiments were boosted after the UK reversed its unfunded tax cut decision. Nikkei 225 index rose 0.78% and Topix gained 0.7%. Hang Seng fell 0.14% and CSI 300 index lost 0.24%.

The Indian rupee was unchanged at 82.35 against the US dollar on Monday.

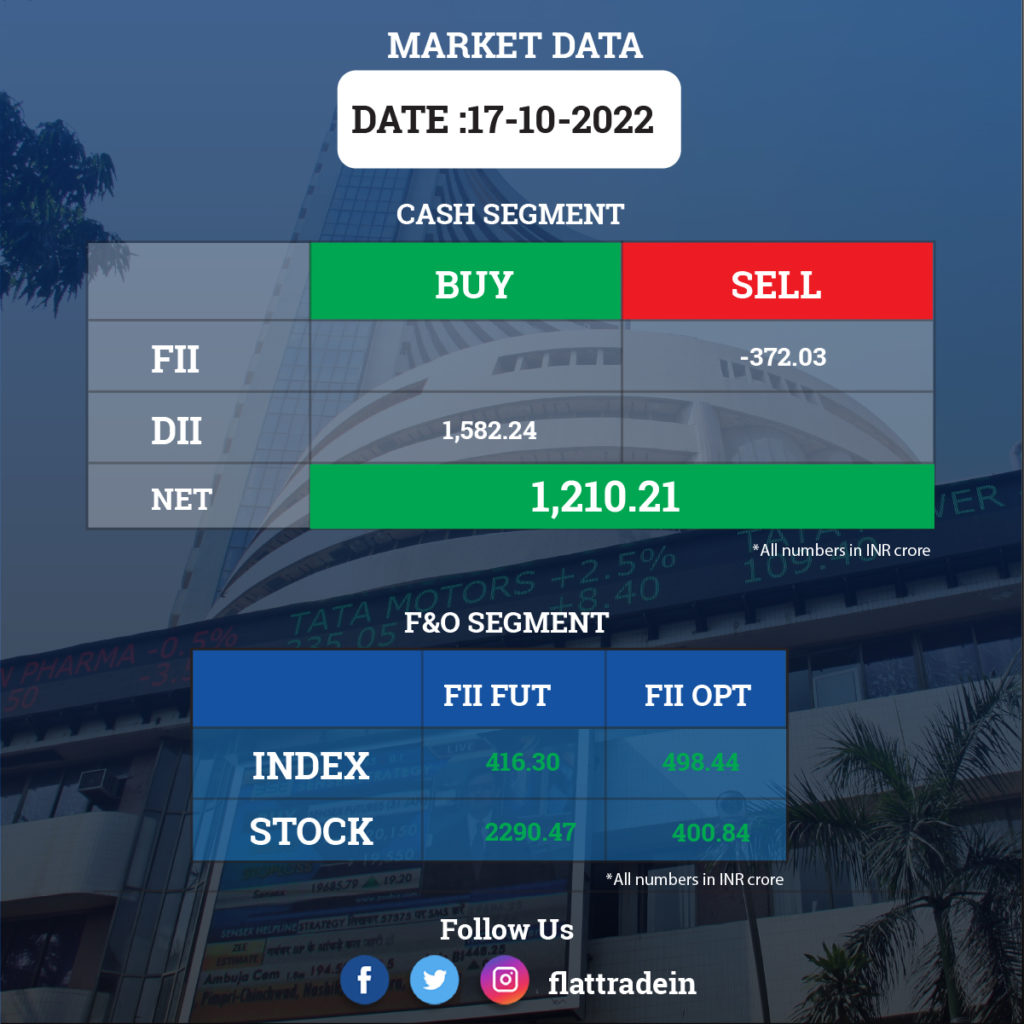

FII/DII Trading Data

Upcoming Results

ICICI Lombard General Insurance Company, JSW Ispat Special Products, KPIT Technologies, L&T Technology Services, Tata Communications, HFCL, Mahindra CIE Automotive, Network18 Media & Investments, Gujarat Fluorochemicals, Gujarat Mineral Development Corporation, Heritage Foods, Newgen Software Technologies, Polycab India, Schaeffler India, Tinplate Company of India, and TV18 Broadcast will report their earnings.

Stocks in News Today

Reliance Jio: Reliance Jio’s 5G network network will be powered by Swedens’ Ericsson and Finland’s Nokia, the European telecom equipment manufacturers said. Both the suppliers have inked multi-year supply contracts with Jio for supplying 5G network equipment. Under its contract, Nokia will supply equipment from its AirScale radio portfolio to support different spectrum bands and self-organising network software. Jio will deploy a standalone 5G network, which will interwork with its 4G network and enable it to provide services such as machine-to-machine communication, network slicing, and ultra-low latency.

Adani Enterprises: The Supreme Court dismissed petitions filed by Kerala’s Left Democratic Front (LDF) government and some employee unions challenging the leasing out of the Thiruvananthapuram International Airport by the Airports Authority of India (AAI) to Adani Enterprises Ltd (AEL).

V-Mart Retail: The fashion retailer said that it will acquire online marketplace LimeRoad, in a move which will help the company expand its presence in the omni-channel space. The company has signed a “business transfer agreement with A M Marketplaces (LimeRoad) and certain other parties for the acquisition of its LimeRoad business as a going concern on a slump sale basis,” said V-Mart Retail in a regulatory filing.

Oil and Natural Gas Corp (ONGC): The company plans to take a stake in the new Russian entity that will manage the Sakhalin 1 project in the far east as it seeks to retain a 20% share in the asset, Reuters reported citing three sources familiar with the matter. “ONGC Videsh will protect its share in the project, which means it will take a stake in the new entity,” said one of the sources. The development comes after Russian President Vladimir Putin earlier this month issued a decree to establish a new operator for the ExxonMobil-led project and authorised the Kremlin to decide whether foreign shareholders could retain stakes in Sakhalin 1.

Oil India Limited (OIL): the company is interested in picking up a petroleum mining lease (PML) in an area spread over 67 square kilometres (sq. km) in Jaisalmer and Bikaner under the Discovered Small Field policy, Business Standard reproted citing a senior state government official. “A proposal in this regard has been submitted to the state government and action will be taken soon,” said Subodh Agarwal, additional chief secretary, mines and petroleum, Rajasthan, after meeting OIL Chairman and Managing Director Ranjeet Rath in Jaipur recently.

Tata Coffee: The company recorded a 172 percent year-on-year growth in consolidated profit at Rs 147 crore for the quarter ended September FY23 driven by improved performance of plantation and instant coffee businesses and one-time exceptional income on disposal of a non-core property. Consolidated revenue increased by 31 percent YoY to Rs 718.3 crore during the quarter led by higher realisations in all businesses.

Adani Transmission: The company saw a 13% jump in the number of electricity units sold during Q2FY23 as demand from the commercial segment continued to rise. The firm sold 2,233 million units compared with 1,975 million units last year on account of higher energy demand.

Zee Entertainment Enterprise: Invesco Developing Markets Fund will sell a 5.51% stake in the media major in a block trade on Tuesday totalling about $169.5 million, according to deal terms. The stake will be offloaded at a price range of Rs 250-Rs 263.7 per share.

Tata Metaliks: The company’s consolidated revenue rose 36% YoY to Rs 877 crore in Q2FY23 as against Rs 645 crore in the year-ago period. Net profit fell 74% to Rs 14.29 crore in Q2FY23 from Rs 54.82 crore Q2FY22. EBITDA fell 59% YoY to Rs 40.92 crore in the reported quarter from Rs 99.89 crore in the year-ago period. EBITDA margin declined 5% in the reported quarter as against 15% in the corresponding quarter last fiscal.

HeidelbergCement India: The cement maker reported a decline of 88.23% in its net profit to Rs 7.01 crore in the second quarter ended September 30, 2022, citing lower sales volume. The company had reported a net profit of Rs 59.56 crore in the year-ago period.

Aster DM Healthcare: The company’s subsidiary, Aster Pharmacies Group, has entered into a joint venture agreement with Abdulmohsen Al Hokair Holding Group to establish, manage and operate a pharmacy chain across the Kingdom of Saudi Arabia. It will market and commercialise pharmaceutical products under the ‘Aster Pharmacy’ brand.

SJVN: The company’s subsidiary, SJVN Green Energy, and Assam Power Distribution Company (APDCL) has signed a Memorandum of Understanding (MoU) to develop 1,000 MW floating solar power projects in Assam.

Star Housing Finance: The company said the board of directors approved the sub-division of one share (face value Rs 10) into two fully paid-up shares (face value Rs 5), and the issue of one bonus equity share for every fully paid-up equity share.

Indowind Energy: The company reported consolidated profit at Rs 3.91 crore for the quarter ended September 2022, up 587% on strong sales. Revenue during the quarter grew by 65% to Rs 14.7 crore compared to the corresponding period last fiscal. In the half year ended September FY23, consolidated profit increased by 249 percent to Rs 5.61 crore and revenue rose by 48 percent to Rs 22.5 crore compared to the same period last year.

Maharashtra Seamless: The company said its consolidated profit for the quarter ended September FY23 grew by 86 percent to Rs 176.6 crore compared to the year-ago period and revenue increased by 49 percent to Rs 1,414.2 crore during the same period. The company also said it has appointed Sarat Kumar Mohanty as Chief Financial Officer and recommended the issue of bonus shares in the ratio of one bonus equity share against one existing share, subject to the approval of shareholders.

Spandana Sphoorty Financial: The non-banking finance company has turned profitable with Q2FY23 net at Rs 49.5 crore against a loss of Rs 222.68 crore in the previous quarter and a loss of Rs 58.87 crore in Q2FY22. Revenue fell 24.5 percent year-on-year to Rs 281 crore, but grew by 21 percent sequentially.

Samvardhana Motherson: Japanese company Sojitz Corp will sell 1.9% stake in the auto component major through a block deal, as per reports. The floor price for the block deal is Rs 64.36 per share.