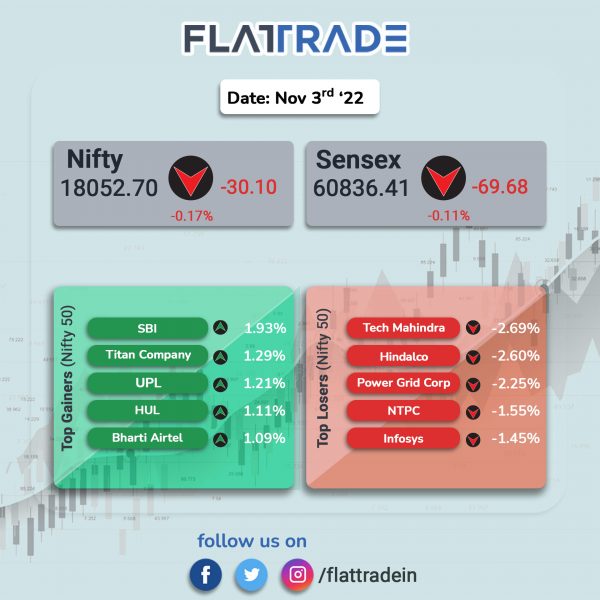

Benchmark stock indices ended lower after the US Fed hiked key interest rates by 75 basis points amid heavy selling in technology and energy stocks. The Sensex slipped 0.11% and the Nifty 50 index fell 0.17%.

In broader markets, the Nifty Midcap 100 index rose 0.34% and and the BSE Smallcap index edged up by 0.11%.

Top losers among Nifty sectoral indices were IT [-1.18%], Energy [-0.555] and Auto [-0.42%]. Top gainers were PSU Bank [2.52%], Realty [0.58%], Bank [0.37%], Private Bank [0.34%] and FMCG [0.29%].

The Indian rupee ended 9 paise lower at 82.88 against the US dollar on Thursday.

The S&P Global India services Purchasing Managers’ Index edged up to 55.1 in October from September’s six-month low of 54.3, helped by robust domestic demand. Meanwhile, the S&P Global India Composite PMI Output Index rose to 55.5 in October from 55.1 in September as activity in both manufacturing and services remained strong.

Stock in News Today

HDFC: The mortgage lender said its consolidated net profit increased by 24% to Rs 7,043 crore in the September 2022 quarter. It had reported a Rs 5,670 crore net profit in the year-ago period, according to its regulatory filing. Its total income on a consolidated basis rose to Rs 43,927 crore in the reoorted quarter from Rs 38,603 crore a year ago. The net interest income (NII) stood at Rs 4,639 crore in the second quarter compared to Rs 4,110 crore in the sam period last fiscal. Net interest margin stood at 3.4% at the end of the September quarter. The Gross NPA was at 1.59% at the end of second quarter compared to 1.785 in the preceding quarter.

Adani Wilmar: The company said its consolidated net profit fell to Rs 48.7 crore in Q2FY23 from Rs 182 crore in the year-ago period. Revenue from operations was up 4% YoY to Rs 14,150 crore as against Rs 13,558 crore. Total expenses rose to Rs 14,149.6 as compared to Rs 13,354 crore in the corresponding quarter of the previous fiscal. Adani Wilmar said it recorded 9% volume growth driven by robust growth in Food and FMCG

Hindustan Petroleum Corp (HPCL): The oil refiner posted a consolidated net loss of at Rs 2,475.7 crore in Q2FY23 compared to Rs 8,557.12 crore in Q1FY23. Revenue fell 6% to Rs 1.13 lakh crore in Q2FY23 from Rs 1.21 lakh crore in the preceding quarter.

Devyani International: The company’s consolidated net profit surged 28.6% YoY to Rs 58.76 crore in Q2FY23 and revenue from operations jumped 44.8% YoY to Rs 747.43 crore. Ebitda improved by 34.23% to Rs 165.5 crore in Q2FY23 from Rs 123.3 crore in the year-ago period. Ebitda margin stood at 22.1% in Q2FY23 compared with 23.9% in the same period last year.

Adani Total Gas: The company said its consolidated revenue from operations was up 7% at Rs 1,190.3 crore in Q2FY23 as against Rs 1,110.2 crore in Q1FY23. Ebitda was up 3.5% QoQ at Rs 226.21 crore in Q2FY23. Consolidated net profit rose 15.64% QoQ to Rs 160 crore in the quarter under review.

Bank of India: The lender said that it standalone net profit stood at Rs 960 crore for Q2FY23. On a sequential basis, net profit improved by 71% from Rs 561 crore in Q1FY23. Operating Profit improved by 26% YoY and stood at Rs 3,374 crore for Q2FY23 as against Rs 2,678 crore in Q2FY22. On a sequential basis, Operating Profit improved by 55% from Rs 2,183 Cr in Q1FY23. Net Interest Income (NII) improved by 44% YoY and stood at Rs.5,083 crore for Q2FY23 against Rs 3,523 crore for Q2FY22.

Indian Bank: The state-owned lender said its consolidated net profit rose 14.32% to Rs 1287.39 crore in the quarter ended September 2022 as against a consolidated net profit of Rs 1126.11 crore during the quarter ended September 2021. Total Operating Income rose 13.12% to Rs 10,727.67 crore in the quarter ended September 2022 as against Rs 9,483.38 crore in the year-ago period. Net NPA ratio stood at 1.5% at the end of the reported quarter as against 3.26% in the same period last fiscal.

Sapphire Foods India: The company’s net profit came in at Rs 26.89 crore in the quarter ended September 2022 as against a net loss of Rs 5 crore during the quarter ended September 2021. Revenue rose 35.89% to Rs 562.77 crore in the quarter ended September 2022 as against Rs 414.15 crore in the year-ago quarter.

Indigo Paints: The company reported a net profit of Rs 37.1 crore in Q2FY23 as against Rs 13.5 crore in the year-ago period. Revenue rose 23.7% YoY at Rs 242.6 crore as against Rs 196.1 crore. Total expense stood at Rs 217.59 crore in the reported quarter compared to Rs 180.69 crore in the year-ago period.

IDFC First Bank: The lender and Niva Bupa Health Insurance Company have joined hands to provide best-in-class health insurance solutions to the bank’s customers. Vikas Sharma, head of Wealth Management & Private Banking, IDFC First said, “Our Bank’s advanced digital capabilities combined with Niva Bupa’s best-in-class health insurance solutions will enable us to deliver an exceptional proposition to our customers. The partnership will empower the two institutions to serve customers better and help them lead healthier lives.”

Elecon Engineering: The company’s net profit rose 82.33% to Rs 64.51 crore in the quarter ended September 2022 as against Rs 35.38 crore in the quarter ended September 2021. Revenue climbed 23.75% YoY to Rs 388.59 crore in the quarter ended September 2022 as against Rs 314.02 crore in the year-ago period.

Ashok Leyland: The commercial vehicles maker said that it has received a reaffirmation in credit ratings and revision in outlook from Negative to Stable from rating agency CARE, according to the company’s exchange filing.

Hawkins Cookers: The company said its net profit rose 17.45% to Rs 30.82 crore in the quarter ended September 2022 as against Rs 26.24 crore in the quarter ended September 2021. Revenue rose 11.70% to Rs 297.33 crore in the quarter ended September 2022 as against Rs 266.19 crore in the year-ago period.

EIH: Shares of the company fell over 2% after it posted tepid earning in Q2FY23. Its consolidated revenue rose 2% QoQ to Rs 401 crore in Q2FY23. Consolidated net profit fell 61% QoQ to Rs 24.6 crore in the reported quarter. Ebitda fell 15% QoQ to Rs 84.7 crore in the reported quarter.