Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.05% higher at 18,124, signalling that Dalal Street was headed for a flat start on Friday.

Japanese shares were trading lower, tracking a fall in the US markets, as investor sentiments were dampened by the Fed’s continued aggressive monetary policy stance. Nikkei 225 index tanked 2% and the Topix fell 1.42%. Meanwhile, Chinese shares were trading higher with the CSI 300 index up 1.93% and the Hang Seng index rising 4.12%.

The Indian rupee ended 9 paise lower at 82.88 against the US dollar on Thursday.

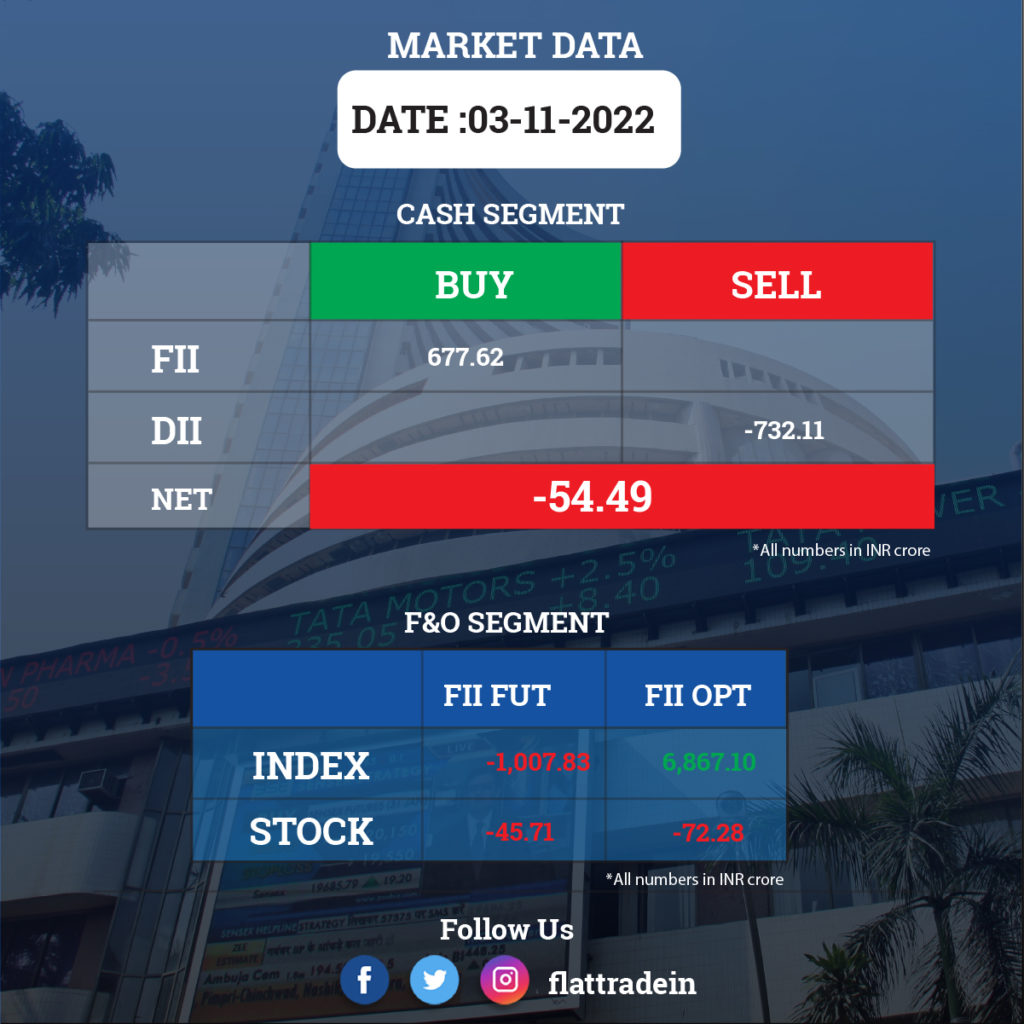

FII/DII Trading Data

Upcoming Results

Britannia Industries, Cipla, Titan, GAIL India, InterGlobe Aviation, Aditya Birla Fashion and Retail, TVS Motor, Marico, City Union Bank, Cummins India, Dreamfolks Services, Elgi Equipments, Escorts Kubota, Go Fashion (India), Mahindra Logistics, Tube Investments of India and Wockhardt will report quarterly earnings on November 4.

Stocks in News Today

Adani Enterprises: The company recorded a 122% YoY growth in consolidated net profit at Rs 432.3 crore for the quarter ended September FY23, aided by strong operating performance. Revenue for the quarter increased by 189% YoY to Rs 38,175 crore and EBIDTA rose by 69% to Rs 2,136 crore on account of strong performance by its airport business.

Hero MotoCorp: The two-wheeler company recorded a standalone net profit of Rs 716 crore for the quarter ended September FY23, down 10% YoY. Revenue stood at Rs 9,075 crore for the quarter, an increase of 7.35% compared to year-ago period. The company sold 14.28 lakh units for the quarter, compared to 14.38 lakh units sold in corresponding period last fiscal.

Vodafone Idea: The telecom operator posted a loss of Rs 7,595.5 crore for the quarter ended September FY23, compared to a loss of Rs 7,296.7 crore in previous quarter. Operating loss rose to 1,558.2 crore in the reported quarter from Rs 1,475.9 crore. Gross revenue for the quarter was at Rs 10,614.6 crore, an increase of 2% QoQ. Average revenue per user (ARPU) improved to Rs 131, up 2.3 per cent quarter-on-quarter from Rs 128 in Q1 of FY23.

Raymond: The company reported over a two-fold jump in its consolidated net profit at Rs 161.95 crore for the second quarter ended September 2022 on improved growth across its business segments. The company had posted a net profit of Rs 56.15 crore during the year-ago period. Its revenue from operations rose 39.76% to Rs 2,168.24 crore from Rs 1,551.32 crore in the corresponding quarter previous fiscal. Raymond’s total expenses surged 31.27% to Rs 1,954.18 crore in the second quarter of FY23, against Rs 1,488.64 crore a year back.

Wipro: The Indian technology services and consulting company announced the appointment of Amit Choudhary as Chief Operating Officer (COO) and member of the Wipro Executive Board.

Amara Raja Batteries: The company reported a 39% YoY increase in consolidated profit at Rs 201.22 crore for the quarter ended September FY23, led by strong operating performance. Revenue for the quarter stood at Rs 2,700.5 crore increased 19.3% compared to year-ago period.

Jindal Stainless (Hisar): The company posted a 49% YoY decline in consolidated profit at Rs 252.7 crore for the quarter ended September FY23, impacted by higher inventory and weak operating performance. Revenue increased by nearly 5% YoY to Rs 3,926 crore for the quarter.

Blue Star: The company reported a 37% YoY increase in consolidated profit at Rs 43 crore for the quarter ended September FY23, aided by top line. Revenue for the quarter stood at Rs 1,576 crore increased by 27% YoY.

JK Lakshmi Cement: The cement company recorded a 29% YoY decline in consolidated profit at Rs 61.8 crore for the quarter ended September FY23 impacted by higher power & fuel cost. Revenue from operations increased by 13.6% to Rs 1,373.5 crore compared to same period last year.

Schneider Electric Infrastructure: The company reported a profit of Rs 8.74 crore for the quarter ended September FY23, as against a loss of Rs 8.7 crore in same period last year. Revenue from operations stood at Rs 420.8 crore for the quarter, a rise of 39.5% compared to corresponding period last fiscal.

Orient Electric: The company reported a loss at Rs 0.28 crore for the quarter ended September FY23 against profit at Rs 34.77 crore in same period last fiscal. Revenue for the quarter stood at Rs 510.6 crore, a declined of 14% YoY.

GMM Pfaudler: The company reported a 150% year-on-year growth in consolidated profit at Rs 97 crore for the quarter ended September FY23 on strong operating performance. Revenue for the quarter stood at Rs 780 crore increased by 20.5 percent YoY.

Sanofi India: The company recorded profit at Rs 130.9 crore for the quarter ended September FY23, down 75% YoY as the year-ago period had an exceptional gain of Rs 489.2 crore. Revenue fell 8.3% year-on-year to Rs 692 crore for the quarter.

Ajanta Pharma: The company posted a 20% year-on-year decline in profit at Rs 157 crore for the quarter ended September FY23 dented by weak operating performance. Revenue from operations at Rs 938 crore for the quarter increased by 6% and EBITDA at Rs 196 crore fell by 25.5% compared to corresponding period of previous fiscal.

Persistent Systems: The company has announced a strategic partnership with Software AG to develop joint solutions to accelerate operational excellence by modernizing applications and processes as well as moving data more easily across enterprises to unlock value.

Mahindra Lifespaces: The real estate firm reported a net loss of Rs 7.7 crore for the quarter ended September 2022 as against a net profit of Rs 6.5 crore in the year-ago period and Rs 75.4 crore profit in the previous quarter. The company’s consolidated total income for the quarter also declined to Rs 73.8 crore as against Rs 65.7 crore a year ago and Rs 117.3 crore in the previous quarter. During the quarter, the company achieved sales of Rs 399 crore in the residential business, while collections in the residential business stood at Rs 286 crore.

Ethos: The company registered five-fold YoY increase in profit at Rs 13.6 crore for the quarter ended September FY23, supported by robust demand and focused marketing initiatives. Revenue for the quarter stood at Rs 177.7 crore a rise of 32% YoY with growth across offline and online channels.