Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.51% higher at 17,428, signalling that Dalal Street was headed for a positive start on Thursday.

Asian shares were mixed as investors were cautious amid rising oil prices after deep production cuts pledged by OPEC+ members. Japan’s Nikkei 225 index rose 0.92% and Topix was up 0.79%. In China, Hang Seng fell 0.62% and CSI 300 index was trading 0.58% lower.

Indian rupee gained 36 paise to 81.52 against the US dollar on Tuesday.

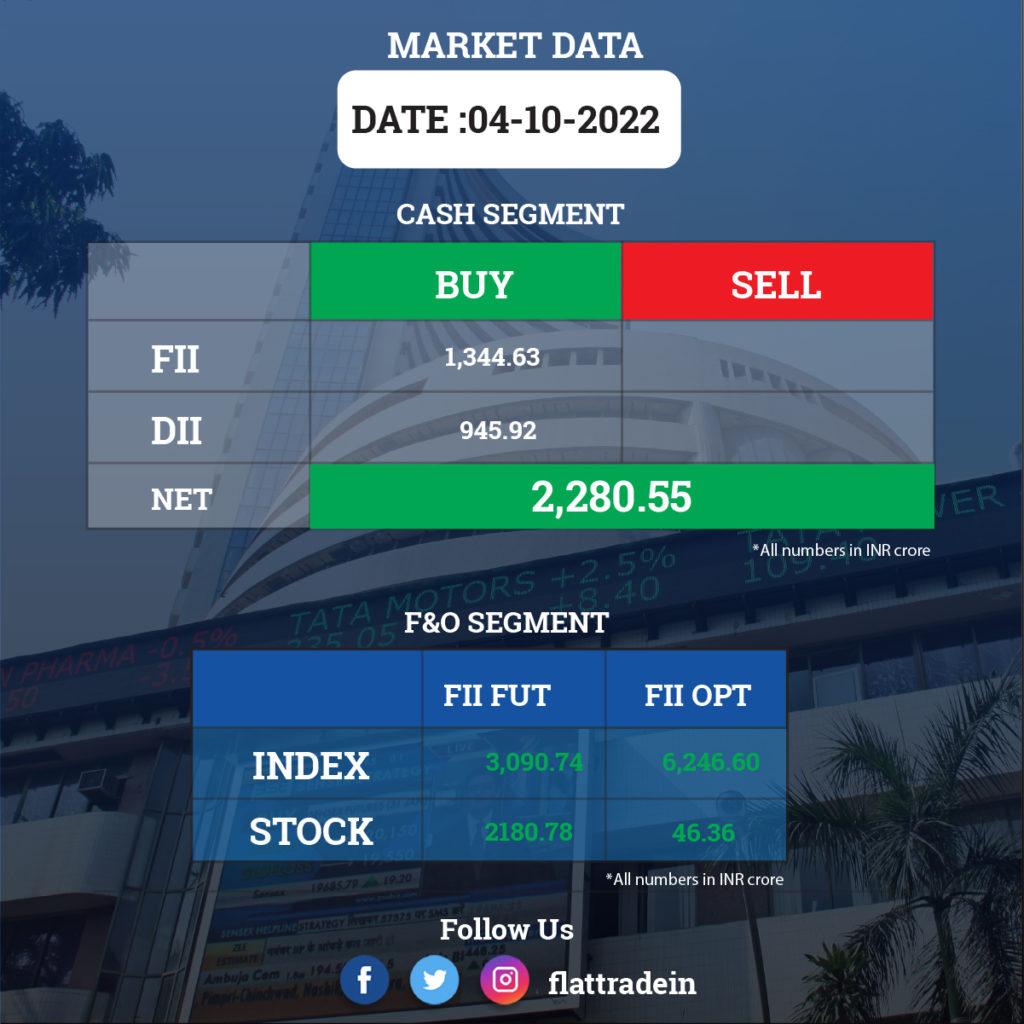

FII/DII Trading Data (4-10-2022)

Stocks in News Today

Reliance Jio: The telcom arm of Reliance Industries launched the beta trial of 5G services in four Indian cities on the occasion of Dussehra. The Jio True 5G services will be available to select customers through an invitation. The Jio True 5G service is being launched in Delhi, Mumbai, Kolkata and Varanasi for the existing Jio users by invitation. The invited customers will get unlimited 5G data with a speed up to 1 gigabyte per second.

Tata Steel: The company through its subsidiary, T S Global Holdings Pte Ltd, has completed the divestment of its 19% equity stake in AI Rimal to Tanmia. With this transaction, its shareholding in Al Rimal reduced from to 51% from 70%. T S Global Holdings had entered into an agreement with Oman National Investments Development Company (Tanmia) and the existing shareholders of Al Rimal.

JSW Energy: The company’s subsidiary, JSW Neo Energy, has signed a Memorandum of Understanding with the Government of Maharashtra for setting up a 960 MW capacity of Hydro Pumped Storage Project in Maharashtra. With this MoU, the company has secured resources for about 6 GW hydro PSPs with various states governments.

Apollo Hospitals Enterprise: The company said it has acquired a 60% stake in leading classical Ayurveda hospital chain AyurVAID for a consideration of Rs 26.4 crore. The investment will be used to upgrade existing centres, set up new centres, strengthen enterprise platforms, and for digital health initiatives, the healthcare major said in a regulatory filing.

Adani Enterprises: In an exchange filing, Adani Enterprises announced the creation of two new subsidiaries — Adani Disruptive Ventures (ADVL) and Alwar Alluvial Resources (AARL). The mission statement of ADVL says, “As ‘your partner for growth’, ADV aims to turn great ideas into great outcomes by leveraging its existing platform to enable companies to create commercially viable solutions.” Meanwhile, the manufacturing and processing of minerals, the production of pigments and TiO2 slag, and other incidental activities related to these will be undertaken by AARL.

HDFC Bank: The private sector lender said it has registered a 23.5% rise in loans to Rs 14.80 lakh crore in the second quarter of this fiscal. The credit book was Rs 11.98 lakh crore as of September 30 last year.

Hindustan Unilever: The FMCG is racing to deliver household goods to grocery stores, halving the time it takes from receiving an order to delivering it in a single day, amid rising competition from online grocery wholesalers, Livemint reported citing sources. In a pilot project in Chennai, parts of Maharashtra, and other states, the company’s on-ground sales team has been tasked with ensuring that products reach stores the next day instead of the day after, three people familiar with the development said.

SpiceJet: The finance ministry has expanded the scope of the Emergency Credit Line Guarantee Scheme (ECLGS) to enhance the maximum loan under the scheme. The loan limit under the scheme has been raised to Rs 1,500 crore from Rs 400 crore to help the Covid-hit sector tide over the liquidity stress.

Zee Entertainment: The Competition Commission of India (CCI) said it had granted approval to the amalgamation of Zee Entertainment Enterprises Limited (ZEE) and two Sony group firms Bangla Entertainment Private Limited (BEPL) and Culver Max Entertainment Private Limited (CME), with certain modifications.

HCLTech: The IT services company will open a new technology center in Campinas city, Brazil, to scale up its operations in the country and will hire 1,000 employees. The employees will work on solutions and services for its digital, engineering, and cloud domains.

DLF: The realty major has sold all 292 luxury homes in Gurugram for over Rs 1,800 crore within few days of the launch of the project, signalling strong demand despite rise in interest rate on home loans and property prices. DLF had launched its project ‘The Grove’ located at DLF phase-5 in Gurugram, Haryana, in the last week of September 2022.

Hindustan Zinc: The Vedanta group firm said its mined metal output rose by 3% to 2,55,000 tonnes in the July-September quarter on the back of better grades and improved mill recoveries. The company’s mined metal production was at 2,48,000 tonnes in the corresponding quarter of previous fiscal. The refined metal production at 2,46,000 tonnes was 18% higher on account of improved smelter performance and better mined metal availability among others, Hindustan Zinc has said in a statement.

Lupin: The drug firm said it has received an approval from the US health regulator to market Darunavir Tablets, used to treat Human Immunodeficiency Virus (HIV) infection, in the US market. The company said it is the exclusive first filer for 800 mg tablets and is eligible for 180-day exclusivity. Darunavir tablets (600 mg and 800 mg) had estimated annual sales of $343 million in the US, according to MAT June 2022 data.

Happiest Minds Technologies: The IT company’s board has approved raising of up to Rs 1,400 crore through equity or debt bonds, according to its regulatory filing. The board has given permission to even opt for a public issue, preferential allotment, private placement etc to raise funds, according to the filing.

Sterlite Technologies: The company has completed its divestment of stake in IDS UK. In September 2022, it had entered into definitive documents to sell its stake (through its wholly-owned subsidiary) in Impact Data Solutions, UK (IDS UK) to Hexatronic Group AB.

Godrej Consumer Products: The FMCG company, at a consolidated level, expects to deliver higher than mid single-digit sales growth. It expects close to double digit sales growth ex-Indonesia’s Hygiene comparator. On the profitability front, it expect a mid-teen decline in EBITDA due to consumption of high cost materials, significant upfront marketing investments to drive category development, and a weak performance in Indonesia. However, with significant correction in commodities like palm oil derivatives and crude oil, we expect recovery in consumption, gross margins expansion and upfront marketing investments in upcoming quarters.

Jubilant FoodWorks: The company’s subsidiary, Jubilant Foodworks Netherlands B.V., has acquired additional stake in Netherlands-based DP Eurasia N.V. As on October 3, the subsidiary is holding 49.04% stake in DP Eurasia, the exclusive master franchisee of the Domino’s Pizza brand in Turkey, Russia, Azerbaijan and Georgia.

Wipro: The IT company has asked its employees to be in office at least three days a week and the it has informed its employees that offices will be open for four days a week, starting from October 10. The decision was communicated to all its employees through an email. In a statement, Wipro said it has adopted a flexible and hybrid approach in its return-to-work policy.

Atul Auto: The company said its board of directors will meet on October 8 to consider the proposal for raising of funds via rights issue, or preferential issue including a qualified institutions placement.